The cost of studying abroad is prohibitive. Even a relatively affordable MS degree in the USA can cost up to ₹30 lakhs (including living expenses).

Now that you’ve scored decently on SAT or GRE, you need to find a student loan for studying abroad.

Loans are complex financial agreements. And before you sign on the dotted line, you must understand the terms and conditions.

The fine print is meant to be treacherous. And you are neither a lawyer nor an underwriter. You need help. And you’ll find it here.

In this guide, expect to be introduced to the key terms you need to understand, to make sense of the education loan process.

After reading this guide, you will be able to:

- Understand the meaning of terms such as moratorium, force majeure, guarantor, collateral, and right of lien.

- Differentiate between flat rate EMI and reducing balance EMI

- Differentiate between a flat rate of interest and a floating rate of interest

- Ask the right questions to ensure you understand your liabilities of repayment of your loan

- Know how to secure your best education loan at the lowest rate of interest, and for the most flexible terms

The complete guide to education loans for study abroad

1. Tenure

‘Tenure’ means the duration within which the loan amount has to be repaid.

A study loan for abroad usually has a duration not exceeding fifteen years. However, you can repay it in as little as six years.

Is it not easier to pay back ₹20 lakhs over 15 years instead of 8 years? Why shall I repay a student loan for study abroad early?

A valid question, but there is much more to it than the monthly payment.

- A loan for a longer duration would carry a much larger overall interest component. You are not only paying back ₹20 lakhs but also an interest on the rest for an extended period.

- The longer you drag out a loan, the more it will impact your future. You surely want to start a family in your 30s. It is best to pay an older loan back before that.

What’s the ideal moratorium period for your education loan?

Can you start repayments within the moratorium period?

Can you seek an extension on the moratorium?

These are tricky questions. The answers depend on the lender’s policies, your chosen degree, your job prospects, and your expected future cash flows. To find answers, you need the considered advice of an experienced professional. On FundRight, you can talk to our education and financial advisors, for free.

This is way better than relying on the biased opinion of education counselors and bank agents.

2. Guarantor

Banks protect their assets. If the loan applicant defaults, they want someone else to pay back.

That is why lenders expect a guarantor for your education loan.

Usually a close family member signs on as a guarantor.

Note: Anyone cannot become a guarantor. That person has to furnish tax returns for the past several years and prove they have the funds to repay the student loan for study abroad.

3. Moratorium

The moratorium is a period during which you are not required to pay any installments.

You would study for 2-4 years (depending on the stage of your education) and then need another half a year to find a suitable job.

Most foreign education loans specify the period of moratorium.

Note: A 10-year loan with a 2-year moratorium is not a 12-year loan. Interest continues to accumulate during those 2 years. The repayment begins from the 25th month onwards to the 120th month.

4. Collateral

Collateral is an asset that is pledged as security for repayment of a loan, to be forfeited in the event of a default.

Collateral can be in the form of a house/property or gold jewelry. Why these and not paintings and diamonds? Because they are easy to value and sell.

The bank does not prevent the house from being used during tenure. Jewelry, though, has to be deposited at the loan issuing branch.

Can you keep cash as collateral? Of course. If your education costs ₹30 lakhs, your parents (or any other well-wisher) can maintain it as a fixed deposit (without the right to liquidation). In the end, they get back the amount and interest.

For those with the wherewithal, the last option is the easiest form of collateral.

Education loan for abroad studies without collateral is only possible for smaller sums, or for loans sought from international lenders.

On FundRight, you can seek your education loan from international lenders. Not having to arrange collateral is one less problem for you during the tricky phase of securing the perfect education loan.

5. EMI

It is the acronym for Equated Monthly Installments.

We have become so used to this instrument for powering our needs that we no longer try to understand what it means.

Flat Rate EMI

A percent is applied, and the interest is added to the principal. Thereafter, the total is divided by the number of months’ installments.

Let’s use an example:

Raj took an education loan on Dec 1, 2018.

The amount is ₹10 lakhs and interest is 12% per annum. The loan had a moratorium till Dec 1, 2020, and then to be paid back over 6 years.

His total liability:

₹10,000,000 (principal) + 2 * 0.12 * ₹10,000,000 (interest during moratorium) + 6 * 0.12 * ₹10,000,000 (interest during repayment) = ₹19,600,000

EMI would be ₹19,600,000 ÷ (12 * 6) = ₹272,222

Reducing Balance EMI

As the loan is repaid, the principal outstanding reduces. Why should Raj pay interest on ₹19,600,000 for 72 months when every month he is paying back some amount of principal?

Calculation of Reducing Balance EMI is complex and banks have specialized calculator software that let you calculate.

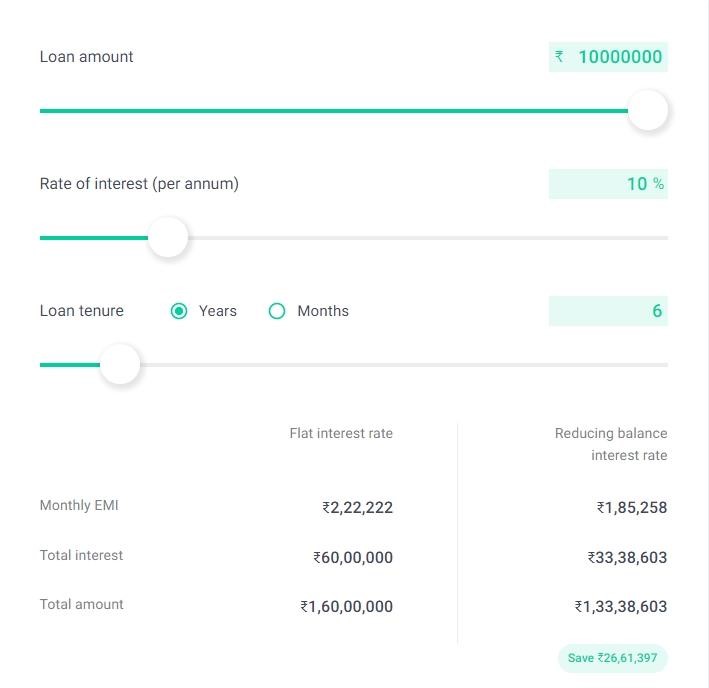

A comparison of a loan of ₹10,000,000 at 10% for six years Flat Rate and Reducing Balance EMI.

If all other loan conditions remain the same, the latter is always cheaper.

6. Floating & Fixed Interest

Education loan interest rates can be fixed or floating.

Both the EMI examples above are for fixed rates.

A floating rate can vary within a range say 7%-13%. It depends on the lending rate set by the RBI depending on the state of the economy.

The new interest rate can kick in annually, semi-annually, or quarterly.

7. Force Majeure

A Force Majeure is a clause that offsets the liability of a bank in case it is unable to fulfill its duties to you as a client.

In the previous example, let’s say Raj has decided to avail of the student loan for study abroad in two slices on Dec 1, 2018 and Dec 1, 2019.

The bank fails to send him the second installment in 2019 because of a global ransomware attack.

As a result, Raj suffers a financial loss. The Force Majeure clause prevents Raj from seeking damages.

Usually, such a clause is very expansive and covers terrorism, hacking, flood, fire, political unrest, extreme weather, tsunami, etc.

8. Right of Lien & Set-Off

A clause that gives the bank the right to sell collateral when it wishes without asking permission.

It usually occurs when a bank is in a dire financial mess and needs liquidity.

Before you get scared, a bank cannot liquidate loans in this manner suddenly. A lengthy legal process has to be completed before the assets of the bank (including collateral you put up) can be sold.

Therefore worry not, since financial institutions have to abide by Basel Norms (a list of obligations to maintain financial health) that are strictly enforced by the Reserve Bank of India.

9. CIBIL Score

Your lending bank will send your information to Credit Information Bureau (India) Ltd known as CIBIL.

CIBIL calculates the creditworthiness of the individual. You cannot ask the bank not to share data.

In case you default, your CIBIL score would be affected for life. The chances of receiving a home or car loan in the future would be affected. This is unaffected in case of repayment by a guarantor.

Even if a loan is not refused to you in the future, you might have to pay a higher interest.

Though the CIBIL score is currently not shared internationally, it might be and any history of default would carry over abroad.

To conclude…

Therefore, be careful and compare the terms and conditions of various loans before you sign.

We are not discouraging you at all, but want you to keep every single factor in mind before you decide.