Medical emergencies are unpredictable and can be particularly overwhelming when you’re studying abroad, away from home and your support network.

Facing such emergencies in a foreign country, coupled with the stress of handling hefty medical bills, can be daunting.

This is precisely why international student health insurance is vital. It acts as your safety net, so you can receive the best possible medical care without having to worry about paying a huge medical bill.

In this guide, you will find all the information you need to know about international student health insurance for Indian students traveling to the USA.

Let’s first understand what international medical insurance is and why we need it.

What is international student health insurance?

International student health insurance is a type of insurance designed specifically for students studying abroad. The medical coverage generally includes doctor visits, hospital stays, emergency services, mental health care services, and sometimes even prescription medications.

If you’re studying abroad, international student health insurance is something you’ll likely need. The insurance typically lasts for your entire study period and can be extended if you stay longer.

Importance of health insurance in the USA for international students

In the USA, healthcare isn’t free.

Unlike some countries with universal healthcare, the US relies on a private system where medical services can be quite expensive. Doctor visits, hospital stays, surgeries, and even simple tests can add up to $3,000 – $5,000 quickly.

For example, treating something as common as a broken leg can cost up to $7,500. If you end up in the hospital, you might have to deal with hefty bills running into tens of thousands of dollars.

This is where health insurance comes in. If you have sufficient coverage, and the medical treatment you are seeking is covered by the insurance, then you will pay next to nothing.

In fact, international student health insurance is not only recommended, but mandatory in the USA. That’s because most universities in the USA require international students to have health insurance.

Types of health insurance plans for international students in the USA

There are generally two main types of plans available. Here’s a breakdown:

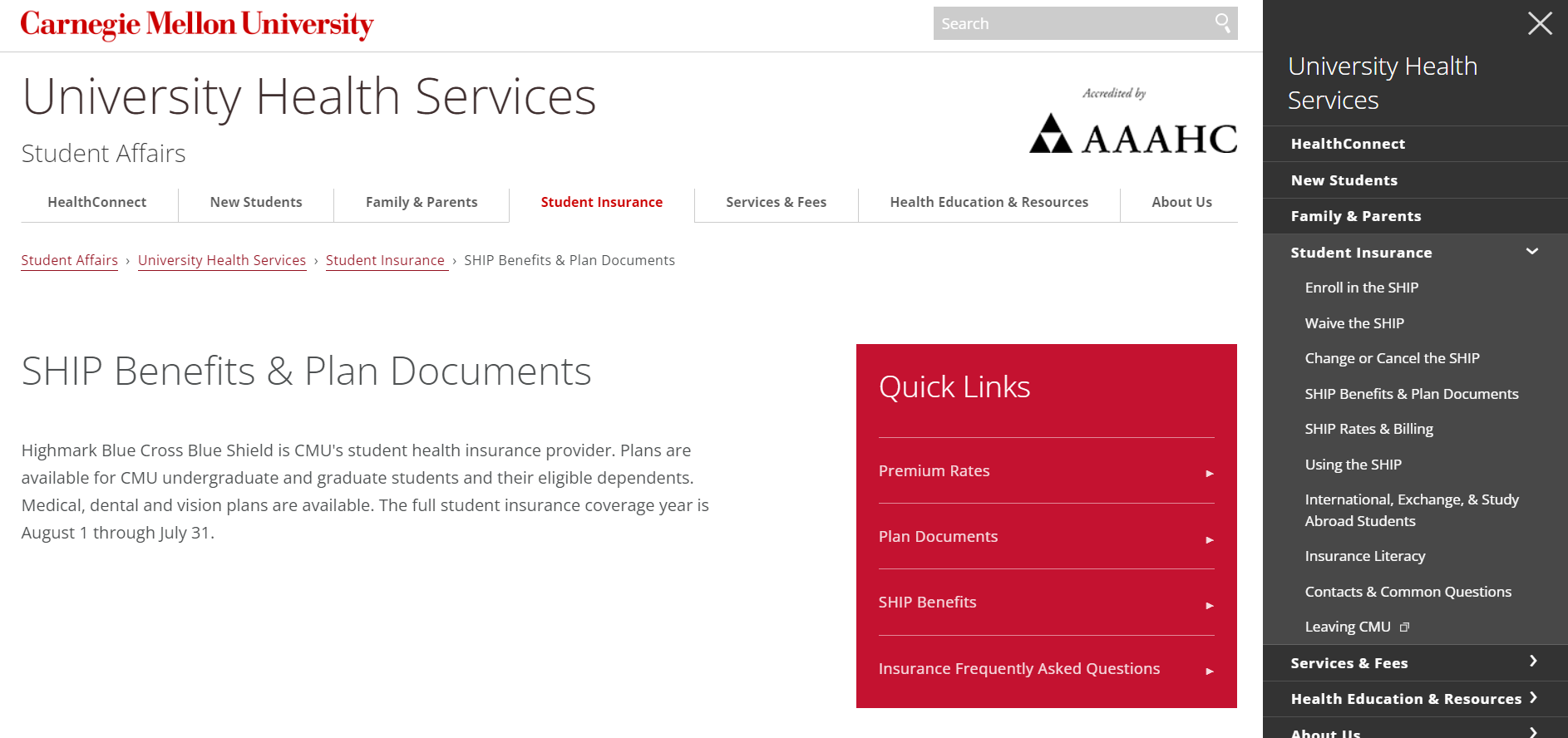

1. University-sponsored health insurance plans

These plans are offered directly through the university. Such an insurance plan is designed to meet the specific needs of international students. Students can expect comprehensive coverage from a university-sponsored plan.

Let’s take Carnegie Mellon University (CMU) as an example. They offer a university-sponsored plan through Highmark Blue Cross Blue Shield. This plan covers medical, dental, and vision care. This ensures that you’re protected on multiple fronts. The full coverage year runs from August 1st to July 31st, which overlaps with the academic calendar for the Fall intake.

The cost of such university-sponsored plans is usually included in your tuition fees. This means you’re automatically enrolled as soon as you start your program. This setup is known as a ‘Mandatory Group Health Insurance Plan.’ It ensures you’re covered right from the start and lets you focus more on your program and less on managing health insurance.

However, this isn’t the only option. Another arrangement is the ‘Group Health Insurance Plan with the option to waive.’ A waiver allows you to opt out of the university-sponsored plan and choose a private health insurance plan instead.

2. Private health insurance plans

If the university-sponsored plan isn’t the right fit for you, you can always opt out of it. In such a case, you’ll need to purchase a private health insurance plan, which must also meet the criteria set by the university.

Here’s what you can expect from private health insurance plans:

- You get a wider range of options to tailor your coverage to your specific needs and budget

- You can choose the level of coverage, deductible (the amount you pay out of pocket before insurance kicks in), and benefits that best suit you

- You can get additional coverage options for pre-existing conditions, maternity care, mental health services, or sports injuries

- If you’re bringing family members with you to the USA on an F2 visa, you can often add them to your private health insurance plan

- Some private plans offer coverage for emergency medical evacuation or repatriation as well

In this way, private insurance offers more flexibility and benefits. You can even opt for ‘minimum necessary’ rather than ‘full’ coverage to keep your insurance expenses to a minimum, while still having enough coverage to take care of the most common situations where you might need medical assistance.

Benefits of health insurance in the USA for international students

Here’s how having health insurance benefits you as an international student in the USA.

1. Avoiding unexpected medical costs

It’s impossible to predict when you might fall ill or get injured. That is why health insurance is crucial because it covers these high costs so that a medical emergency doesn’t put a strain on your finances.

2. Getting preventative care and early treatment

If you have a health insurance policy, you can regularly get health check-ups done, get vaccinated, and undergo any type of necessary screenings. These services are also usually covered without additional costs. That way, you can stay healthy and catch any issues early.

3. No yearly or lifetime limits

A lot of student health plans offer unlimited coverage. This means there are no annual or lifetime caps on the amount you can claim for medical care. You can receive the necessary treatments without worrying about reaching a coverage limit.

Next, let us look into a few top providers to find an international student health insurance plan that best suits you.

Best health insurance plans for students in the USA

Here is an overview of the top four international health insurance providers and the different plans they offer.

1. ISO Insurance

ISO Insurance offers affordable and customized insurance plans for international students studying in the USA. It is one of the cheapest health insurance providers in the USA, with plans starting at just $31 monthly.

You also get different plans depending on different visa types, including F1, J1, J visa scholars, OPT, and F2/J2 dependents.

OPTima plans

ISO Insurance offers short-term insurance plans designed for students on the F1 OPT program. These plans are called OPTima Basic and OPTima Enhanced.

| Feature | OPTima Basic | OPTima Enhanced |

| Monthly Cost | $39 | $79 |

| Annual Maximum | Unlimited | Unlimited |

| Per Injury/Sickness Maximum | $125,000 | $500,000 |

| Deductible | $400 per event | $250 per event |

| Emergency Room Copay | $350 | $350 |

| Coinsurance | 75% in-network | 75% in-network |

| Pre-existing Conditions | Covered after 12 months | Covered after 12 months |

| Medical Evacuation | $50,000 | $60,000 |

| Repatriation of Remains | $25,000 | $50,000 |

| Provider Network | First Health & Multiplan | First Health & Multiplan |

J1 exchange plans

ISO Insurance offers J1 exchange plans tailored for individuals traveling to the USA on a J1 visa for work or study-based exchange programs. These plans typically meet or exceed the insurance requirements set by the US Department of State for J1 visa holders.

| Plan Features | J1 Exchange Plan | J1 Exchange Superior Plan |

| Monthly Premium | $39 | $58 |

| Annual Maximum Coverage | Unlimited | Unlimited |

| Max Coverage per Injury/Illness | $125,000 | $300,000 |

| Deductible per Event | $400 | $250 |

| Coinsurance | 75% in-network | 75% in-network |

| Pre-existing Conditions | Covered after 6 months | Covered after 6 months |

| A.M. Best Rating | A++ | A++ |

| Medical Evacuation | $50,000 | $60,000 |

| Repatriation of Remains | $25,000 | $50,000 |

| Provider Network | First Health & Multiplan | First Health & Multiplan |

F1 Insurance plans

ISO Insurance offers F1 insurance plans specifically designed for international high school students. They typically provide two main plan options: F1 Basic and F1 High School Plus.

| Plan Features | High School Basic | High School Plus |

| Monthly Premium | $69 | $99 |

| Annual Maximum Coverage | $1,500,000 | $2,500,000 |

| Annual Deductible | $200 | $100 |

| Copay – Primary Care Physician | $35 | $25 |

| Copay – Specialist | $50 | $50 |

| Copay – Emergency Room | $350 | $250 |

| Coinsurance | 80% in-network | 80% in-network |

| Preventive Care | Not Applicable | $500 maximum |

| Medical Evacuation | $100,000 | $100,000 |

| Repatriation of Remains | $50,000 | $50,000 |

| Provider Network | Cigna PPO | Cigna PPO |

2. International Student Insurance (Student Secure)

The Student Secure plan, offered by International Student Insurance, is designed to meet the needs of international students studying abroad. This plan offers four coverage levels: Elite, Select, Budget, and Smart.

Here’s an overview:

| Plan Level | Policy Max | Deductible | Price per Month (in the USA) | Mental Health Coverage | Pre-existing Conditions | Sports Coverage |

| Smart | $200,000 | $0 | $31 | Inpatient: $5,000 max Outpatient: $500 max | Acute onset up to $25,000 | Leisure & recreational sports covered |

| Budget | $500,000 | $0 | $52 | Inpatient: 30 days

Outpatient: 30 visits |

Covered after 12 months | Leisure & recreational sports covered |

| Select | $1,000,000 | $0 | $104 | Inpatient: 30 days

Outpatient: 30 visits |

Covered after 6 months | School sports covered up to $5,000 |

| Elite | $5,000,000 | $0 | $178 | Inpatient: 40 days

Outpatient: 40 visits |

Covered after 6 months | School sports covered up to $5,000 |

3. Allianz Care

The range of Care plans offered by Allianz Care are worth considering for Indian students going to the USA. The coverage on offer goes up to $5,000,000, which is among the maximum coverage amounts offered under such plans. Here’s an overview of the plans.

| Plan Type | Max. Plan Limit | Room Type | Diagnostic Tests | Emergency Out-patient Treatment | Maternity Plan Option |

| Care | US$2,500,000 | Semi-private room | Included | Included | No |

| Care Plus | US$ 4,000,000 | Private room | Included | Included | Yes |

| Care Pro | US$ 5,000,000 | Private room | Included | Included | No |

4. Cigna Global

Cigna Global offers four types of insurance plans: Silver, Gold, Platinum, and Cigna Close Care Plan. We’ve shared more details about each of the plans below:

| Plan Name | Coverage Type | Annual Benefit Limit | Ideal For |

| Silver Plan | Worldwide or excluding the USA | Up to $1,000,000 | Students looking for substantial coverage with a limit |

| Gold Plan | Worldwide or excluding the USA | Up to $2,000,000 | Students needing higher coverage limits |

| Platinum Plan | Worldwide or excluding the USA | Paid in full, with no annual limit | Students seeking comprehensive, unlimited coverage |

| Cigna Close Care Plan | Country of residence + Country of nationality | Up to $500,000 | Students who travel frequently between two countries |

Note: As you can see, getting affordable medical insurance can significantly reduce your study abroad costs. Similarly, at every step of your journey, you can save a lot of money by making the right choices and comparing your options.

For instance, by comparing your education loan offers via FundRight, you can save up to ₹23,00,000 on interest expenses over the repayment period of your loan. Here’s how FundRight works:

- Complete Your Profile: Start by signing up and completing your profile on the FundRight platform.

- Receive Loan Offers: Wait as you receive loan offers from over 15 top lenders, including Indian banks, NBFCs, and international lenders. You’ll get these offers within two days.

- Compare and Shortlist: Compare the offers and make a shortlist of the ones that interest you.

- Get Expert Help: A financial expert will assist you in negotiating for even better terms with the lenders.

- Upload Documents and Manage Your Loan: Upload your documents securely and manage your entire loan search and approval process from home. You can expect to get your loan approval within about 10 days.

By following these steps, you can ensure you’re making the best financial decisions for your education abroad.

How to apply for international student health insurance in the USA?

Step 1: Understand your requirements

First, you need to know what your visa status will be. As mentioned earlier, if you’re on an F1 visa, you will be eligible for university-sponsored health insurance plans as well as private student insurance plans.

But if you’re on an Optional Practical Training (OPT) visa, you’ll have to look into private health insurance options.

Step 2: Research your options

Before buying any insurance plan, check if your university offers one. Many universities provide comprehensive plans for international students.

If your university doesn’t offer such a plan or if you’re looking for a private insurance plan by choice, there are several private providers to consider such as ISO Insurance, Allianz Care, Student Secure, and Cigna Global. These companies specialize in health insurance for international students in the USA.

Step 3: Compare plans

Next, you need to compare the different plans each insurance company offers. Focus on what each plan covers, including medical benefits and deductibles (the amount you must pay out of pocket before your insurance starts to cover costs).

Step 4: Apply for coverage

After deciding on a health insurance plan, visit the insurer’s website to start the application process. Look for the application form and fill it out with your personal information. This will include details such as your full name, date of birth, contact information, and passport number.

You will also need to provide information about your study program, including the name of your university, your course of study, and the duration of your program. Additionally, some insurers may ask for proof of enrollment or an acceptance letter from your university.

Step 5: Provide necessary documentation

Next, you must submit proof of enrollment at the university and a copy of your visa. This is essential to verify that you’re a legitimate international student going to study in the USA.

Step 6: Pay the premium

Once the company has reviewed and accepted your application, you will need to pay your first insurance premium to activate it.

Step 7: Receive your insurance ID card

After your payment is processed, the insurance company will send you an insurance ID card and your policy document. Remember, this card is very important because when you want to use your insurance benefits, you’ll need to present this card at hospitals and other medical facilities.

Additionally, check the policy document for detailed information about what’s covered and what’s not in your policy.

Cost of international student health insurance in the USA

Many universities offer standard health insurance plans to both domestic and international students. However, these can be quite expensive, ranging from $2,000 to $7,000 annually.

For example, during the academic year 2023-24, the Student Health Insurance Plan (SHIP) at Stanford University cost $7,128. At the University of Chicago, it cost $4,917. These university plans are comprehensive but can significantly strain your budget.

On the contrary, private health insurance companies offer more budget-friendly options. For instance, ISO Student Health Insurance, which specializes in international student health insurance services, has plans starting at just $31 per month.

These private plans are designed with the financial constraints and needs of international students in mind. They provide comprehensive benefits similar to SHIP but at a fraction of the cost. Additionally, they often come with more flexible enrollment periods. This makes it easier for you to find a plan that fits your schedule and budget.

Conclusion

Clearly, selecting the right student health insurance in the USA is crucial, given the exceptionally high healthcare costs.

While there’s an initial cost to health insurance, the benefits significantly outweigh these expenses. It provides peace of mind and financial protection against potentially enormous medical bills.

Always check out reviews for international student health insurance plans in the USA. This will help you find a plan that fits your budget and healthcare needs, enabling you to concentrate on your studies without worrying about health-related financial risks.

FAQs

How do I get dental insurance as an international student in the USA?

Unfortunately, not all plans include dental coverage, so you may need to purchase it separately from some insurance providers.

Does international student health insurance cover medications and eye care?

Yes, most plans cover prescription medications, but eye checks and eyewear coverage vary and may require an additional premium in some private health insurance.

Can I get health insurance coverage for my family as an international student?

Yes, you can get coverage for the dependents through the F2 healthcare visa option.

Does health insurance cover full-body checkups?

No, not all health insurance plans provide annual health check-ups. However, some university and private insurance plans provide health check-ups once every year. You will have to opt for them separately.