In times when education abroad continues to be prohibitively expensive, students depend on education loans more than ever.

Bank of Baroda enjoys a strong reputation as one of the top banks in India. The bank offers–among other products–education loans to students who want to study abroad. In this guide, we discuss aspects like eligibility, application process, and benefits of Bank of Baroda education loan.

Bank of Baroda education loans

Bank of Baroda, commonly referred to as BOB, is a major Indian public sector bank headquartered in Vadodara, Gujarat, and is the second-largest public sector bank in India after the State Bank of India.

Here is a comprehensive list of Bank of Baroda’s various loan offerings.

- Baroda Gyan: Covers graduation, post-graduation, and professional courses in India.

Up to ₹ 125 lakhs | 10-15 years tenure.

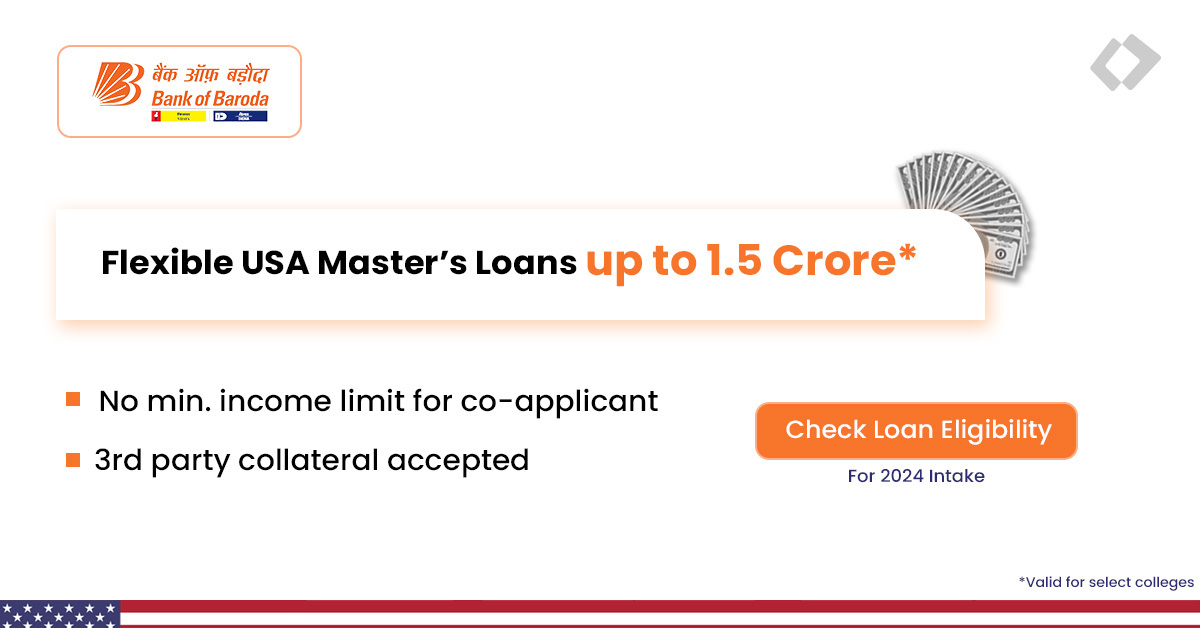

- Baroda Scholar: Designed for MBA, MCA, MS, and other job-oriented courses.

Up to ₹ 150 lakhs | 10-15 years tenure.

- Baroda Vidya: Supports parents in financing schooling for their children for recognized institutions, covering expenses like books and computers.

Up to ₹ 4 lakhs | flexible repayment schedule.

- Baroda Education Loan for Premier Institutions: For Indian nationals admitted to top institutes in India. Loan amounts vary based on the institution.

Up to ₹ 80 lakhs | 10-15 years tenure.

- Domestic EDP: For resident Indians studying and working simultaneously.

Up to ₹ 20 lakhs | 10-15 years tenure.

- International EDP: For employed Indians pursuing programs abroad.

Up to ₹ 80 lakhs | 10-15 years tenure.

Also Read: Education loan for Study Abroad Guide for Students

Interest rates for Bank of Baroda education loans

Here’s a table summarizing Bank of Baroda education loan interest rates:

| Scheme | Interest Rates |

| Baroda Vidya | 12.50% p.a. |

| Baroda Gyan | 11.05% to 11.15% p.a. |

| Baroda Education Loan to Students of Premier Institutions | 8.55% to 10.20% p.a. |

| Baroda Scholar | 9.70% to 11.15% p.a. |

| Baroda Executive Development Premier Institutions (India) | 8.55% to 10.20% p.a. |

| Baroda Executive Development Premier Institutions (Overseas) | 11.15% to 11.50% p.a. |

| Baroda Skill Loan Scheme | 10.65% p.a. |

| Digital Education Loan | 9.15% to 10.20% p.a. |

Note that Bank of Baroda education loan interest rates can change at any time. Please be careful and check the bank’s website for the latest applicable interest rates.

Application process for education loan from Bank of Baroda for Indian students

The application process for an education loan from Bank of Baroda is quite straightforward. Here’s the process:

- Choose the right loan product and apply

As you have seen above, Bank of Baroda offers many different types of education loans. So, for students, the first step is researching and selecting the right loan for their purpose.

The next steps are as follows.

- Visit the official website of the Bank of Baroda

- Navigate to the education loan section here

- Choose the specific loan scheme you’re interested in (such as Baroda Gyan, Baroda Scholar, or others)

- Click on the “Apply Now” button

- Fill out the Bank of Baroda Education Loan Application Form

Note on comparing loan offers

The interest rate you will pay depends on your individual circumstances. It’s much better to compare offers from India’s top lenders before initiating the process with one.

FundRight makes this comparison easy.

With just one login that takes less than 5 minutes, you can create a profile and within two days get offers from over 15 top Indian and international lenders, including banks and NBFCs.

In the later sections of this guide, we will explain more about how FundRight can help you find the best possible education loan to study abroad.

- Visit the branch to discuss your loan requirements in detail

Whether you apply online or offline, the student will have to go to the bank/branch for a personal interview. Be ready to discuss your academic background, chosen degree, university, and potential career prospects in your field of study.

You should also be prepared for multiple visits to the bank branch throughout the loan application process. This can be time-consuming and inconvenient.

A better way to apply

A much better way is to handle everything from your home and save your valuable time.

This is where FundRight can help. By creating one profile, you can receive loan offers from over 15 top Indian and international lenders, including banks and NBFCs, without ever having to leave your home.

All the documents needed to complete your application can be securely uploaded via FundRight. This makes the process smooth and hassle-free.

- Submit your documents

The bank will require certain documents in addition to the loan application.

These include:

- Identification proof (passport, Aadhar card, etc.)

- Address proof (utility bills, bank statements, etc.)

- Academic records (transcripts, certificates)

- Admission letter from the foreign university you’re enrolling in

- Proof of income of the co-applicant (if applicable)

- Wait for the decision on your loan application

Once your documents are verified and the credit score of your co-applicant is assessed (if relevant), the bank will decide whether to approve your loan.

You’ll be asked to sign a promissory note and various loan documents to assure your commitment to repayment.

- Wait for loan disbursal

After approval, the bank will disburse the loan amount. Usually, it is sent directly to your university’s bank account. The disbursement can be partial (payment each semester) or complete (the tuition fee for the course deposited in one go).

Eligibility for Bank of Baroda education loan

Here are some eligibility criteria for a Bank of Baroda education loan:

- You’ll need to be an Indian citizen.

- A strong academic record in your previous studies can be a plus.

- The loan might be specific to particular courses or institutions. Bank of Baroda website has a comprehensive list of institutions abroad. You can access it here.

- You must first secure an admission to your desired program and only after that can you apply for an education loan.

- For some loans, a co-applicant with good creditworthiness might be necessary (e.g., a parent, or sibling).

Why choose Bank of Baroda for a study abroad loan?

Bank of Baroda is a major public sector bank. Here’s why Bank of Baroda education loan for abroad are a good choice:

- Trusted bank

Bank of Baroda enjoys an excellent reputation. The bank has assisted thousands of students with their education loans for studying abroad. With a Bank of Baroda loan, you can focus on your admission and prepare to go abroad without worrying about timely loan disbursement.

- Global reach

The bank has 107 branches abroad. Through partner networks, they have ATMs worldwide which you can access using the international debit card that comes with your loan account. You have support, no matter where you are in the world.

- Cost-effective financing

Competitive interest rates from the Bank of Baroda make your study abroad loan more affordable. A lower interest means huge savings over the loan term. For instance, even a difference of 1.6% (9.4% versus 11%) brings you savings of about ₹ 4.5 lakhs over a 10-year period on a loan of ₹ 40 lakhs.

- Comprehensive coverage

When you go abroad, there is not only a tuition fee but also the cost of boarding and living. Education loans from Bank of Baroda provide the financial support you need to study abroad. Loan amounts cover not only tuition, but also living expenses, travel, and other study-related costs.

- Complete transparency

Bank of Baroda offers a clear and straightforward loan application process. There are no hidden fees or other unexplained charges. Throughout the process, you will remain informed and bank personnel will do their best to guide and support you.

Bank of Baroda education loan EMI calculator

Equated Monthly Installments or EMIs provide a structured way to repay a loan amount with interest.

Here is an easy explanation of why EMI is important:

- Manageable payments: EMIs break down the total loan amount and interest into equal monthly payments. This makes repayment of the loan more manageable.

- Budgeting: With a fixed EMI, you can easily budget your finances. This allows you to plan your income and expenses perfectly.

Bank of Baroda has an EMI calculator that is easy to use. You need to fill in the loan amount, interest rate, and tenure. The Bank of Baroda EMI calculator does the rest and shows you the monthly payment.

Also read: Education Loan Repayment Tips That Actually Work

Documents required to secure a student loan from Bank of Baroda

When applying for a Bank of Baroda education loan for study abroad, you will need to provide several documents.

Here’s a comprehensive list:

Student-Applicant Documents

- Proof of Identity:

- Aadhar Card

- PAN Card

- Passport (mandatory for studying abroad)

- Proof of Residence:

- Aadhar Card

- Passport

- Voter ID card

- Academic Records:

- 10th and 12th mark sheets

- Graduation mark sheets

- Entrance exam results (e.g. GRE and TOEFL)

- Proof of Admission:

- Admission letter from an institution abroad

- Statement of Cost of Study/Schedule of Expenses

- 2 Passport-Size Photographs

- Details of any other loans you are repaying

Co-Applicant/Co-applicant Documents

- Proof of Identity:

- Aadhar Card

- PAN Card

- Proof of Residence:

- Aadhar Card

- Passport

- Voter ID card

- Utility bills

- 2 Passport-Size Photographs

- Income Proof for Salaried Co-Applicant:

- Salary slip

- Copy of Form 16

- IT returns for a minimum of two previous assessment years

- Bank account statement for the last 6 months

- Income Proof for Self-Employed Co-Applicant:

- Business address proof

- IT returns for a minimum of two previous assessment years

- TDS certificate / Form 16A

- Bank account statement for the last 6 months

Collateral Documents

- Title deed of house, property.

- Proof of ownership of jewelry and other assets.

Things to remember when applying for Bank of Baroda education loans

Before you take a Bank of Baroda education loan for studying abroad, you need to carefully consider various aspects. This is because, even though EMis spread out the cost of a loan over many years, a loan of several lakhs is a major responsibility.

Here are some essential factors to keep in mind during the application process:

- Research loan options

Bank of Baroda has multiple loan schemes. This means you will need to compare not only these loan products to find one that suits you the most.

Note: We recommend that you don’t settle for the first offer from a lender. It is prudent to compare loan offers from different lenders.

- Understand eligibility criteria

Before applying for the loan make sure you meet the eligibility requirements for the education loan scheme from Bank of Baroda.

- Gather required documents

Ensure you have all the necessary documents listed above. These usually include ID proof, residence proof, acceptance letter, transcripts, co-signers income proof, and collateral documents.

- Consider suitable repayment options

Choose a repayment plan that works for you. Consider the moratorium, and monthly payment amount (EMI). Do you want a long tenure? It means lower payments each month but overall you would have to pay a much larger interest. The EMI calculator offers you an easy way to plan ahead.

- Read the fine print

Read the loan agreement thoroughly without missing any details. Pay close attention to details like interest rates, repayment schedules, prepayment options, late payment fees, and any other terms and conditions. Understanding the fine print is critical before you sign the loan document.

Also read: How To Get U.S. Education Loan To Study In US As An Indian Student

Collateral rules for Bank of Baroda education loans

Collateral is an asset that you pledge as security for an education loan. Essentially it is a safety net for the bank. If you fail to repay the loan, the bank can seize and sell the collateral to recoup their investment.

When it comes to Bank of Baroda education loans to study abroad, the collateral requirements vary based on the loan amount.

Here’s what you need to know:

- Loan Amount Up to ₹4 Lakh:

- No Collateral Required: If your education loan amount is up to ₹4 lakh, you won’t need to provide any collateral. This makes it easier for students to access funds without additional security.

- Loan Amount Between ₹ 4Lakh and ₹7.50 Lakh:

- Third-Party Guarantee: For education loans exceeding ₹4 lakh and up to ₹7.50 lakh, a third-party guarantee is necessary. Additionally, the assignment of future income may be required.

- Loan Amount Above ₹7.50 Lakh:

- Collateral Security: If your education loan amount exceeds ₹7.50 lakh, you’ll need to provide collateral security equivalent to 100-125% of the loan amount. Collateral options may include residential property, fixed deposits with the Bank of Baroda, or other assets. The decision to accept or reject a collateral rests with bank officers. Every loan is discretionary and the loan officer has to be satisfied with every aspect.

You can get an education loan of up to ₹1 cr without collateral, via FundRight.

What is FundRight?

FundRight is the world’s first reverse bidding platform for education loans. Students can create their profile on the platform, specify their education loan needs, and then wait as 15+ top lenders compete to offer the best loan to the students. This means that students enjoy the unprecedented experience of getting the best possible loan terms, without having to visit any bank branch in person. Students have saved up to ₹ 23 lakhs in interest expenditure over the total repayment duration of their education loans via FundRight.

How it works:

- Sign up on FundRight.

- Receive personalized offers from 15+ lenders, including public banks

- Upload your documents

- Get help from a financial expert at every stage of your application

- Get your loan approved in as little as 10 days

Why wait? FundRight can get you loan offers in just 2 days. Apply today.

Also Read: How To Get An Education Loan Without Parental Support?

FAQs

1. What is the effect of the repo rate on Bank of Baroda education loans to study abroad?

The repo rate is the interest rate at which commercial banks borrow from the Reserve Bank of India.

If the repo rate goes up, the loan interest rate goes up and banks will charge you more interest on your education loan.

2. How long does the approval decision take for a Bank of Baroda education loan for studying abroad?

It takes between 1-2 weeks for a loan to be accepted or rejected. The major step is the appraisal of collateral and verification of the documents you have submitted.

In principle, the loan will be approved within a week but in practice, it might take a few more days. After the final verification of collateral, the disbursal happens within fifteen days.

3. Can I convert my Bank of Baroda education loan from a floating rate to a fixed rate?

You can switch between a floating interest rate and a fixed interest rate education loan. Bank of Baroda may apply necessary charges for this conversion. It’s advisable to check with the bank for specific details.

4. Is a Bank of Baroda education loan available without collateral?

Yes, such a loan option is available but the amount is limited to ₹ 7.5 lakhs.

5. There is a moratorium period. How will my repayments be determined?

During the moratorium, you do not have to pay any EMI. However, the interest will build up on your loan. This extra interest will be added to your original loan amount. Your monthly payment (EMI) will then be based on this higher total.

For example, say your loan amount is ₹50 lakhs. There is a two-year moratorium and the principal and interest together amount to ₹56 lakhs. Your EMIs will be based on ₹56 lakhs.