Yes Bank is one of the most recognized names in the Indian banking space. Like all top banks, it offers attractive education loan products for students who wish to study abroad.

If you are looking for an education loan from Yes Bank, this guide has all the information you need.

In this article, we will discuss the interest rates, documents required during the application process, and other important aspects of Yes Bank’s education loan for studying abroad.

Also read: Best Education Loan Providers in India 2025: Top Banks & Interest Rates

An introduction to Yes Bank education loans

Yes Bank is an Indian private-sector bank established in 2005. It is headquartered in Mumbai with a pan-India network of 1,198 branches.

The key advantages of Yes Bank education loans are:

- Competitive interest rates on education loans

- Quick and hassle-free loan application process

- Special interest rate offers for female students and working professionals pursuing management training courses

Interest rate of Yes Bank education loan

Here’s a table that summarizes the Yes Bank education loan and its key features, including interest rate.

| Loan Amount | Up to 1.5 Crore |

| Interest Rate | Starting from 11% |

| Processing fee | Up to 1% of the loan amount |

| Tax Benefits | Yes, under Sec 80E |

| Application Process | Online, Offline |

Application process for education loan from Yes Bank

If you’re an Indian student seeking an education loan from Yes Bank, here’s a step-by-step guide to the application process.

- Download the application form from the official Yes Bank website or their mobile app. Fill in all the required fields and sign the agreement.

- Gather all the necessary documents listed by Yes Bank and submit them along with your completed application form.

- Once you’ve submitted your application and documents, wait for Yes Bank to review and decide on your loan approval.

We recommend that students compare offers from multiple lenders before committing to one. For this. we’ve built FundRight, where you can compare loan offers from over 15 lenders like NBFCs and banks, including Yes Bank. This way, you can find the best deal for your education needs.

Eligibility for Yes Bank education loan

To be eligible for Yes Bank education loan, you need to meet the following criteria:

- Must be an Indian citizen.

- Must have secured admission to a recognized university (admission letter required)

- Must have cleared 10+2 or any other equivalent examination.

Also read: Education Loan Eligibility Criteria Guide For Indian Students

Why choose Yes Bank for a study abroad loan?

Yes Bank offers education loans with competitive interest rates for Indian students. Here are more reasons why students prefer Yes Bank education loans.

- Enjoy a fast and clear approval process for your loan.

- Choose a repayment period that suits you, ranging from 36 months to 180 months.

- Experience a hassle-free loan disbursement process with minimal documentation.

- Manage your funds easily while studying abroad with Yes Bank’s multi-currency FOREX card.

- Start your repayments after up to 12 months after you complete your degree program, for peace of mind.

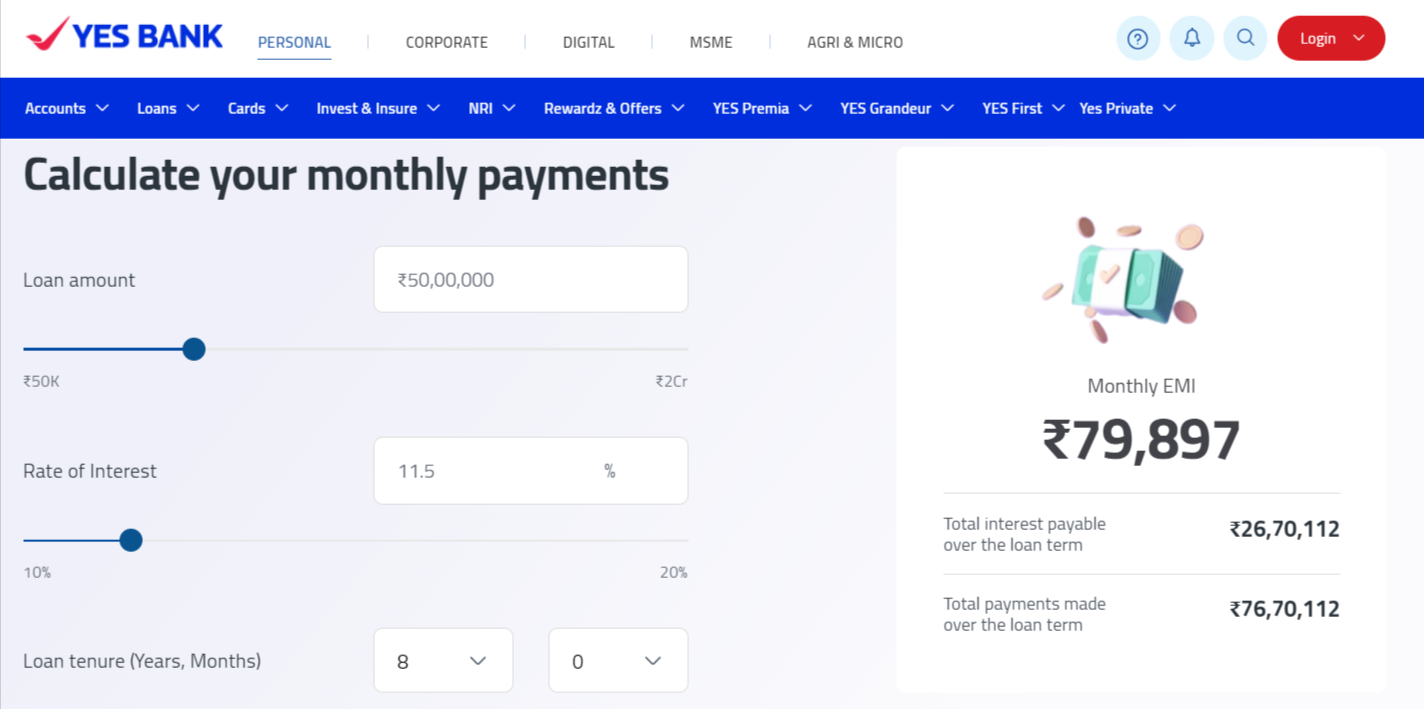

Yes Bank education loan EMI calculator

The EMI of Yes Bank is calculated on the basis of the following variables:

- The interest rate

- The total amount of sanctioned loan

- Loan repayment tenure

For instance, you take a loan of ₹50 lakhs with an interest rate of 10%, to be repaid over 15 year, you can calculate the EMI using the following formula:

EMI = P x R x (1+R)^N / [(1+R)^N-1]

Where:

- P is the total loan amount

- R is the rate of interest

- N is the loan tenure in months

To make this process easier, you can use the Yes Bank EMI Calculator. Simply enter the values of P, R, and N to get an accurate EMI figure.

Below is a screenshot of the Yes Bank EMI Calculator for your reference:

Your documents checklist for Yes Bank education loan

Here’s a list of some documents that a student must submit while applying for a Yes Bank education loan.

| Documents | Details |

| Academic records |

|

| Admission proof |

|

| Course expenses |

|

| Photograph |

|

| Identification documents for applicant and co-applicant |

Note: The documents should be self-attested. |

| Co-applicant’s financial documents | If salaried:

For self-employed

|

| Collateral-related Documents |

|

Things to remember when applying for Yes Bank education loans

When you’re applying for a Yes Bank education loan, there are a few things you need to keep in mind.

Eligibility criteria

When you’re applying for a Yes Bank education loan, the first thing you need to consider is the eligibility criteria.

Loan amount and margin

First, you must determine the loan amount you need. The loan amount considers tuition fees, living expenses, and other costs.

Next, you must understand the margin amount necessitated by the bank. The margin amount is that part of the total expense (or total loan amount sought) that you must finance yourself. For example, if a student has applied for an education loan of 60 lakhs and the loan margin is 15%. Then the loan margin will be 15% of the loan amount, which is 9 lakhs. This means the bank will issue a loan of ₹51 lakhs.

Tenure

When selecting the tenure for your Yes Bank education loan, you will need to carefully compare different combinations of tenure and EMI. You can opt for a repayment period of up to 15 years. While choosing a longer tenure means your monthly EMI will be lower, it also means that you will end up paying more in interest over the duration of the loan. Conversely, a shorter tenure will increase your monthly EMI but reduce the overall interest expense. So, you must consider your financial situation and future income prospects before deciding on the tenure that works best for you.

The moratorium period is the time when you don’t need to make any principal repayments. For a Yes Bank education loan, this period can be extended up to 12 months. Note that the interest keeps on building up for this period.

Once you have considered these points and feel you meet the eligibility criteria, you can move forward with applying for a Yes bank education loan.

Collateral rules for Yes Bank education loans

When you apply for a Yes Bank education loan, the requirement for collateral depends on the loan amount.

Collateral Loans

For higher loan amounts, Yes Bank expects you to pledge collateral as security. Here’s how it works:

- Collateral Loan Amount: Up to ₹1.5 crore

- Rate of Interest: 10.75 – 11.5%

Non-Collateral Loans

Yes Bank also offers non-collateral loans for students who might not be able to provide collateral. These loans have slightly different terms:

- Non-Collateral Loan Amount: Up to ₹55 lakhs

- Rate of Interest: 11-12.5%

Whether you opt for a collateral or non-collateral loan, make sure you understand the terms and choose the option that best suits your financial situation.

Also read: Non Collateral Education Loan for Study Abroad: How To Apply?

If you need a higher loan amount, you can still secure it with the same collateral. Additionally, some of India’s top banks offer non-collateral loans up to ₹1 crore. So while Yes Bank provides a good education loan product, you must compare different options to find the best fit for your needs. This is where FundRight can be a great help.

What is FundRight?

FundRight is a platform that helps students find the best education loan offers. Here’s how it works:

- Create a Loan Demand: You specify the amount of loan you need.

- Receive Offers: Over 15 banks and NBFCs respond with offers within 2 days.

- Compare and Apply: Compare the loan offers, choose the best one, and securely upload your documents on FundRight.

- Consult a Financial Expert: Speak with an expert who can guide you on negotiating for even better terms.

- Get Approval: If all goes well, you can receive an approval decision within 10 days.

Find the best study abroad loan deals with FundRight, sign up now.

Frequently Asked Questions (FAQs)

1. Does Yes Bank provide education loans for studying abroad?

Yes, students can get education loans for studying abroad from Yes Bank.

2. Can I apply for a Yes Bank education loan online?

Yes, you can apply for the Yes Bank education loan online.

3. What are the interest rates for Yes Bank education loans?

The interest rate for a Yes Bank education loan starts at 10.99%. Contact your nearest branch for more details.

4. What are the benefits of a Yes Bank education loan?

The benefits of Yes Bank education loans include competitive interest rates, flexible repayment options, and coverage for various education expenses such as tuition fees, accommodation costs, exam fees, and travel expenses.

5. Who is eligible for a Yes Bank education loan?

Yes Bank education loan eligibility criteria depend on your academic qualifications, co-applicant profile (if required), and future earning potential.

6. What expenses does a Yes Bank education loan cover?

Yes Bank education loans cover various expenses apart from tuition fees, such as hostel charges, books, lab equipment, travel, and other education-related costs.