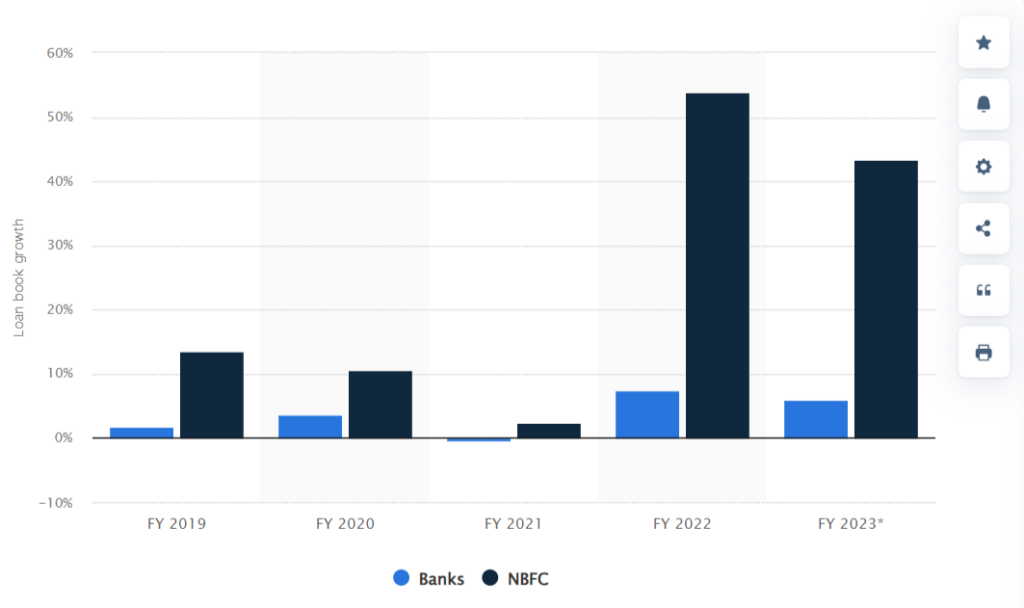

If you’re looking for an education loan, here’s an interesting graph for you.

This graph shows the growth in the amount of education loans for study abroad, given to Indian students from 2019 to 2023.

Let’s ignore the dip in FY2021 (because of COVID-induced lockdowns).

Overall, the trend is clear: there is a growing demand for education loans in India. So, you’re not alone.

But of course, not all education loans are the same, particularly when it’s an education loan for studying abroad.

That’s why we’ve put together this simple guide for you.

This guide aims to help students and their families by educating them about various aspects of education loans, and how to get the right one. We explain education loan types, application processes, interest rates, and the best available options from various lenders.

What is an education loan?

An education loan in India is a financial advance offered by banks and NBFCs. It is to help students fund their higher education.

These loans cover a wide range of expenses, including tuition fees, hostel charges, exam fees, books, and even travel costs.

Banks can provide loans up to ₹1.5 crore for studies in India and abroad. Education loans for abroad studies are a great way to bridge the financial gap for students pursuing higher education.

Education loan interest rates in India 2024

Here’s a table with indicative education loan interest rates in India for 2024. These rates are indicative, and could change significantly given your personal situation and financial condition.

Note: The interest rates change frequently, and also depend on individual financial and personal circumstances of the borrower. Below is a table that shows indicative numbers.

The actual interest rate you may get can vary between 8.75% and 14%, depending on your specific case and qualifications.

Note: Compare interest rates from 15 banks and NBFCs in just 15 minutes with FundRight.

When you know how to compare education loans, you can save lakhs. So it’s essential to understand the market jargon.

Terms like “fixed interest rates” and “floating interest rates” may seem daunting at first. But they are not that hard to understand. By familiarising yourself with these concepts, you can make informed choices.

Let’s explore some important facts and terminology about education loan interest rates in India.

Fixed interest rates

Fixed interest rates offer stability by staying the same throughout the loan term. This helps the borrower budget more effectively as monthly payments remain consistent. Fixed rates provide certainty and protection against market rate increases. But they can start higher than floating rates.

Floating interest rates

Floating interest rates fluctuate based on market conditions. These rates adjust periodically, resulting in savings if market rates decrease. Floating rates start lower than fixed rates. Overall, floating rates are a great option for borrowers comfortable with market fluctuations.

Explaining education loan interest rates using real-life examples

At this moment the repo rate (the interest rate at which the Reserve Bank of India lends funds to commercial banks) is at 6.25%.

Banks usually lend at 4-6% above the repo rate. Hence a State Bank of India education loan is priced at about 10.5%.

But that is the rate of interest levied if you choose a ‘flexible rate’ education loan. For a ‘fixed rate’ education loan, the rate is possibly 11% or more.

If the repo rate rises to 8% then banks would charge around 13% from customers. In that case, those holding fixed-rate loans would gain more.

But if the repo rate falls to 5% those holding floating rates would enjoy a cheap loan.

Moratorium period

Paying back an education loan for a hefty amount (above 40 lakhs) can take time. Most people rely on getting a job to pay back their loan amounts. In many cases this gets delayed, which can become worrisome for a borrower.

The good news is that banks know and understand these facts, that’s why they offer a moratorium period – during which you don’t have to pay your monthly instalments. Depending on your course duration and the bank policy this period can be 24-48 months long.

More specifically, if your course duration (let’s say for a Master’s degree) is 24 months, then the moratorium period will be the course duration + a grace period of 6-12 months, which would mean a total 30-36 months in this case.

However, the interest will be charged even for the moratorium period.

Another example:

Say you took a loan of ₹40 lakhs to pursue an MS in Data Science from IIT Chicago. The course lasts 2 years and the education loan interest rate in India is 10.5% per annum.

Hence you start to pay back when accumulated interest and principal is ₹24.24 lakhs.

You will find it easy to calculate the EMI using our education loan emi calculator.

An illustration of how to use our EMI calculator

Also read: Guide To Student Loan For Study Abroad – Key Terms To Know

Types of education loans

There are multiple criteria based on which we can compare education loans. Location, type of course, and type of collateral are the common distinctions.

Based on location

- Domestic Education Loan: For students pursuing education within India. Contingent upon admission to an Indian educational institution.

- Overseas Education Loan: Facilitates studying abroad. It covers expenses like airfare, accommodation, and tuition fees.

Based on course

- Undergraduate Loans: Financial aid for 3 to 4-year undergraduate degrees.

- Postgraduate Loans: Supports 2-year advanced courses within India, deepening knowledge in specific fields.

- Career Development Loans: Enables professionals to enhance skills and career prospects through professional courses and training e.g. nursing, hotel management, etc.

Based on collateral/security

- Unsecured Loan: Many nationalised banks are offering small loans up to ₹7.5 lakhs without any collateral to study abroad. However, if you look at private banks or non-banking financial institutions (NBFCs), they can fund larger amounts up to ₹1 crore without any collateral/security.

- Secured Loan: The borrower (or parents) has to pledge assets like property, fixed deposits, or securities for financing. Students can get secured loans for up to ₹1.5 crores.

- Third-Party Guarantee: Obtain a loan with a guarantee letter from a trusted third party. Some banks can insist that the third party be related to the borrower (e.g. uncle, cousin, etc).

Also read: All About Education Loans Without Co-Applicants

Education loan for studies abroad

It’s easy to understand why so many students want to study abroad and seek education loans for the same. Reasons include global recognition, best-in-class education, and investment in learning.

Moreover, compared to the ~3% spent by the US, India’s spending on research and development is the lowest in the world at 0.7%. This is why the US is considered a haven for pursuing STEM subjects.

But studying abroad comes with a hefty price tag.

Pursuing an MS degree in the USA may require anything between ₹45 lakhs ($55,000) and ₹1.5 crores ($180,000). This includes tuition fees, living expenses, and incidentals. Unless you secure a top-notch scholarship, self-financing becomes the norm.

Many bright minds who excel in exams like the SAT and GRE/GMAT turn to student loans to fund their international education dreams. These loans bridge the financial gap, allowing students to explore foreign shores and gain a world-class education.

However, education loans are complex financial agreements. Before you sign on the dotted line, tread carefully. The fine print can be hard to grasp.

Also read: Lowest Education Loan Interest Rate For Study Abroad

Education loan eligibility criteria

Before applying for an education loan, you must meet the education loan eligibility criteria set by financial institutions.

Specific requirements may vary slightly between different banks. We offer a general overview of what is typically expected.

- Citizenship: Applicants must be Indian citizens.

- Residency: Applicants should be residents of India. Special consideration may be given to those classified as Resident Not Ordinarily Resident.

- Age: The minimum age requirement is usually 18 years, with a maximum age limit of around 35 years. Exceptions may be made for individuals pursuing doctoral degrees abroad.

- Academic Background: Applicants must be enrolled in a recognized college or university in India. They must be pursuing undergraduate, postgraduate, or doctoral courses approved by educational bodies.

- Admission Confirmation: You can apply even without proof of application. Loan disbursal depends on proof of admission, loan application doesn’t.

Documents required for education loan

Applicants and co-signers need to provide various documents to support their loan application:

- Identification Proof: PAN card, Passport, Aadhar Card, Voter ID card, or Driver’s License.

- Age Proof: PAN card, Aadhar Card, Passport, Birth Certificate, Bank Passbook, or Driver’s License.

- Academic Documents of the student: From 10th grade onwards alongwith test score cards (GRE/GMAT or IELTS/TOEFL/Duolingo).

- Address Proof: Aadhar Card, Voter ID card, Driver’s License, along with other acceptable documents like rent receipts or utility bills.

- Co-signer Documents: Form 16 and salary slips for salaried co-signers, or business-related documents like P/L Account, Balance Sheet, and Income Tax Returns for self-employed co-signers.

- Collateral-related Documents: Title Deeds or ownership documents for pledged assets such as property.

Education loan fee and charges

Let’s explore the different charges involved in the loan process. Like interest rates, these are subject to change.

Loan processing charges/processing fee/administration fee/original fee

During loan approval, borrowers may incur processing charges, typically between 0.5% – 5% of the loan amount, with additional GST as per applicable rates. Some banks may cap it at lower rates. For instance, State Bank of India charges at most INR 10,000.

Legal and incidental charges

Covering legal documentation and other expenses, these charges are based on actual costs, ensuring compliance with procedural requirements. For most banks, these are a part of processing fees.

Stamp duty charges

These charges, varying by state, may apply to loan documentation. Not always part of processing fees.

Secured loan charges

Include costs for evaluating property value and legality. Necessary for loans secured by property.

Delayed payment charge

For missed instalments, a charge, plus applicable government taxes, is applied to the overdue amount to encourage timely repayments. It can be between 15% and 20% of the instalment.

Best banks and NBFCs providing education loans

Here are some of the major banks and NBFCs providing education loans in India:

Best banks for education loans

- State Bank of India (SBI): Offers education loans with competitive interest rates and flexible repayment options.

- HDFC Bank: Provides loans for both Indian and international studies, with a focus on premier institutions.

- Axis Bank: Offers loans from ₹20 lakhs up to ₹1.5 crores for various courses.

- ICICI Bank: Provides education loans starting from ₹20 lakhs.

- Bank of Baroda: Offers education loans for studies in India and abroad.

- Union Bank of India: Offers comprehensive loan solutions for students pursuing higher education overseas.

- IDFC First Bank: Provides customised education loans for students, with flexible repayment options.

Best NBFCs (Non-banking financial companies)

- HDFC Credila: Specialises in education loans for studying abroad.

- Avanse Financial Services: Another leading NBFC for education loans in India.

- InCred: Provides education loans with minimal documentation.

- Auxilo Finserve: Offers unsecured education loans.

- Prodigy Finance: A global platform for funding international students.

- Tata Capital: Offers education loans designed to provide financial support for higher studies, in India and abroad.

- MPower Financing: specializes in providing education loans to Indian students studying in the U.S. and Canada, without requiring collateral.

Process to apply for an education loan in India?

In India, education loans are a popular option for students to pursue their international education dreams. Now, let’s find out how to apply for an education loan.

The education loan application process can take anything between 2 weeks and 6 weeks. You’ll find yourself consuming a lot of confusing technical information. Many students simply choose a loan product recommended by someone they know, or from a bank near their home.

This approach is time consuming, confusing, and expensive. FundRight is a better alternative that can help you avoid the confusion, and apply for an education loan within minutes.

How to get your student loan for your studies abroad via FundRight?

- Fill a short form to share your preferences

- Compare education loan offers from India’s top lenders

- Pick the best offer, submit your documents, and get your loan approved in just 2 days

Of course, you have the option to do all the steps manually. For this, you’ll need to know the complete loan application-to-approval process.

Education loan process

Education loan eligibility

- Academic Qualifications: Banks typically require good academic scores in your previous examinations (e.g., Class 10th,12th marks, Undergraduation and GRE/GMAT/IELTS/TOEFL).

- Nationality: You must be an Indian citizen.

- Course and Institution: The loan is usually sanctioned for recognized universities abroad based on rankings that these banks may follow. An example of a popular system is the QS ranking system.

Application process

- Choose a Lender: Research and compare education loan schemes offered by different banks and NBFCs. Consider factors like interest rates, processing fees, loan amount offered, and repayment terms. You also need to know if you fulfil the education loan eligibility criteria for different banks.

- Apply Online or Offline: Many banks and NBFCs allow online applications for education loans. Alternatively, you can visit their branch and apply in person.

- Submit Documents: Submit all the required documents mentioned earlier. The bank will verify their authenticity.

Documents Required for Education Loan

- Completed application form with your photograph.

- Offer letter or admission confirmation from the foreign university.

- Mark sheets.

- Proof of identity and address (Aadhaar card, PAN card, etc.).

- Estimated cost breakdown of your entire study program. It has to show tuition fees, living expenses, etc.

- Co-applicant documents (usually your parents or guardian). These include proof of income, income tax returns, P/L accounts, etc.

Also Read: List Of Documents Required To Secure A Study Abroad Loan

- Loan Approval and Sanctioning: Once approved, the bank will sanction the loan amount. This may involve signing loan agreements and completing other formalities.

- Loan Disbursement: The loan amount will be disbursed directly to the university or as per the agreed-upon disbursement method.

Here’s how you can condense this agonising long process down to 10 working days, when you get your education loan via FundRight.

Additional tips for the education loan process

- Start Early: Apply for the loan as soon as you have apply to a college or have your GRE/GMAT/IELTS/TOEFL scores in hand to ensure timely processing and disbursement.

- Co-applicant’s Credit Score: A healthy credit score of your co-applicant (parent/guardian) can influence the interest rate offered.

- Negotiate Interest Rates: Compare interest rates offered by different lenders and try to negotiate for a better deal.

- Clarity on Terms: Ensure you fully understand the loan terms and conditions. Pay attention to interest rates, repayment tenure, prepayment charges (if any), etc., before signing any agreements.

By following these steps and conducting thorough research, you can navigate the education loan process in a better way.

Ready to explore your education loan options with ease?

Visit FundRight today and take the hassle out of securing financing for your studies abroad!

FAQs: education loans in India

1. Who can avail an education loan?

2. What costs are covered under an education loan?

3. What are the documents required to apply for an education loan?

– Mark sheets of all qualifying exams

– Proof of admission

– Passport size photographs

– Estimated expense details

– Bank statement of the borrower for the last six months

– Income tax assessment order not more than two years old

4. Do I need a cosigner to get an education loan?

5. What is the interest rate of an education loan?

The interest rate of an education loan depends on the amount borrowed and the bank issuing the loan. Typically, the education loan interest rate varies from 8.6% to 13.5%.