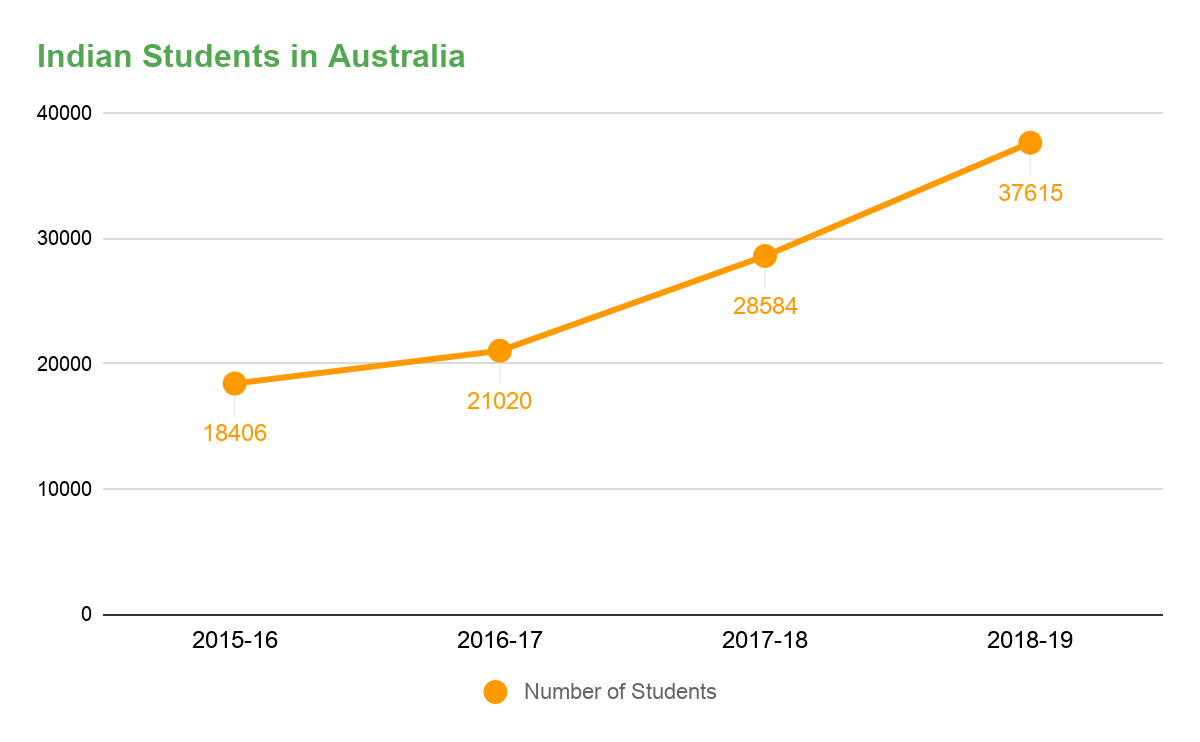

As of January 2021, over 1 million Indian students study outside the country. And 77,000 of the students study in Australia.

Australia has some of the best-ranked universities in the world. However, when compared to 15 other popular study destinations, the cost of studying in Australia is the highest.

That’s why student loans for studying in Australia are necessary. Getting funding from any source is a hurdle and a half. But using FundRight will make the experience so much better for you.

We have over 30 lenders on our platform. You can compare all of the rates from your home.

What’s more, lenders will bid to give you a loan on our platform. This way, you can get the lowest interest rate for your study abroad loan.

But now let’s talk specifics about student loans for Australia.

Cost of Studying in Australia

Degree-wise breakdown

International students make up a fifth of the higher students in Australia. So universities in Australia lost a significant portion of their revenue in 2020. So the cost for many courses increased multifold in Australia.

Here’s a breakdown of the approximate cost for various courses in Australia in 2022.

| Degree | Cost in AUD | Cost in INR |

| Arts | $58,000 | ₹31,63,763.70 |

| Engineering | $37,000 – $49,000 | ₹20,18,263 – ₹26,72,835 |

| Medicine | $255,200 – $630,000 | ₹1,47,13,500 – ₹3,63,22,500 |

| Computer Science | $38,000 – 92,000 | ₹20,72,810 – ₹50,18,384 |

| Psychology | $32,000 – $50,400 | ₹17,45,525 – ₹27,49,201 |

Other expenses

Australia is a pretty expensive country to live in. So international students will also have to spend a large portion of their budget on their living needs.

Here are the average monthly living costs for various cities in Australia without rent.

- Sydney: $1,446.69

- Melbourne: $1,222.10

- Adelaide: $1,311.06

- Canberra: $1,222.10

- Perth: $1,296.13

- Brisbane: $1,394.91

- Newcastle: $1,281.27

A large one-time expense you’ll have to plan for is your student visa. A student visa for Australia costs $630. That is approximately ₹35,000.

If you are planning to work in Australia after finishing your course, then you’ll need a temporary graduate visa. This costs $1,680 or ₹92,000. Though this won’t be an immediate cost for you, it’s one you’ll need to plan for.

Getting A Student Loan for Studying in Australia

It’s always a good idea to be ahead of the loan application game. Some banks can drag the application process for more than two months.

Plus, you need to show proof of funds for getting a student visa to Australia. So start your loan research process parallel to the college applications. And once you get your admission, immediately apply for the loan.

But, if you do find yourself in a situation where your visa appointment is next week and you still don’t have a sanctioned loan, worry not. FundRight can ease your pain. If you’re in a crunch, we can get your loan approved in 2 days.

If you’re not, then we can help you find the best rates. We are India’s first loan bidding platform. You can choose between 30+ lenders to get your education loan for Australia.

Potential Providers

There are widely two types of education loan lenders – banks and NBFCs. And even within banks, you can borrow from nationalized banks or private banks.

The key difference between these types of lenders is the interest rate you’ll pay. Typically, NBFCs have higher rates of interest. This is because they have to cover their borrowing cost and spread.

But the benefit you get with NBFCs is the option of not submitting collateral for even high loan amounts. This applies only in specific cases. And you can also get the loan sanctioned quicker.

Banks, especially nationalized banks, will have a lower ROI. But, the processing time in banks is typically longer. In India, most banks don’t offer loans over 4.5 lakhs without collateral. So that’s another point to consider.

Process For Applying

Most lenders will need your offer letter from your college. So step one is getting accepted into a program in Australia.

Your next order of business should be to research the best interest rates and terms for your study loan for Australia.

No matter the final lender you choose, the documents you’ll need to submit are pretty much the same. So make sure you have all your documents prepared. Here’s a list of the documents you’ll need.

- PAN Card (of applicant and co-signer)

- Aadhar Card (of applicant and co-signer)

- Academic Records – 10th, 12th, and UG mark sheet if applicable (of applicant)

- Passport Sized Photo (of applicant and co-signer)

- Cost of study documents

- Proof of admission

- Co-signer’s income proof, bank statements, and IT records

Once the lender approves your application, you’ll sign an education loan agreement document. This document will dictate the terms of repayment and interest type.

Wait, there’s more.

How To Allocate Your Funds

Most lenders prefer to disburse your loan directly to your university’s account. But for studying in Australia, the embassy has different requirements.

For study loans for Australia, the lender should transfer the money to you, the student. You should then send your university the proof of receipt.

The university will then send you a Confirmation of Enrollment (CoE) letter. This is crucial for your Visa application process.

The money will reside in your Indian savings account with a hold on it. So only when you need the money can you access it.

The Easiest Way To Get Funds

Unless you enjoy jumping through hoops, FundRight is the best way to get an education loan for Australia.

Just submit your profile to us and we’ll help you find the right lender. Our financial experts can answer any questions you may have about the borrowing process. Write to us at grad@gradright.com to start your education loan process.