Introduction to Prodigy Finance education loans for studying abroad

If you are looking for an education loan to study abroad, chances are you have already heard of Prodigy Finance education loan. As one of the biggest lenders for education loans, Prodigy Finance has helped over 40,000 students fund their master’s abroad.

Established in 2007, Prodigy Finance is a UK-based financial institute aiming at making quality education accessible through a simplified application process. Its unique philosophy on assessing a candidate has revolutionized the education loan process. Rather than just looking at one’s financial history, it also assesses a candidate’s past academic performance and future earning potential. Through this philosophy, Prodigy Finance has managed to fund education loans worth over $2 billion.

Read the full guide to find out more about the terms & conditions, interest rates, application process, and documentation for an education loan from Prodigy Finance.

About Prodigy Finance education loans

If you are looking for a collateral-free education loan without a cosigner to fund your education abroad, Prodigy Finance is your answer. You can get no-collateral education loans starting from $10,000 to $200,000 from Prodigy Finance. Interest rates for collateral-free loans range from 11.5% to 15%.

Prodigy Finance offers student loans to more than 1,500 schools in over 150 countries. This means there is a good chance your school or university is included in their coverage.

Apart from a simplified application process and high-quality service, Prodigy Finance also offers flexible repayment options on education loans. Students can start repaying their loans six months after graduating, without any penalties.

Interest rates for Prodigy Finance education loans

The interest rates for Prodigy Finance education loans range from 11.5% to 15%. Your interest rate will depend on various factors like:

- Fixed Margin: Also known as fixed rate of interest, this is a set of percentages that is added to your base interest rate. The fixed margin doesn’t change over the life of your ed-loan. Prodigy Finance’s fixed margin or fixed rate of interest is 8.7%.

- Variable Base Rate: Unlike fixed margin, this part of the interest rate varies or fluctuates over the life of your loan. The base rate helps lenders determine your creditworthiness. It is often based on external benchmarks like LIBOR. The periodic change in the base rate affects your total interest rate.

Note: Variable interest rates have the potential of future rate cuts to the borrowers. This means your interest rate can potentially decrease over a period of time.

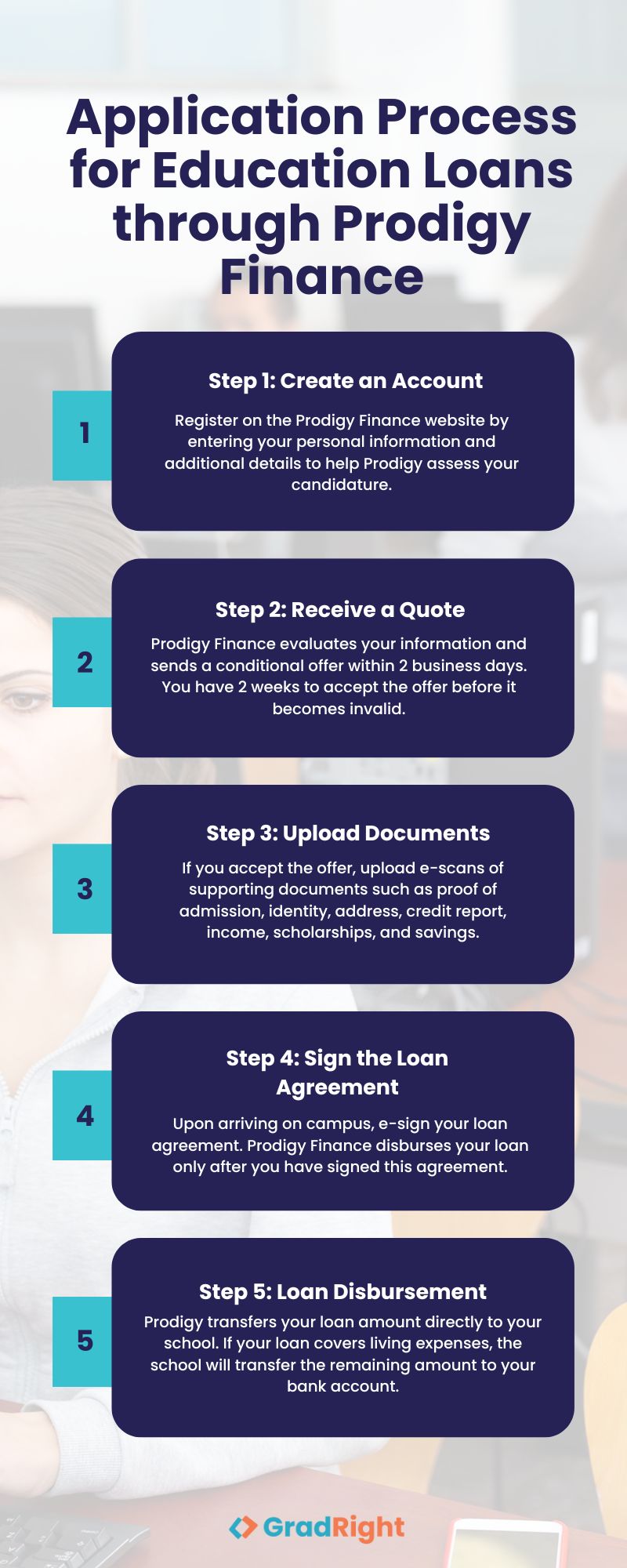

Application Process for Indian students to get education loans through Prodigy Finance

The application process for an education loan through Prodigy Finance is fairly easy and completely online. Here are five simple steps you can follow to complete your application process in 30 minutes:

Step 1: Create an account

You need to start by registering yourself on the Prodigy Finance website. After entering your personal information like name, email address, etc, you will have to enter a few more details for the Prodigy team to understand your candidature.

Step 2: Receive a quote

With the help of the details you enter in the first step, Prodigy Finance assesses your candidature and sends you a conditional offer within 2 business days. You will have 2 weeks to accept the offer. If you fail to accept it in that time frame, the offer will be considered invalid.

Step 3: Upload documents

If you accept the offer, your next step will be uploading the e-scans of your supporting documents. Some basic documents that you will have to submit are:

- Proof of admission

- Proof of identity

- Proof of address

- Credit report

- Proof of income

- Proof of scholarships (if any)

- Proof of savings (if applicable)

- Financial aid form

Depending on your application, you may have to provide more documents on top of the ones mentioned above.

Step 4: Sign the loan agreement

Now, once you arrive on campus, you will have to e-sign your loan agreement. This is a crucial step as Prodigy Finance only disburses your loan after you have signed the agreement.

Step 5: Enjoy your education abroad

Loan disbursement is the final step in your education loan application process through Prodigy Finance. Prodigy transfers your entire loan amount directly to your school, thereby saving you the hassle of meeting deadlines and dealing with currency transfers. If your loan amount includes your tuition cost along with living expenses, your school will transfer the amount left after paying the tuition to your bank account.

Also Read: Education Loan for Abroad Studies (Comprehensive Guide)

Eligibility criteria for education loans through Prodigy Finance

Here are 3 key eligibility requirements that you need to meet for a Prodigy Finance education loan:

Intent

You must be looking to study abroad as Prodigy Finance only offers loans to Indian students who wish to pursue an approved program in a university outside India. To prove your intent, you can provide any of the following documents: an admission letter, correspondence with the university, enrollment confirmation, visa application, etc.

Admission

Having an admission letter from one of the universities that Prodigy Finance covers would strengthen your application. You can apply for a loan even without an admission letter if you have some kind of correspondence or confirmation from the university.

Residency

There are selected countries that Prodigy Finance covers. You must be a legal resident of one of those countries.

Why should you choose Prodigy Finance for an education loan to study abroad?

Here’s why you should choose Prodigy Finance for an education loan to study abroad:

- Prodigy Finance provides education loans for master’s programs with interest rates starting at as low as 11.5%*.

- It offers loans for more than 1,500 schools in 18 different countries.

- You can finance 100% of your education and living costs through collateral-free loans with a co-applicant. This significantly simplifies the documentation process.

- Prodigy disburses the loan amount directly to your school, saving you the hassle of international wire transfers and currency exchange.

- Prodigy offers flexible loan repayment terms, starting from a 7-year tenure to 20 years.

- If you wish to repay your loan sooner, you can start doing so just 6 months after your program culminates.

Other Banks & NBFCs Offering Education Loan to Study Abroad:

- Union Bank of India Education Loan

- ICICI Bank Education Loan

- Yes Bank Education Loan

- IDFC Bank Education Loan

- Bank of India Education Loan

- State Bank of India Education Loan

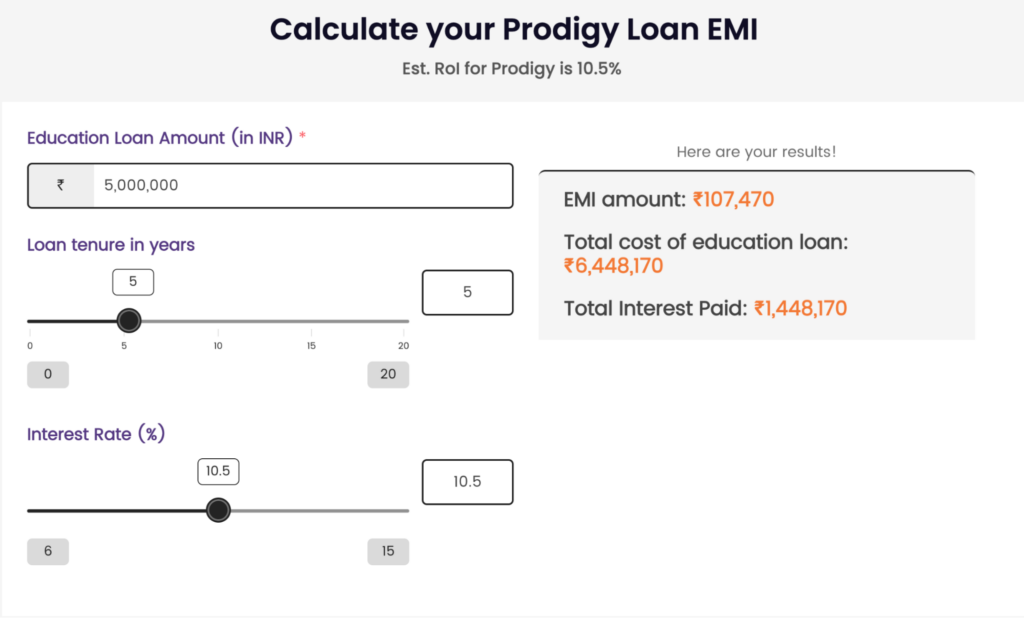

Prodigy Finance’s Education Loan EMI Calculator

As the name suggests, an EMI Calculator calculates your Equated Monthly Installment through a mathematical formula that uses your education loan amount, tenure, and interest rate.

Prodigy Finance doesn’t have an Education Loan EMI calculator. However, you can try the GradRight’s Education Loan EMI Calculator and find out your EMI amount for a Prodigy Finance Education Loan.

As seen in the image above, you have to enter the principal education loan amount, your loan tenure, and your interest rate.

After you finish that, you can see the results on the right corner of the page. There, you can see your EMI amount, total interest amount, and the cost of your education loan.

GradRight’s Education Loan EMI Calculator uses the following formula to calculate the results:

EMI = [P*R*(1+R)^n]/[(1+R)^n-1]

Here, ‘P’ stands for the principal amount, ‘R’ stands for the interest rate, and ‘n’ stands for the loan tenure.

Let’s look at a few examples using the above-mentioned formula and the EMI calculator. To help you understand the workings of the tool, we will enter different values in the tool:

| Education Loan Amount (in INR) | Loan Tenure (in years) | Interest Rate | EMI Amount | Total Cost of Ed-loan | Total Interest Amount |

| 50,00,000 | 5 | 10.5% | ₹1,07,470 | ₹64,48,170 | ₹14,48,170 |

| 50,00,000 | 7 | 10.5% | ₹84,303 | ₹70,81,483 | ₹20,81,483 |

| 80,00,000 | 10 | 11.3% | ₹1,11,563 | ₹1,33,87,550 | ₹53,87,550 |

| 80,00,000 | 12 | 11.3% | ₹1,01,710 | ₹1,46,46,192 | ₹66,46,192 |

| 1,00,00,000 | 15 | 11% | ₹1,13,660 | ₹2,04,58,745 | ₹1,04,58,745 |

Documents required for securing a student loan from Prodigy Finance

It is extremely important to produce all the documents required to get a student loan from Prodigy Finance in advance.

Here’s a list of documents that you must keep handy while applying for an education loan:

Proof of identity:

- A coloured copy of your valid passport

- A selfie to confirm your identity, as mentioned in your valid passport

Proof of address:

- Any document with your full name and address would work.

- Indian students can provide their Aadhaar Card for the same.

Proof of admission:

- You can provide an acceptance letter/ i-20 form (if applicable)/ email from the university.

- This must display your name, course, and school.

- The course mentioned on the acceptance letter must match your loan application.

Credit Report:

- You will need to provide a copy of your credit report.

- If you don’t have a credit report, you can also submit any document that summarises your credit history.

Salary slips:

- If you are currently employed, you need to submit your salary slips for the last three months.

- If you’re holding a post-study job offer, you must provide documents confirming the same, along with proof of income.

Savings/family contributions:

- You may have to provide your bank statements for an official savings account.

- If someone from your family is contributing to your savings, you must provide their bank statements.

Scholarship/ sponsorship:

- If you have a scholarship or sponsorship offer, you need to provide a letter proving the same.

- The letter must contain an official letterhead and your name.

- This must be in a PDF format and should be non-editable.

Things to remember when applying for Prodigy Finance education loans

Here are some things you must remember while applying for an education loan from Prodigy Finance:

- The minimum amount for an education loan application at Prodigy Finance is $10,000.

- Check whether Prodigy offers a loan for your school or country of interest. You can get the list here.

- Ensure you have produced all the important documents related to your personal, academic, and financial information.

- Make sure you have checked and met all the eligibility requirements.

- You can apply for a loan even without an admittance letter from the university of your choice. However, once you have accepted the education loan offer made by Prodigy, you must provide proof of admission to further the disbursement process.

Collateral rules for Prodigy Finance education loans

If you are looking for a collateral-free loan to finance your education abroad, Prodigy is a great option for you.

Instead of asking you to provide collateral, Prodigy Finance analyzes your fundability by assessing your future earning potential. Hence, it is important that your intended university and your past academic performance show promise.

Apart from Prodigy Finance, there are many lenders that offer collateral-free education loans to study abroad. However, exploring multiple lenders and comparing their offers can be an arduous process.

Simplify Your Loan Search with FundRight

An easier way to secure the best loan without spending months on research and filling out multiple forms is by creating an account on FundRight. With interest rates starting from 9.25%, you can compare offers from over 15 lenders and secure a loan with ease.

Here’s how FundRight works:

- Create a Profile: Register on FundRight and provide all necessary details about your academic background and financial needs.

- Receive Offers: Within two days, receive competitive loan offers from 15 top banks and NBFCs.

- Compare and Decide: Compare the loan offers based on different criteria and seek personalized help from FundRight’s financial experts to choose the best deal.

- Submit Documents: Securely upload all required documents through the FundRight portal.

- Get Approval: Get your loan approved in as little as 10 days.

By negotiating the best deal for you, the FundRight team helps you save up to INR 23 lakhs. Start your education loan journey for Spring ’25 admissions today and ensure you get the best possible terms for your education loan.

Sign up on FundRight now and discover how much you can save on your education loan.

Also Read: Collateral vs Non Collateral Education Loan for Abroad Studies

FAQs

1. Is Prodigy Finance trustworthy to get an education loan to study abroad?

Yes, more than 40,000 students have trusted Prodigy Finance to fund their master’s abroad. With over 17 years of experience in the business, Prodigy has disbursed education loans worth more than $2 billion.

2. What processing fees will I have to pay on an education loan from Prodigy Finance?

You will have to pay a 5% processing fee while taking an education loan from Prodigy Finance. After completing your application, you will receive a quote from Prodigy. The quote mentions all the terms & conditions, including the processing fee.

3. I don’t have any collateral. Can I still get an education loan from Prodigy Finance?

Yes, you can get an education loan from Prodigy Finance without collateral. Instead of using collateral, Prodigy assesses your affordability based on your earning prospects after graduating.