Every year, thousands of Indian students secure education loans and travel to international destinations for their studies. In many cases, the loan that a student gets is not the best that they could have got. For instance, students can reduce their interest rates through negotiation with lenders, which may result in substantial savings, or even get more favorable repayment terms after negotiation.

The education loan marketplace can get confusing for students, and they’re tempted to hasten their loan search process. Also, not many students are fully aware of their options. For instance, NBFCs (non-banking financial institutions) offer some great education loan products, but most students don’t even consider them for their loans.

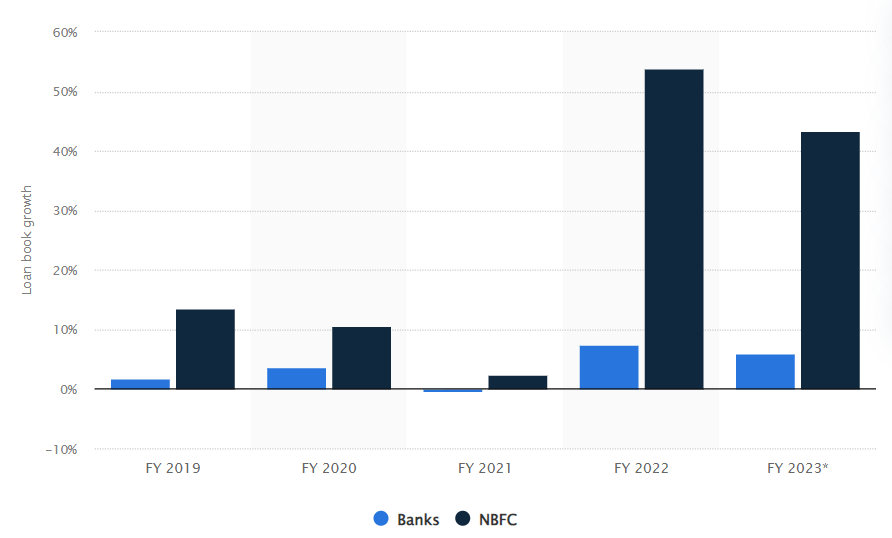

Note: This graph clearly shows that NBFCs are outpacing traditional banks in terms of the education loans they issue.

This is just one piece of evidence that students need more information and help to secure their best possible education loans\

So, if you are wondering how to apply for an education loan for abroad studies, and how to make sure the loan is the best you can get, then this guide is the perfect answer.

What is an education loan for studying abroad?

An education loan is a financial aid package provided to students who seek to pursue higher studies outside India. These students mostly seek loans to study in the USA, Canada, Ireland, Australia, the UK, France, or Germany.

The education loan for students studying in India covers:

- Tuition fees.

- Living expenses include accommodation, food, and general expenses.

- Other educational expenses include books, lab fees, equipment, and laptops.

- Travel expenses for international students include flights to and from the country of study.

But a loan lender requires collateral for the loan you take out. This collateral acts as a security measure to ensure that if you fail to repay the loan, they have the means to recover the funds.

Based on collateral requirements, loans are again classified into two types:

- Secured loans

- Unsecured loans

Banks and NBFCs offer both types of loans based on their financial situation and availability of assets.

Let us see what these are:

Secured loans

A secured loan requires security in the form of assets like land, property, or fixed deposits (FDs).

If the borrower fails to repay the loan, the lender has the right to seize the collateral to recover the loan amount. In the case of education loans, parents often provide the collateral on behalf of the student.

Now you may wonder, ‘How can I get an education loan for studying abroad without collateral?’

That is where unsecured loans play their part.

Unsecured loans

Unsecured loans don’t require assets or a guarantor, which makes them appealing to students. They are given based on your creditworthiness and potential future earning power. Because of the lender’s greater risk, they are often given at higher interest rates compared to secured loans.

In the next sections, we will explore how to get an education loan for studying abroad.

7 Steps To Secure A Study Abroad Loan

1. Check Your Study Abroad Loan Eligibility

a. Select and Apply For your University

Most lenders do not ask for an acceptance letter for an education loan for studying abroad. But that doesn’t mean you shouldn’t start the process.

It’s always a good idea to apply early. Start your college application process before you start your loan process. This will give you a better idea of how much money you’ll need to borrow.

If you’re confused about college applications, then SelectRight is the resource you need. Speak to college alumni to get a first-hand account of the experience at your dream colleges.

Without an acceptance letter, most lenders will only sanction a conditional loan.

b. Course-related Eligibility

Your loan being sanctioned is based on one basic criterion alone. Your ability to repay it.

That’s why students pursuing some courses like STEM, MBA, or Law have a higher chance of approval. But that doesn’t mean it’s a no-go for Arts majors.

You still have a good chance of getting an education loan to study abroad, but your interest rates may change.

c. Financial Eligibility

If the bank feels you can’t pay back a loan, they won’t lend to you. That’s why one of the factors for being eligible for education loans for studying abroad is your current financial situation.

Well, not yours, but that of your guarantor. They should retain a good credit score, have paid their taxes on time, and have a good bank balance.

2. Choose Your Bank

This is perhaps the most strenuous part of the whole process – the research. Many banks and lenders advertise one interest rate. But it’s only after your application is complete that you’ll be hit with curveballs like hidden fees.

FundRight ends this confusion.

Our platform is a one-stop place to compare the interest rates and fees offered by 15+ lenders. Plus, you won’t have to negotiate with the banks. Our platform is the one place where lenders will compete with each other for your loan, and in doing so offer the best interest rates to you.

3. Prepare Your Documents

Any loan process requires oodles of documents. And it’s hard to keep track of it all when the loan officer demands one document after another.

Here is a checklist of the documents you’ll need.

Documents Needed For Both Applicant & Co-Signer

- Passport Sized Photo

- Photo ID: PAN card, Drivers License, Aadhar Card, Voter ID card, or Passport

- Proof of Residence: Share Certificate or Title Deed (with Flat No), Electricity Bill, Municipal Tax Receipt, Registered Rent agreement (with utility bill), Landline phone bill, Voter ID, Aadhaar card or Passport

- PAN Card

- Aadhar Card

- Birth Certificate

Documents Needed For Applicant

- Academic Documents: 10th, 12th, UG Graduation Certificates, Provisional Certificate, Entrance test scores, TC (if applicable)

- Admission Proof: Not all lenders mandate this, but if you have it, attach the document

- Fee Structure of applied University

- Documents to prove work experience (where necessary)

Documents Needed For Co-Signer

- Registration certificate (in the case of Doctor or CA professional)

- If Salaried: 3 months salary slip, 3 months bank statement, Form 16

- If Self-Employed: 2 years ITR with the statement of income

Documents Needed If Submitting Collateral

If Immovable Collateral:

- Property title deed

- Building approved plan

- NOC for a mortgage from a builder or society

If Liquid Assets

- Proof of FD, Government Bonds or Life Insurance Policy

4. Home & Telephonic Verification

Within one week of applying for a loan, officers from the bank will conduct a home verification. This is only to check whether you do live at the address you’ve provided.

Agents may also ask to verify your ID documents at your home. Expect some questions about your cosigner’s income status.

The same details will be verified again on the number you’ve provided to the bank. All this is done to assure that the information you’ve provided to the bank is correct.

At this point in a study abroad loan process, there is a very low chance for your loan application to get rejected.

5. Study Abroad Loan Subsidy

This stage is applicable if you’re below a particular income slab or if you belong to a minority community.

Some subsidies lower the interest rate component. Some schemes pay a portion of the interest for you.

Here are some education loan subsidies for abroad studies by the Indian government.

Padho Pardesh Scheme

This is targeted toward meritorious students belonging to minority communities. Your total family income from all sources should not exceed ₹6 lakhs/annum.

This scheme awards a 100% interest subsidy on study abroad loans for the duration of the moratorium period.

Central Scheme of Interest Subsidy for Education Loans (CSIS)

This is an interest subsidy scheme for those belonging to economically weaker sections. This subsidy is granted to students whose family’s annual income is less than ₹4.5 lakhs/annum.

You can avail a full interest subsidy during the moratorium period.

Dr. Ambedkar Central Sector Scheme

This is a subsidy granted to OBC and EBC candidates. If you belong to the OBC group, your total family income should not be higher than ₹3 lakhs/annum. For EBC candidates, the total family income shouldn’t exceed ₹1 lakh/annum.

You can avail 100% interest subsidy during the moratorium period.

6. Loan Approval Stage

This is when you can start breathing a sigh of relief.

Once all the verification is completed, the bank will have you sign a loan agreement. Read the terms carefully.

Along with the bank, you’ll come up with a repayment plan. The EMI you’ll need to pay will be informed. You will also get a loan disbursement calendar. Most lenders send the money directly to the institution, but some will transfer it to your bank account.

After you’ve signed, you’ll get the loan sanction letter.

7. Post-Approval Responsibilities

It’s not all over once your loan is sanctioned. Unless you have a complete loan holiday, you should diligently keep up with the EMI payment.

An interest backlog may result in fines and extra charges.

Some banks also request you to update them about your scores. This is just to ensure that you’re keeping up your end of the deal by scoring well.

Tips to boost your chances of getting a cheap education loan in India

The following tips can help you secure an inexpensive loan for studying abroad.

-

Choose the right lender and loan type

Public-sector banks offer lower interest rates, starting at around 7.75%, compared to private-sector banks, where interest rates start at around 10.5%. Public banks often provide more economical options than private banks in terms of interest rates.

On the other hand, secured loans require collateral such as property or fixed deposits generally and they have lower interest rates due to the reduced risk to lenders. So, if you’re choosing to provide collateral, this might be a viable option for reducing costs.

-

Understand interest rate structures

Fixed vs. floating rates- Fixed-rate loans provide a constant interest rate throughout the loan period. It helps you predict and maintain repayment stability.

Whereas floating rates depend on the market conditions. They potentially start lower but fluctuate over time. Hence, you must choose this based on your financial stability and risk tolerance.

Base rate and margin- For floating rate loans, understand that the interest consists of a base rate (LIBOR or MCLR) plus a margin.

The margin varies based on the lender’s risk assessment. An expected rise in central bank rates could increase these rates, so consider this when selecting your loan type.

-

Check academic and institutional relationships

University tie-ups

Check if your university has tie-ups with banks or NFBC’s as it can lead to faster loan processing, lower rates, and seamless disbursement experiences.

Negotiate based on academic merit

Some lenders offer better rates or conditions to students with excellent academic records or high potential for future earnings. Presenting a strong academic profile can help you negotiate more favourable terms. With so many banks and NBFCs providing loans for education abroad, choosing the one that fits your requirements can be overwhelming.

That’s where FundRight plays its part.

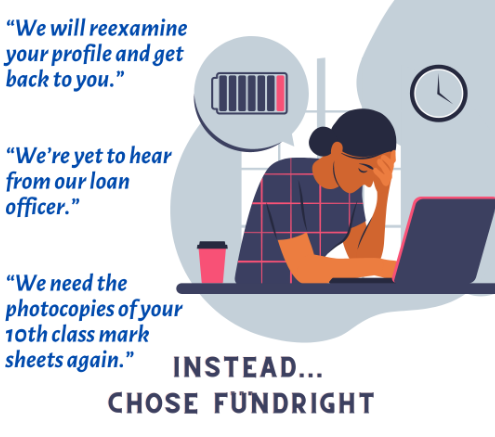

With FundRight, you eliminate the hassles of comparing banks, submitting photocopied documents, and being clueless about the next step.

FundRight is a DIY education loan search, comparison, and acquisition platform, where you can compare India’s top lenders, and then negotiate further to get an education loan with the best possible terms.

How does FundRight work?

- Register on the platform.

- Specify your loan requirements.

- Get loan offers from 15+ lenders

- Compare and find the best offer, with the help of expert financial advisors from Fundight.

- Upload your documents securely, and get your loan approved in 10 days.

Why choose FundRight?

Whether you’re pondering the cost of studying engineering or wondering how to get an education loan for MBBS abroad, FundRight has what you need.

Here’s how:

- FundRight gives you 15+ lender options in India and abroad.

- FundRight helps you avoid lengthy loan approval processes and gets a quick turnover period from lenders.

- Lenders compete for your loan, which means you can expect the best interest rates and loan terms.

- A transparent platform to compare loan offers and make an informed decision

- With FundRight, you could save up to 23 lakhs over the life of your loan.

Sign up on FundRight today and take the first step towards your education journey abroad.

FAQs

1. How do you take a bank loan for your higher education?

Start by researching banks that accept your course. Then assess total expenses, understand eligibility, compare loan products results, and finally apply.

2. What is the maximum limit of foreign education loans with collateral?

The maximum limit for foreign education loans with collateral varies; typically, ₹1.5 crore from public banks and ₹80 lakh from private banks.

3. What factors affect the interest rate of an education loan for studying abroad?

Factors like your academic background and your chosen program affect the Interest rates of your bank loan.

4. Can I get an education loan to study MBBS abroad?

Yes, you can get an education loan for an MBBS abroad. You must present a strong academic record, be accepted into a recognized medical school, and meet detailed financial requirements.

5. What are the repayment terms for education loans for studying abroad?

It usually varies depending on the duration of your course. However, for most banks, repayment terms start 6 months after the course completion, plus a grace period ranging from six months to a year.