Introduction to the Tata Capital education loans for studying abroad

Tata Capital Limited is a leading non-banking financial service provider in India. Established in 2007, the company is a subsidiary of Tata Sons Limited, one of India’s largest and most respected conglomerates.

The company is based in Mumbai and has over 723 branches in India. This number is growing and is expected to reach 1,000 by 2025.

Tata Capital is registered with the Reserve Bank of India (RBI) and offers multiple financial solutions, including commercial finance, investment banking, consumer loans, private equity, treasury advisory, and credit cards.

In this guide, we will focus on Tata Capital Education loan for studying abroad and its application process, documents required, collateral rules, etc. Keep reading to find out.

About education loans from Tata Capital

Tata Capital education loans are a popular choice among students in India. The NBFC offers loans at competitive interest rates for students looking to study domestically or internationally.

With Tata Capital, students can avail of education loans for up to ₹75 lakhs without collateral and up to ₹2 crores with collateral. This makes Tata Capital education loans highly attractive for students looking to pursue top-rated programs at top universities abroad.

Students can also get a 100% financing option which gives them the peace of mind they need for funding every aspect of their studies abroad. This includes living expenses, tuition, books, accommodation fees, lab fees, travel, etc.

Read on to find out more about the Tata Capital education loan interest rates.

Interest rates for Tata Capital education loans for studying abroad

Tata Capital education loans are available at competitive interest rates compared to other banks and NBFCs. Interest rates vary based on the type of loan you choose, whether secured or unsecured. Below is the table detailing the two types of loans and their respective interest rates:

| Loan Type | Interest Rate |

| Secured (with collateral) | [REPO + 3.75%(spread)] onwards* |

| Unsecured (without collateral) | 10% and above |

A secured loan can result in lower interest rates. However, in unsecured loans, collateral is not required, which results in higher interest rates.

* REPO rate stands for the Repurchase Option Rate. It is the rate at which the Reserve Bank of India (RBI) lends short-term funds to commercial banks. When banks face a shortage of funds, they can borrow from the RBI at the REPO rate.

Application process for getting an education loan from Tata Capital

The Tata Capital education loan application process is straightforward. Here’s the step-by-step procedure to get started with application process:

Step 1: Visit the official website

First, visit the official Tata Capital education loan website, select the ‘Loans for you’ option, and navigate the education loan page.

Step 2: Fill up the application

Once you are on the page, click ‘Apply now’, and you’ll be redirected to the online application form. Fill out the application with your educational details and the required loan amount.

Once you complete the details, re-check the application thoroughly and click ‘Apply’.

Step 3: Submit the required documents

After submitting your application with basic details, the officials will review it. Once you receive confirmation of your basic loan eligibility, the next step is to submit a few required documents for the application.

Here is the list of documents required for applicants and co-applicants respectively:

- Identity proof (Aadhaar, Passport, PAN card, Voters ID, Driver’s License)

- Residency proof (Aadhaar, Pan-card, Voters ID)

- Academic documents

- X and XII mark sheets.

- Graduation mark sheets (if applicable).

- University admission letter.

- Standardized test scores (CAT, CET).

- Language proficiency scores (IELTS, GRE, PTE, Duolingo).

- Financial documents (for co-applicants)

- Income tax returns for the last 3 years

- Last 3 months’ salary slips

- Last 2 years’ Form 16

- Bank statement for the last 6 months

- Balance sheet

- Business proof (if self-employed)

Step 4: Verification of your documents

Once you submit your documents, the lenders will scrutinize and verify every detail of your application from the documents you submitted.

The process can take a bit of time due to the complexity of the verification process. Upon verification, you will receive a loan agreement document, if approved.

Step 5: Sign the loan agreement

The loan agreement document outlines various loan terms like interest rate, repayment tenure, moratorium period, pre-processing fee (if any), extra charges, etc. Read the agreement thoroughly and then proceed to sign it.

Once you accept the loan terms and sign the contract, the sanctioned loan amount will be disbursed into your bank account.

Eligibility for the Tata Capital education loan to study abroad

The Tata Capital Education loan eligibility criteria are easy to meet. Here is an overview of the eligibility criteria you need to fulfill:

- You should be an Indian citizen.

- Your age must be between 16 and 35.

- You must have at least completed a 10+2 degree or diploma.

- You should be pursuing a graduation or post-graduation degree in professional education.

- Your chosen university must be recognized as an accredited institute of education.

- You should have standardized scores like GRE, GMAT, etc.

- You must have a co-borrower who will support your loan application.

(This co-borrower can be your father, mother, brother, sister, parent-in-law, grandparents, or spouse).

- If you want to secure an education loan with collateral, then you can pledge collateral securities like property, fixed deposit, or even your collateral pledged to an existing Tata Capital home loan.

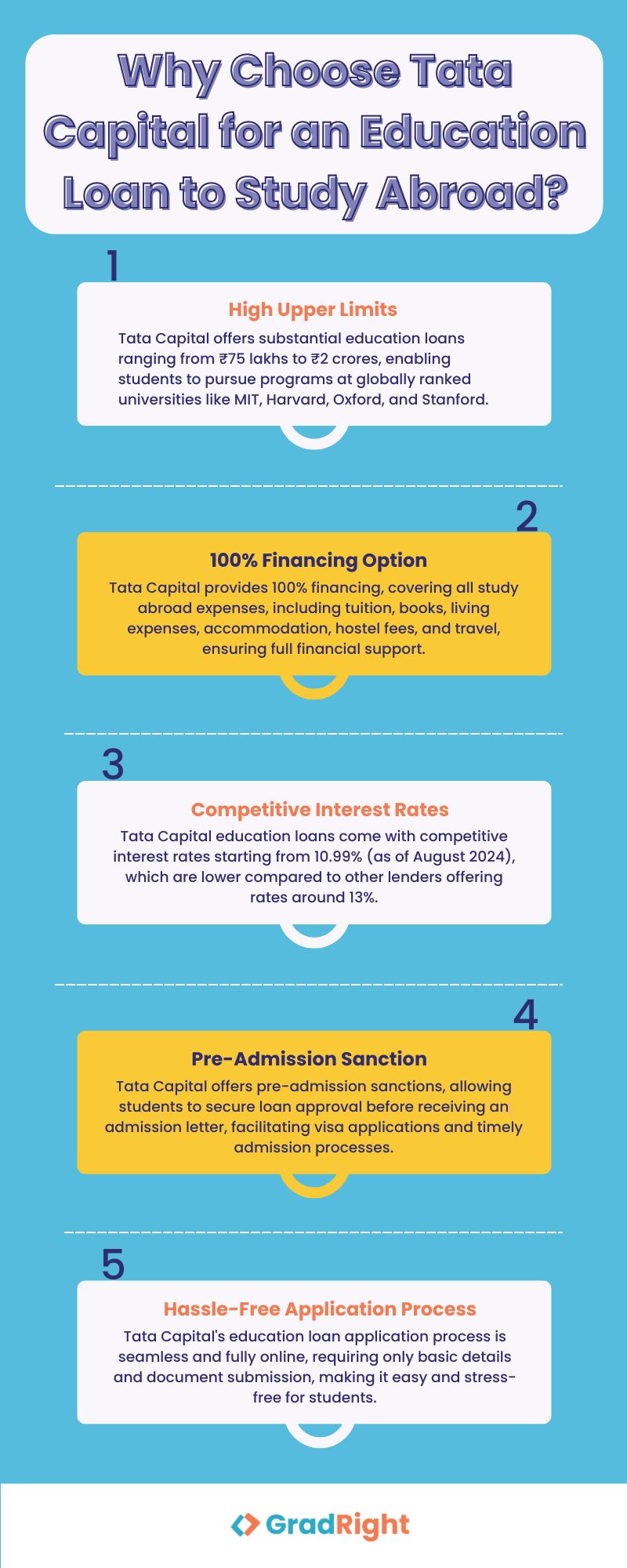

Why choose Tata Capital for an education loan to study abroad?

Tata Capital’s education loan for studying abroad has multiple features that make it an attractive choice among students. Here is an overview:

High upper limits for education loan amounts

Tata Capital offers substantial education loan amounts to students planning to study abroad. These amounts can range from ₹75 lakhs to ₹2 crores, allowing students to pursue leading programs at globally ranked universities such as MIT, Harvard, Oxford, Stanford, etc.

100% financing option

A Tata Capital education loan for studying abroad comes with a 100% financing option. This means that you can get enough funding to cover all expenses of studying abroad, like tuition, academic books, stationery, and work-laptop, as well as living expenses like accommodation charges, hostel fees, and even travel.

Competitive interest rates

Tata Capital education loans are available at competitive interest rates as compared to other banks and NBFCs in India. Their interest rates start from 10.99% (as of August 2024) which is much lower than other lenders offering loans at interest rates such as 13%.

Pre-admission sanction

Tata Capital offers pre-admission sanctions, which means students can secure loan approval even before receiving an admission letter. This document helps them to get a visa and secure admission into the institution of their choice. This speedy and unconditional loan processing is particularly useful for students who are struggling with fast-approaching timelines around admissions, visas, and loans.

Hassle-free application process

Tata Capital’s education loan application process is seamless and hassle-free. All you need to do is fill in your basic details and submit the required documents. You can complete the entire process online.

Tata Capital education loan EMI Calculator

Even though Tata Capital offers various financial products, it currently does not provide a specific EMI calculator customized for education loans on its website. However, you can use Tata Capital’s Personal loan EMI calculator as a reference to estimate potential monthly payments.

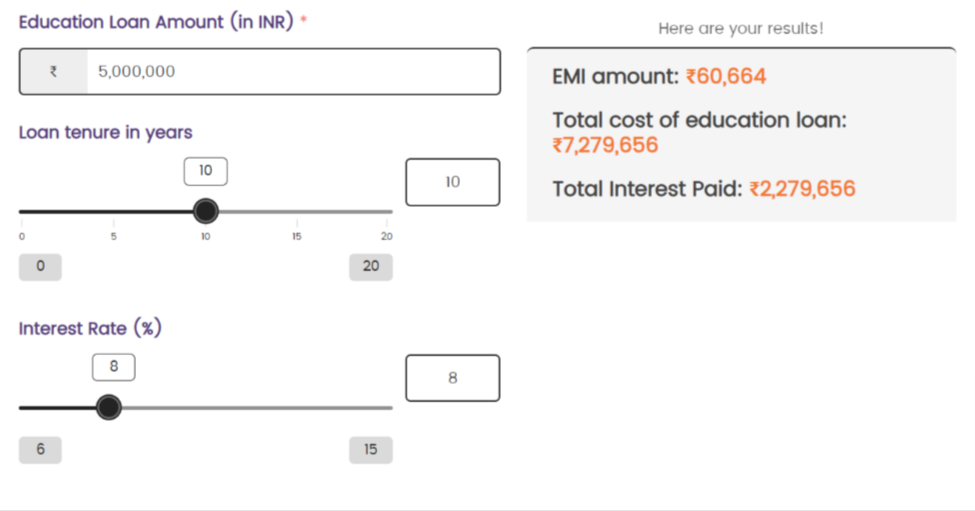

An even better mechanism to get a sense of your EMIs is to use FundRight’s education loan EMI calculator.

Here’s how to use the FundRight EMI calculator:

- Access the EMI calculator on the FundRight platform.

- Enter the desired loan amount, repayment tenure, and the interest rate offered by InCred.

- On the left side of the screen, you will see the calculated EMI amount along with the total interest payable over the loan tenure.

An illustration of the education loan EMI calculator from Fundright.

Next, let’s look at the documents you need to submit when applying for an education loan from Tata Capital.

Other Banks & NBFCs Offering Education Loan to Study Abroad:

- Union Bank of India Education Loan

- Yes Bank Education Loan

- IDFC Bank Education Loan

- Bank of India Education Loan

- State Bank of India Education Loan

Documents required for securing an education loan from Tata Capital

You must submit the following documents along with your application to get an education loan from Tata Capital. These documents prove your academic and financial capability to study abroad.

Here is the list of documents for applicants:

- A duly filled and signed education loan application form.

- 2 passport-size photographs.

- Identity proof (Aadhaar, Passport, PAN card, voter’s ID, Driver’s License).

- Residency proof (Aadhaar, Pan-card, Voters ID, utility bill, electricity bill).

- Academic documents

- X and XII mark sheets

- Graduation mark sheets (if applicable)

- University admission letter

- Standardized test scores (CAT, CET)

- Language proficiency scores (IELTS, GRE, PTE, Duolingo)

- Receipt of any amount

Documents required for co-applicants:

- Address and Residence proof (Aadhaar, Pan-card, Voters ID, utility bill, electricity bill)

- Identity proof (Aadhaar, Passport, PAN card, voter’s ID, Driver’s License)

- Financial documents (for salaried co-applicants)

- Income tax returns for the last 3 years

- Last 3 months’ salary slips

- Last 2 years’ Form 16

- Bank statement for the last 6 months

- Balance sheet

- Business proof (if self-employed)

- Financial documents (for co-applicants with self-employed professionals)

- Provide proof of office address (lease deed, telephone bill, etc.)

- Proof of income tax results for the last two years

- Stamped current account bank statement for the last six months

- Business proof like Registration Certificates, Sales Tax Certificates, or GST certificates

Things to remember when applying for Tata Capital education loans

Taking an education loan to study abroad is a huge commitment. Therefore, knowing a few things before taking out a Tata Capital education loan can help you make informed decisions.

- Choosing programs with excellent job prospects and great industry demand can increase your chances of securing loans of substantial amounts without or with collateral.

- If you are choosing an education loan with a co-applicant, they can take responsibility for repaying your loan if you cannot.

- If you lack collateral security for a secured loan, your co-applicant can strengthen your application. The co-applicant’s income and credit history are assessed, providing additional assurance for loan repayment, thereby increasing your chances of securing an education loan.

- There are no prepayment charges on the education loans, meaning you don’t have to pay any margin money to study abroad.

- Check whether your chosen course qualifies for an education loan from Tata Capital.

- Before accepting the loan agreement, ensure you have checked the loan terms, such as interest rate, repayment period, moratorium, and any extra processing fees or charges. If you have any doubts or inquiries, connect with professionals who can guide you. Since taking a loan is a big decision, the slightest mistake can cost you a lot.

As you can see, securing an education loan to study abroad is an exhausting process. Researching different lenders and comparing their loan terms, like interest rates, repayment periods, tenure, etc, can turn exhaustive and lead to indecisiveness. That’s why so many students choose to get their education loans for studying abroad via FundRight.

Here’s how FundRight works.

- Simply register on FundRight and create a loan demand by providing your personal and financial information.

- Within 2 days, you’ll start getting multiple loan offers tailored to your requirements.

- You can also get personalized help from financial advisors to compare different loan terms and make the best choice that will be fruitful for you in the long run.

- Once you shortlist the lender’s offer, you can easily submit the documents through the platform and your loan application.

- Get your loan approved within 10 days.

Over 60,000+ students have used FundRight and secured the best education loans tailored to their requirements. With Spring ’25 admissions just around the corner, now is the best time to sign up on FundRight.

Collateral rules for Tata Capital education loans

When applying for the Tata Capital education loan, it’s important to understand the collateral rules as they affect the loan amount you take.

- For Tata Capital education loans, students can take unsecured loans up to ₹75 lakhs, provided they’re academically strong and have admission to a well-ranked program with high job prospects.

- Students can take secured loans up to ₹2 crores, by pledging collateral like houses, land, bungalows, etc.

Note: Applicants must provide relevant documentation, such as property titles and valuation reports if collateral is required.

Also Read: Collateral vs Non-Collateral Education Loan for Abroad Studies

FAQs

1. What is the starting interest rate for Tata Capital education loans?

The starting interest rate for Tata Capital education loans is approximately 10.99%.

2. What types of documents are needed to apply for these loans?

Applicants must provide ID proof, admission letter, academic records, income proof, and property documents if collateral is required.

3. Is collateral mandatory for all education loans?

No, collateral is not required for loans up to ₹75 Lakhs. However, it is necessary for loans exceeding this amount.

4. When do borrowers begin repaying their education loans?

Repayment starts after course completion, with an additional grace period of one year.

5. Are there any additional fees apart from the interest rate for Tata Capital education loans?

Yes, additional fees are associated with Tata Capital education loans apart from the interest rate. The processing fees range from 1% to 2% of the loan amount.