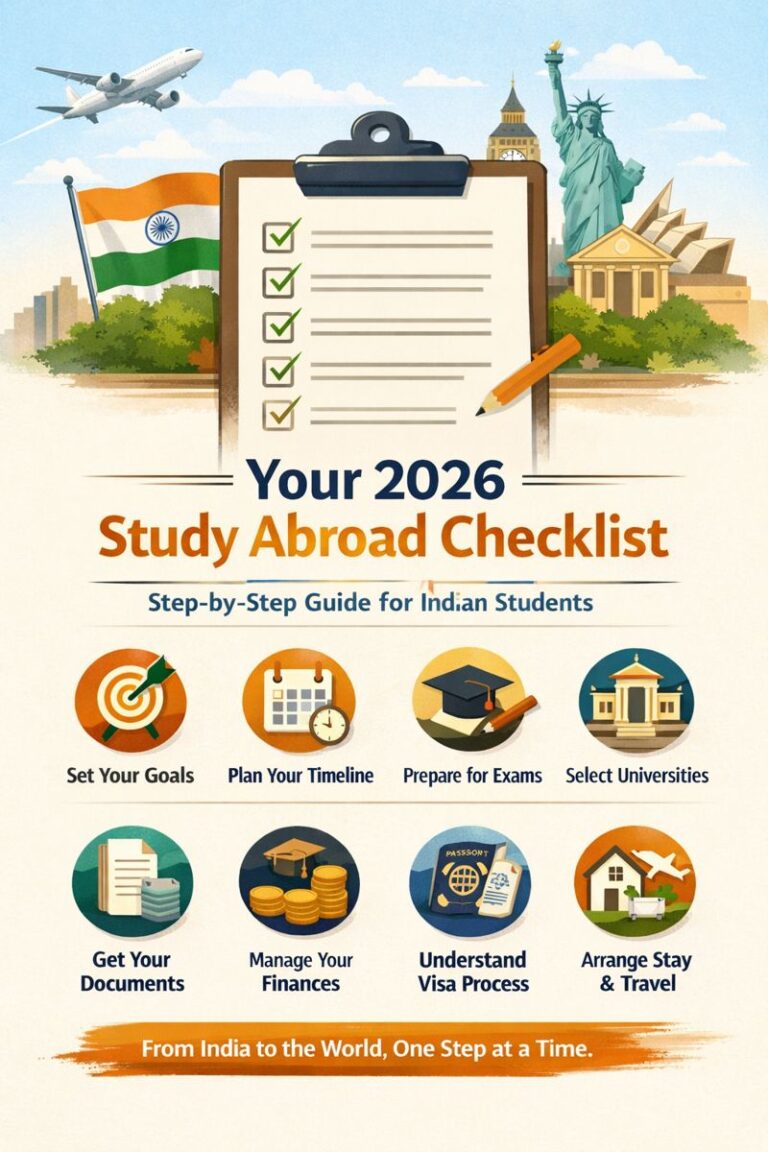

You have secured admission to your desired program at a university in the USA. Your visa is ready and your bags are almost packed. But have you sorted your student health insurance?

Since the cost of medical treatment in the USA is exceptionally high, students need to purchase adequate health insurance coverage.

In this article we will explore the importance of student health insurance plans, why you need it, popular providers, and the benefits of having health insurance while studying in the USA.

Importance of student health insurance in the USA

Healthcare in the USA is enormously expensive. A minor procedure, such as a root canal treatment, can cost upwards of $2,000. For most students from India, this expenditure can be huge.

That’s why you need to buy student health insurance. So you can mitigate the huge expenses if you suffer from unforeseen illness.

You must note that it is not mandated as a visa condition as many believe. But universities make it compulsory for international students to have health insurance before arrival.

Knowing that you are covered in case of a medical emergency offers peace of mind. You can focus on studies without constantly worrying about potential healthcare costs by paying a few hundred dollars each year.

Also Read: Education loan for Study Abroad Guide for Students

Why do I need international student health insurance?

An F-1 or M-1 student visa in the USA does not require you to buy health insurance but all USA universities have strict requirements for international students to have health insurance on arrival.

International student health insurance is essential for several reasons:

Compliance with Regulations

As we have mentioned before, universities require you to have insurance. Some schools offer their own insurance options. Others allow students to purchase coverage from third-parties, as long as it meets the school’s requirements.

Please note that J-1 visa holders have to mandatorily buy insurance worth $100,000 per accident or illness before they travel.

Defray Medical Expenses

Unlike other Western nations, the USA does not have universal medical care. Healthcare costs are the #1 reason for bankruptcies in the USA. The average cost of a hospitalization in the USA is $14,000 versus a few thousand rupees in India. Different comparisons show that medical care in the USA is between 15 and 20 times more expensive than in India.

Preventive Care

Many health insurance plans cover preventive treatment such as vaccinations and annual check-ups at no additional cost. This proactive approach helps protect your health and prevents more serious issues down the line.

Unlike India, you can also get dental coverage as an optional extra. When a toothache strikes at midnight, this is indeed a welcome relief.

Cost of Medication

Health insurance plans in the USA not only pay for inpatient stays but also for medication. The insurance company co-pays a part of the prescription medicine cost. This covers ongoing treatment such as asthma inhalers. Because the cost of medicines is sky high in the USA, it is necessary to reduce your out-of-pocket expenses.

Mental Health Cover

If the primary physician prescribes therapy as a treatment for mental health issues, health insurance covers the cost. Traveling abroad and being in a highly competitive environment might cause anxiety. A health insurance policy that also provides for mental health checkups might be exactly what a student needs to get back on their feet.

Also Read: International Student Health Insurance USA 2024: Complete Guide

List of popular student health insurance providers in the USA

There are at least 25 large health insurance companies in the USA. Here’s a brief introduction to the top student medical insurance providers in the USA:

ISO Student Health Insurance

ISO (International Student Organization) is a leading health insurance provider to international students. They offer some of the best student health insurance plans in the USA.

Established in 1958, ISO has become the largest insurance manager for international students, covering over three million individuals across more than 2,500 universities. With affordable options starting as low as $31 per month, ISO ensures that students receive quality healthcare at the lowest possible prices.

International Student Insurance

International Student Insurance (ISI) is reputed for its affordable health insurance solutions for international students.

They offer a variety of plans that cater to different budgets and healthcare needs. ISI emphasizes customer service and has a 5-star rating for support. ISI’s flexibility allows students to choose from various coverage levels, making it easier for them to find the perfect plan.

Cigna Global

Cigna Global is a giant in the American health insurance market. Though they are based out of Connecticut, USA, their services extend to 200 nations. Cigna offers customizable plans that include inpatient and outpatient care at hundreds of USA hospitals.

International students who have a Cigna policy have access to thousands of affiliate hospitals across the globe. This means you don’t need to buy separate insurance if you travel outside the USA (except your home country).

IMG (International Medical Group)

IMG provides health insurance solutions for travelers and international students. Their plans offer various levels of coverage that can be customized based on individual needs.

IMG’s policies include benefits such as emergency medical evacuation, and access to a vast network of hospitals and clinics. Their commitment to customer service makes them a popular choice among those studying in the USA.

Compass Student Insurance

Compass Student Insurance offers a range of affordable health insurance options for international students.

The company offers multiple plans which ensure that students can find an option that fits their budget. Compass offers easy online enrollment and immediate confirmation upon completion, making it a highly streamlined health insurance provider.

Besides, you can always choose from Indian health insurance providers. Both public and private sector health insurance companies in India offer coverage for students going to the USA for higher studies.

These include:

- Bajaj Allianz Student Travel Insurance

- Bharti AXA Smart Traveller Student

- Chola Student Travel Protection Plan

- Future Student Suraksha

- National Overseas Mediclaim (Employment and Studies)

- New India Overseas Mediclaim Insurance (Employment & Studies)

- Oriental Overseas Mediclaim (Employment and Study)

- TATA AIG Student Guard

Compare the cost of student health insurance in the USA

You can choose from hundreds of student healthcare plans if you are going to the USA. It is difficult to offer a synopsis across so many insurance products from multiple companies.

This table offers an overview of a few popular plans from International Student Insurance, one of the top student medical insurance providers in the USA.

ISI offers multiple plans and we have chosen four (“Smart” “Budget” “Select” and “Elite”) across different price points to illustrate the cost vis-a-vis features.

| Feature | Student Secure: Smart | Student Secure: Budget | Student Secure: Select | Student Secure: Elite |

| Price (Monthly) | $30.60 | $51.30 | $102.60 | $175.50 |

| Medical Maximum | $200,000 | $500,000 | $1,000,000 | $5,000,000 |

| Per Injury/Illness Maximum | $100,000 | $250,000 | $500,000 | $500,000 |

| Deductible | $0 (co-pays apply) | $0 (co-pays apply) | $0 (co-pays apply) | $0 (co-pays apply) |

| Coinsurance | In-network: 80% of the next $100,000 after co-pays, then 100% to maximum. Out-network: Usual, Reasonable, and Customary (URC) | In-network: 80% of the next $45,000 after co-pays, then 100%. Out-network: URC | In-network: 80% of the next $25,000 after co-pays, then 100%. Out-network: URC | In-network: 80% of the next $10,000 after co-pays, then 100%. Out-network: URC |

| Pre-existing Conditions (Acute Onset) | $25,000 lifetime maximum | Additional $25,000 lifetime maximum | Additional $25,000 lifetime maximum | Additional $25,000 lifetime maximum |

| Pre-existing Conditions (Full) | Not covered | 12-month waiting period | 6-month waiting period | 6-month waiting period |

| Maternity | Not covered | Up to $5,000 | Up to $10,000 | Up to $15,000 |

| Mental Health | Outpatient: $50 per day, $500 max. Inpatient: Up to $5,000 | Outpatient: 30 days max, inpatient: 30 visits, includes drug/alcohol | Outpatient: 30 days max, inpatient: 30 visits, includes drug/alcohol | Outpatient: 40 days max, inpatient: 40 visits, includes drug/alcohol |

| School Team Sports | Not covered | Not covered | $5,000 per injury/illness for intercollegiate, intramural, or club sports | $5,000 per injury/illness for intercollegiate, intramural, or club sports |

| Recreational, Fitness & Leisure Activities | Covered per policy conditions | Covered per policy conditions | Covered per policy conditions | Covered per policy conditions |

| Adventure Sports | Some exclusions apply | Some exclusions apply | Some exclusions apply | Some exclusions apply |

| Emergency Medical Evacuation/Repatriation | $50,000 / $25,000 | $250,000 / $25,000 | $300,000 / $50,000 | $500,000 / $50,000 |

Here is a brief explainer of some of the features:

- Medical Maximum is the maximum amount of coverage. A plan for $400,000 will cover you for that amount.

- Illness Maximum is the highest amount covered for each separate injury or illness. Such as the maximum expense for appendicitis operation can be $20,000.

- A deductible is the amount you must pay out-of-pocket before the insurance company starts to cover the remaining costs.

- Coinsurance is the percentage of medical expenses covered by the insurance. If there is 20% coinsurance or co-pay it means you must meet the entire deductible and 20% of the remainder.

- Emergency Medical Evacuation is coverage for medical evacuation to the nearest medical facility or repatriation of remains in case of death.

Also Read: insurance on education loan

Benefits of availing international student health insurance

International student health insurance offers numerous benefits that ensure your well-being during your studies abroad.

Here are the key advantages:

Financial Protection Against Medical Costs

Healthcare abroad can be expensive, especially since the USA doesn’t have universal healthcare plans like other developed nations.

Health insurance helps cover costs for doctor visits, hospital stays, surgeries, and emergency care and defrays your financial burden in case you fall ill.

Access to Quality Healthcare

Health insurance companies have network hospitals, that is, hospitals that allow cashless treatment facilities.

You can receive timely treatment from reputable doctors and hospitals without worrying about upfront payments.

Emergency Medical Evacuation

If you face a severe medical emergency that requires specialized care unavailable locally, the healthcare insurance plan covers the cost of medical evacuation to a suitable facility. This is indeed useful in a country like the USA where an expert facility might be many hundreds of miles from the university campus.

Coverage for Pre-existing Conditions

Many international student health plans offer partial or full coverage for pre-existing conditions. This is vital for students managing chronic illnesses such as epilepsy, Type 1 diabetes, and Crohn’s disease. This type of coverage ensures they can receive treatment abroad without facing exorbitant costs.

Besides as stated before, educational institutions in the USA mandate health insurance for international students.

So, when you’re planning to study in the USA, health insurance is something you can’t overlook. But picking the right plan can be overwhelming, especially when you’re bombarded with so many options. You may worry about missing out on something important, or worse, overpaying for a plan that doesn’t even give you what you need. In fact, some students end up paying up to ₹3 lakhs more per year by choosing the wrong plan.

That’s where GradRight comes in.

How GradRight helps you find inexpensive health insurance

GradRight makes sure you don’t waste your money on overpriced health insurance. When you sign up on GradRight, you can compare plans from USA-based insurance companies. This way, you can compare plans, all of which match what your university requires.

These plans offer the same benefits as the ones your university pushes through their preferred partners, but without the hefty price tag.

Here’s the best part: GradRight helps you find a health insurance plan that can save you up to ₹3 lakhs per year, or even more if you’re younger. All plans come from trusted USA-based insurance providers like United Healthcare and Aetna, so you can be sure you’re getting the coverage you need, and that it’s recognized by your university.

Instead of worrying about overpaying or missing key components of your coverage, GradRight makes the process simple.

Sign up today and start saving money on every step of your journey–including health insurance–to a higher education program abroad.