In this article, you’ll get a high-level overview of pursuing an MBA in Finance abroad. We’ll cover everything from salary, fees, and syllabus, to scope, careers, and best colleges for an MBA in Finance. We’ve analyzed the top 100 universities for an MBA in Finance according to the QS Universities Ranking (2023 and 2024). We’ve looked at class profiles, GMAT profiles, scholarships, program outcomes, and job placements to get you the most up to date information about an MBA in Finance abroad. With that said, let’s jump right into the article, beginning with what is an MBA in Finance.

About a Master’s in Business Administration in Finance Abroad

Essentially, an MBA in Finance is specifically tailored towards helping graduates get a job in the finance industry — no surprise there. To begin with, an MBA in Finance is usually a two-year postgraduate course, with your main focus being management. Your secondary focus is in the field of finance, and the choice here is up to you — accounting, FinTech, taxation, legal, and the list goes on and on.

Where a regular MBA would teach you “general” skills like marketing and operations, an MBA in Finance would cover things like portfolio management, investment management, and other things related to finance. Just like a regular MBA though, an MBA in Finance is usually open to people from all educational/professional backgrounds. That is why it is a popular degree choice for people looking to switch in from other careers to the world of finance.

An MBA in Finance abroad offers two key benefits: exposure to international business practices, and the ability to network with a (very) diverse set of people. Of course, that depends on the country you choose and the university you go to.

Now, the majority of the best colleges for an MBA in Finance are concentrated in the USA (44 of the top 100 on the QS list). We’ll talk more about the best countries for an MBA in Finance abroad in the next section.

Top countries to study an MBA in Finance

After thoroughly examining the latest QS Universities ranking for an MBA in Finance, we’ve found that more than 90% of the top MBA in Finance universities are in the following countries:

- United States

The United States dominates the rankings for MBA programs in Finance, hosting a significant number of top-tier institutions. Schools like Wharton, Harvard Business School, Stanford GSB, and Columbia Business School consistently rank among the best worldwide. The USA offers a robust curriculum, extensive networking opportunities on Wall Street, and access to leading financial firms.

- United Kingdom

Known for its historical ties to global finance and strong academic traditions, the UK hosts prestigious institutions such as London Business School, Oxford Said Business School, and Cambridge Judge Business School. These universities provide a blend of theoretical rigor and practical exposure to Europe’s financial markets.

- Canada

Canada is emerging as a favorable destination for MBA programs in Finance, with institutions like York Schulich School of Business, Rotman School of Management, and Ivey Business School offering strong finance programs. Canadian universities combine academic excellence with a very diverse and inclusive environment.

- France

France, particularly Paris, hosts renowned business schools like HEC Paris and ESSEC Business School. The French MBA in Finance programs are known for their rigorous nature and proximity to Europe’s financial centers.

- Australia

Australian universities, such as Melbourne Business School, offer MBA programs with a strong focus on finance. Australia provides a gateway to Asia-Pacific markets and offers a high standard of living along with quality education in finance.

Whether you aim to work in investment banking, corporate finance, or financial consulting, studying abroad in one of these countries will give you the skills and connections needed to succeed.

Top universities in the world for an MBA in Finance abroad

The best schools for an MBA in Finance abroad are concentrated in the five countries mentioned above. Here is the list of the top 25, as per the 2023 QS Universities rankings.

| Rank | University Name | School Name | City | Country |

| 1 | Penn (Wharton) | The Wharton School | Philadelphia | United States |

| 2 | Harvard Business School | Harvard Business School | Boston | United States |

| 3 | Stanford Graduate School of Business | Stanford Graduate School of Business | Stanford | United States |

| 4 | Columbia Business School | Columbia Business School | New York | United States |

| 5 | NYU (Stern) | NYU Stern School of Business | New York | United States |

| 6 | Chicago (Booth) | Chicago Booth School of Business | Chicago | United States |

| 7 | Oxford (Said) | Saïd Business School | Oxford | United Kingdom |

| 8 | Northwestern (Kellogg) | Kellogg School of Management | Evanston | United States |

| 9 | Cornell (Johnson) | Samuel Curtis Johnson Graduate School | Ithaca | United States |

| 10 | Michigan (Ross) | Ross School of Business | Ann Arbor | United States |

| 11 | Duke (Fuqua) | Fuqua School of Business | Durham | United States |

| 12 | London Business School | London Business School | London | United Kingdom |

| 13 | York (Schulich) | Schulich School of Business | Toronto | Canada |

| 14 | Toronto (Rotman) | Rotman School of Management | Toronto | Canada |

| 15 | Cambridge (Judge) | Judge Business School | Cambridge | United Kingdom |

| 16 | MIT (Sloan) | MIT Sloan School of Management | Cambridge | United States |

| 17 | IESE Business School | IESE Business School | Barcelona | Spain |

| 18 | Yale School of Management | Yale School of Management | New Haven | United States |

| 19 | Georgetown (McDonough) | McDonough School of Business | Washington DC | United States |

| 20 | Dartmouth (Tuck) | Tuck School of Business | Hanover | United States |

| 21 | UCLA (Anderson) | UCLA Anderson School of Management | Los Angeles | United States |

| 22 | Western (Ivey) | Ivey Business School | London | Canada |

| 23 | UC Berkeley (Haas) | Haas School of Business | Berkeley | United States |

| 24 | HEC Paris | HEC Paris | Jouy en Josas | France |

| 25 | Melbourne Business School | Melbourne Business School | Melbourne | Australia |

In the next section, we’ll show you what you’ll learn as part of your course.

Course curriculum for an MBA in Finance

Before we begin, understand that each university will have its own take on the MBA in Finance. Some will focus more on mathematics, some on management. However, the core concepts that you will learn, remain broadly the same across all colleges.

And we’ve done the research, so you don’t have to. Here’s what you’ll cover as part of your MBA Finance course.

| Core Areas of Study | Topics Covered |

| Corporate Finance | Fundamentals of corporate finance, financial operations, corporate restructuring, corporate financial strategy, advanced corporate finance |

| Investment Management and Markets | Investment management, capital markets, portfolio management, securities, financial instruments, trading strategies |

| Financial Analysis and Valuation | Financial statement analysis, discounted cash flow valuation, pricing theory, valuation of firms and projects, real estate valuation |

| Macroeconomics and Global Economy | Macroeconomic policy, global economic environment, international financial markets, economic policy in global markets |

| Quantitative and Analytical Methods | Financial mathematics, analytics of finance, data science for finance, financial engineering, quantitative methods |

| Risk Management and Derivatives | Financial derivatives, risk management practices, financial engineering |

| Regulation and Ethics in Finance | Finance ethics and regulation, corporate governance, fiscal crises, shareholder activism |

| Specialized Finance Areas | Energy finance, healthcare finance, real estate finance, distressed investing, ESG and impact investing |

| Emerging and Innovative Topics | Fintech, blockchain and cryptocurrencies, venture capital finance, strategic equity finance, sustainable investing |

| Practical and Experiential Learning | Action learning projects, finance labs, field courses, real-world financial problem-solving |

Remember, your curriculum will skew heavily towards the MBA Finance subjects that you choose as your electives. And also remember that you’ll be studying these modules across a 12 to 24-month period.

We’ll now move on to the eligibility for admission to an MBA in Finance abroad.

Eligibility for an MBA in Finance

Just like with the syllabus, each university will be a little different from the last. However, there are some general requirements that you will need to satisfy for most MBA in Finance courses.

Here are the basic ones:

- You must hold an undergraduate degree from an accredited institution.

- Some programs require work experience, typically ranging from 2 to 5 years. It’s not usually compulsory but helps your application a lot.

- Minimum GPA requirements vary, but a competitive undergraduate GPA (3.0+) is often necessary.

- Some programs require GMAT or GRE scores; specific score requirements can vary.

- For non-native speakers, TOEFL or IELTS scores are required to demonstrate English proficiency.

- Usually, two or three letters of recommendation are required, preferably from professional references. If you do not have two professional references, then one professional and one academic (from university) can do.

- Applicants must submit a statement of purpose or essays detailing their career goals and reasons for pursuing an MBA in Finance.

Also, the TOEFL/IELTS requirement can be waived if your undergrad degree was four years long, and only taught in English. And with the minimum requirements for an MBA in Finance abroad covered, let’s talk about standardized exams.

Note: Many students miss out on the best universities because they don’t know about all their options. Thankfully, SelectRight solves this problem. After setting up your profile and specifying your needs, the AI provides matches from a vast database of 40,000+ programs and 4,000+ universities. This ensures you consider every possibility. Compare these options on multiple criteria and talk to an advisor for personalized advice. Register on SelectRight to uncover the best university opportunities for you.

Thinking about getting started for Spring ’25? Sign up on SelectRight today.

GMAT/GRE requirements for studying an MBA in Finance

To begin with, not all universities require GMAT or GRE scores for admission to their MBA in Finance programs.

There is no set minimum GMAT score for admission, however, you can get a good idea of the score you’ll need by looking at the class profile. For instance, the average GMAT at the London Business School is 700+. Also, the Corporate Finance Institute says that to get into a global top 20 university, you should target a GMAT score of 700 to 750.

As for the GRE, it is as widely accepted as the GMAT, but most universities would prefer the GMAT, as it is a more quantitative exam.

Remember to always check with your target university(ies) if they require/accept the GMAT or GRE for admission. Usually, if your undergraduate degree was not very quantitative (think History, English, Arts), then a GMAT may help you.

However, if your undergrad degree was in math or computer science, then it’s very likely that a GMAT score will not boost your application.

Now, an MBA in Finance abroad can get expensive. However, most students receive some sort of financial aid during their MBA in Finance, which we’ll talk about in the next section.

Scholarships to study an MBA in Finance

For students looking into financial support for an MBA in Finance, there are several prestigious scholarships available for Indian students. These are some examples:

| Source | Scholarship Type | Details |

| Inlaks Shivdasani Foundation | Overseas Scholarships | Offers scholarships to young Indians for full-time Master’s programs at leading global institutions, including finance-related studies. |

| Aga Khan Foundation | Need-Based | Provides scholarships and grants to outstanding students from developing countries who have no other means of financing their studies. Scholarships are awarded on a 50% grant: 50% loan basis through a competitive application process once a year. |

| Tata Trusts | Merit and Need-Based | Supports Indian students pursuing higher education abroad, including MBA programs, with scholarships based on merit and financial need. |

| J. N. Tata Endowment | Loan Scholarships | Offers loan scholarships for Indian students planning to pursue postgraduate studies overseas, such as an MBA in Finance. |

| Government of India | Various | Indian students can access several scholarships offered by different government ministries and bodies for studies abroad. |

However, these scholarships receive lakhs of applications, for just a handful of funding opportunities. You’d be far more likely to get a scholarship from your chosen university, as a lot of them have their own funding programs.

Here are some examples.

| University | Aid Details |

| Harvard University | Provides a range of financial aid options including need-based aid and merit scholarships for MBA students. Admitted students are automatically considered, and international students have access to loan programs without a co-signer requirement. |

| UCLA | Offers both merit and need-based scholarships through the Anderson School of Management. Scholarships are automatically considered upon admission, with additional opportunities for international students to apply for external scholarships. |

| MIT | MIT Sloan grants fellowships and assistantships based on academic excellence and professional potential. These financial aids are available to all admitted MBA candidates without the need for separate applications for most programs. |

While all these scholarships cover a huge part of your tuition fees (and other costs of studying abroad), you will most likely still require an education loan to cover the rest. To simplify your search for the best education loan, we recommend you use FundRight. Here’s why:

- You can receive loan offers from 15+ top Indian and international banks and NBFCs within 2 days of completing your profile.

- You can seek unbiased and reliable advice from a FundRight expert at any stage of your loan search, and use their insights to negotiate loan terms with the lenders.

- You can securely upload your documents via FundRight, instead of having to submit photocopies to bank branches.

- You can get your loan approval in as few as 10 days.

See how much you can save on your education loan to study an MBA in Finance abroad.

Sign up on FundRight and unlock loan offers for Spring ’25.

Now, let’s move on to the scope of an MBA in Finance.

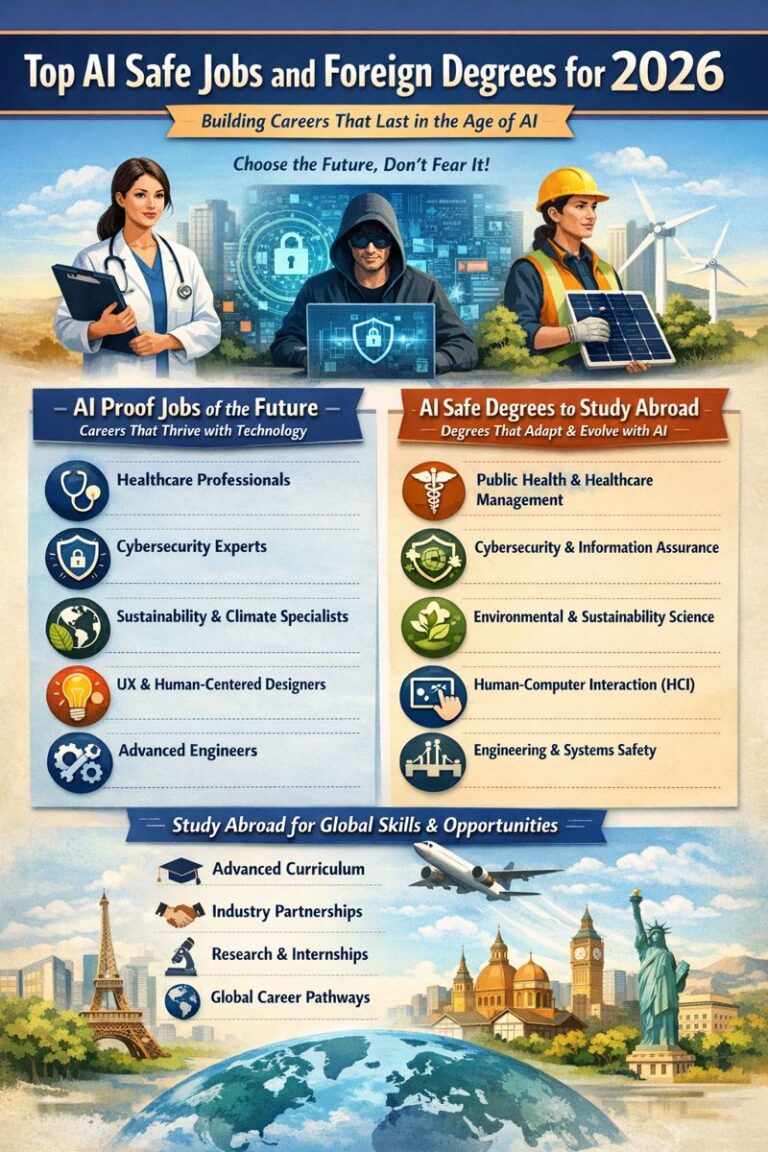

Career scope of an MBA in Finance

An MBA in Finance equips graduates with a strong foundation in financial principles, strategic thinking, and analytical skills. This degree opens up diverse opportunities in several key areas, as under:

- Financial Management

By far, the most common area where graduates of an MBA in Finance work is in management. There, they manage the finances of companies, ensure financial stability, and make acquisitions for the companies, among other things. It’s an exciting field that holds a lot of promise, even in the current markets.

- Investment Banking (IB)

Graduates often head into investment banking where they help companies get the money they need, support activities like mergers and acquisitions, and give advice on big money moves. It’s a fast-paced job that’s all about making major financial moves. This field offers roles that involve raising capital, managing mergers and acquisitions, and providing strategic advisory services to corporations. For IB, there exist specific “tracks”, such as an “MBA in Banking and Finance”.

- Consulting and Strategic Advisory

Many finance professionals work with consulting firms, offering expert advice to improve financial efficiency, reduce costs, and optimize operations for various businesses.

- Corporate Finance

Involves working within corporations to manage financial processes, including risk management, profitability analysis, and financial forecasting. In corporate finance, graduates work inside companies to look after money matters, check on risks, and predict future money needs. This role is key to helping a company plan ahead and stay profitable. Corporate finance roles usually open up after a finance and accounting MBA.

- Venture Capital and Private Equity

Professionals can also move into investment roles that involve funding startups or managing investments in private companies. This path is for those who like to invest in new companies or manage investments in private firms. It’s about finding businesses that could grow big and helping them get there with the right funding.

- International Finance

Working with global finance entails managing finance operations across different countries, dealing with foreign exchange markets, and understanding international financial regulations.

- Public Sector and Non-Profit Management

Finance graduates also work in non-traditional sectors, such as in public sector organizations and nonprofits. There, they mainly end up focusing on budgeting, funding, and financial reporting.

Now, let’s learn more about your potential career after an MBA in Finance — what you’ll work as, and who you’ll work for. Let’s begin with the latter — the top companies that recruit MBA in Finance graduates.

Top recruiters after an MBA in Finance

Here are some of the top companies that actively recruit MBA in Finance graduates.

- Goldman Sachs

- Morgan Stanley

- J.P. Morgan Chase

- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- BlackRock

- Citigroup

These companies represent just a snippet of potential employers who value graduates with an MBA in Finance. We’ll finish this article by sharing the potential job roles and their salaries after completing an MBA in Finance.

Job prospects and salaries offered after studying an MBA in Finance

Here are the most common jobs after an MBA in Finance, and the salaries that accompany those roles. The job roles are the ones we commonly see in the class profiles, and the salary data is from Glassdoor and ZipRecruiter.

| Role | Average Salary (USD) |

| Financial Analyst | $74,000 |

| Investment Banker | $100,000 |

| Portfolio Manager | $96,000 |

| Chief Financial Officer (CFO) | $152,000 |

| Financial Consultant | $85,000 |

| Risk Manager | $98,000 |

| Corporate Finance Manager | $110,000 |

| Overall Average | $102,000 |

Bear in mind that these salaries are for fresh graduates of an MBA in Finance program, and can easily rise with just a couple of years’ experience.

And with that, we come to the end of this guide on an MBA in Finance. We hope you found it useful, and we’ll see you in the next one.

Frequently asked questions

1.Why should you consider an MBA in Finance?

An MBA in Finance can open many doors in various high-paying finance roles. It helps you understand complex financial markets and gives you the skills to manage money and investments effectively. This degree is great for anyone looking to boost their career in finance or take on leadership roles in financial departments.

2.What are the fees for an MBA in Finance?

The cost of an MBA in Finance can vary widely depending on the school and its location. Generally, you might expect to pay anywhere from $30,000 to over $100,000 for the entire program. Some top-tier schools might charge more, reflecting their reputation and the advanced resources they offer.

3.Can I pursue an MBA in Finance online?

Yes, many reputable universities offer online MBA programs in Finance, which provide the same rigorous curriculum as their on-campus counterparts. Online programs are ideal for working professionals seeking flexibility.

4.What is the difference between an MBA in Finance and a Master’s in Finance?

An MBA in Finance covers broad business management skills with a focus on finance, preparing you for leadership roles across various departments. In contrast, a Master’s in Finance is more specialized, focusing deeply on finance-related subjects, and is better suited for careers specifically in finance or economics.

5.What skills can I expect to develop during an MBA in Finance program?

During an MBA in Finance, you’ll develop a range of critical skills, including financial analysis, strategic financial decision-making, understanding of global markets, and mastery of financial tools and models. Additionally, you’ll enhance your leadership abilities, problem-solving skills, and capacity for data-driven decision-making.