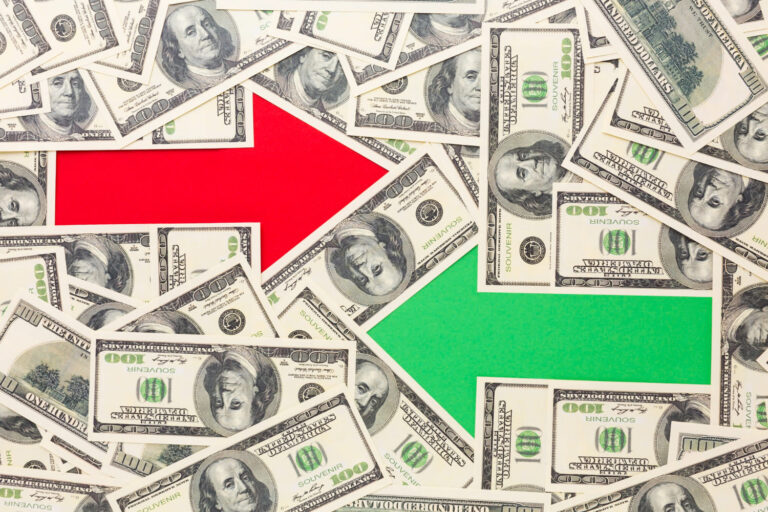

Margin money for an education loan is the amount that you pay from your pocket.

While taking out a loan to study abroad, you can sponsor yourself entirely from the loan, or partly from the loan. In the case of the latter, the other part comes from your savings. That part is known as the margin money.

Why is margin money important?

Because it reduces the amount of interest you have to pay.

This is one of the most prevalent reasons that aspiring Indian students get a couple of years of work experience and save up some money. This alleviates a lot of mental agony while being a foreign student in an expensive city.

What is the margin money amount?

It depends on many factors. As every profile is unique, it will serve you well to inquire the same with the moneylender.

RBI has informed that a 15% of margin money may be insisted on students going abroad for study.

There are certain banks and non-banking financial institutions that are happy to sponsor you completely for your higher studies abroad. This is a good decision for the bank as they will be getting more interest.

From your perspective, you have to keep your current financial situation in mind. Insisting on a higher margin money amount might hurt your family’s way of living and will give you lots of stress when you are abroad.

On the other hand, if you get a higher loan amount, it will cost you a bit more as interest in the long term. Most students choose to pay less as the extra bit of interest seems little in comparison to the loan amount.

How does choosing the right college affect your margin money?

The college or university where you plan to do your Masters determines the following things:

- Your future earning potential. Reputed colleges and universities give their students better opportunities as their alumni network is stronger and they have better relationships with various companies in different industries.

- Your cost of living. If your college/university is in an expensive city, you will be spending a lot there on rent and amenities.

- Your international travel expenses. Through the course of your study, you will be traveling back and forth to India. This, although by a relatively smaller margin, affects the money you will be spending.

- Scholarships from foreign universities. A lot of students are benefited by financial assistance in the form of scholarships. The probability of you getting a scholarship depends on which college you have applied to.

All the above factors decide the loan amount for studying abroad. At GradRight we will send personalized college recommendations to you.

After you roughly calculate or estimate your loan amount, you need to secure the best loan. The best loan will alleviate your financial stress as you go abroad and start a new chapter in your life.

Here is how we can help you secure the best student loan for you to study abroad.

How does FundRight get you the best education loan for studying abroad?

Compare loan offers from 30+ moneylenders

We have a diverse set of moneylenders who are ready to help you get a degree abroad. Public and private banks, Non-Banking Financial Companies (NBFCs), and private moneylenders will be offering you a loan.

Create an account and we will get you started.

We are constantly adding more moneylenders to our list so that you will have more options while choosing the best education loan.

Fast and efficient

If you went to any bank in India for any reason, you know how slow their processes are when it comes to approving loans. You will begin by submitting a lot of paperwork, then talk to the right person, submit some more paperwork, and wait until they call you.

Not to mention, the availability of the right individuals and network in the banks are the most important factors. Keeping all of that in consideration, it will at least take you weeks, if not months, to get a quotation from one bank.

Of course, you will need multiple options to make sure that you are making the right choice. That translates to you running around banks for months at a time.

On FundRight, you’ll find your best loan within two days.

48 hours. That’s how long we take because that’s how long we need. After you fill in your details, we will share your profile with all the moneylenders in our database. We will compile all the quotations at once and send it over to you.

With FundRight, you have to fill your profile only once.

Moneylenders will compete for you

FindRight is India’s first loan bidding platform which means, you are the prize. We will have all 30+ moneylenders (more are constantly being added) competing for you so that you get the best deal while getting an international education loan.

You will save 2-5% in interest on your education loan for studying abroad.

As you will have the loan’s terms and conditions right in front of you from the very beginning, you can make the right choice. What makes this even better is the speed. This will give you more time to think over each of the offers and make the best decision for you.

Receive unbiased financial advice

Every bank, NBFC, and private money lending organization has “experts” who are supposed to help you secure the loan with lowest interests.

Unfortunately, that is not true.

They are salesmen in disguise. After examining your profile, they give you a deal that is best for them, in terms of profit. They consider information like your earning potential, your family’s current monthly income, etc., to make a profitable decision for them.

We will have your loan applications examined anonymously by experts.

At FundRight, we believe in empowering students who want to study abroad. One of the ways we do that is by hiding certain details that might get you any biased advice.

Get low interest, no collateral loans

For a lot of reasons, no collateral loans are preferred. It doesn’t put any of your property on the line, it reduces the long term risks, etc. But there is a catch. No collateral loans often come with a lot of interest.

This puts most applicants off as the financial advantage gets nullified. We have understood that problem and have solved it.

Secure low interest, no collateral loans with FundRight.

Create your profile, answer a few questions that will help us give you the best loan options for studying abroad.