Education comes at a cost. And when you are planning to pursue education abroad, the cost can run to the tune of ₹ 50 lakhs or more per annum.

While funding for your education abroad can be managed in several ways, the most common option people choose is to get an education loan. It not only helps pay for education, but also builds your credit score.

IDFC First Bank is one of the key lenders offering study-abroad loans to Indian students. Your search for the right education loan will introduce you to the IDFC FIRST Bank Education Loan as well. You can use this guide to understand everything about this loan product. , and in this blog, we will discuss their education loans in detail.

An introduction to IDFC bank education loans

Established in 2015, IDFC Bank is headquartered in Mumbai, India. It operates a network of branches across the country, providing a wide range of services. It was recently rebranded as IDFC FIRST Bank following a merger with Capital First in 2018.

With the IDFC FIRST Bank education loan, you can get:

- Loans with collateral for amounts up to ₹ 1.5 crore

- Collateral-free education loans up to ₹ 85 lakhs

- Flexible repayment options

- Tax benefits under Section 80E

- Loan before admission confirmation

IDFC Bank education loan interest rates

IDFC FIRST Bank offers competitive interest rates on education loans. Their interest rate is linked to repo rate, which means the interest rate can change whenever the repo rate changes.

The exact IDFC bank education loan interest rate depends on many factors that are unique to each loan applicant. Here is a quick overview of the interest rate you can expect from an IDFC education loan.

Non-Collateral Loan:

- Maximum Amount: Up to ₹85 lakhs

- Interest Rate: Between 11% and 13.5%

Collateral Loan:

- Maximum Amount: Up to ₹1.5 crores

- Interest Rate: Between 9.5% and 11%

To learn more about IDFC FIRST Bank’s study abroad loans, you can sign up for free on FundRight, and get in touch with an expert from our team.

Also Read: Education Loan in India: Interest Rates, Process, Best Banks & More

Documents required for securing an education loan from IDFC FIRST Bank

You will need to submit a set of documents along with your application for an IDFC First education loan. Knowing what you need beforehand will help ensure you have all the documents in place.

The documents needed for an IDFC education loan include:

| Students Documents | Co-Applicant Documents |

| Photo ID proof (Aadhaar card/PAN card/Voter card/Passport/Driving-license) | |

| Proof of residence | |

| Passport-sized photograph | |

| Proof of admission/ entrance exam score (e.g., GRE, IELTS, GMAT, etc.) | Income-related documents (salary slips/bank statements for 6-8 months) |

| Fee structure document | Relationship proof |

| Salary slips (if experienced) | Balance fund proof (letter from the individual’s bank that they have the necessary amount of fund-balance available) |

| Pre-visa documents in case visa not received | Residence ownership proof |

| Last 6 months’ bank statements | Last 6 months’ bank statements |

| 10th, 12th, and Bachelor’s degree marksheets | |

| KYC Documents | KYC Documents |

Other than that, if collateral is required, you will have to furnish property documents, FD documents, or other collateral-related documents.

All these documents need to be submitted with the duly filled application form while applying for an IDFC education loan.

Also Read: How Fundright Helps You With Affordable Education Loan To Study In Canada

Application process for IDFC Bank education loan for Indian students

Applying for an education loan from IDFC FIRST Bank involves a simple, digitized process. Here’s what you need to do and how:

Step 1: Submit your application

There are many different ways to submit an application to this bank. You can:

- Visit their website and apply online

- Use their mobile banking app

- Use the FIRST UNI app designed for educational financial services

- Visit a nearby IDFC FIRST Bank branch

- Call IDFC FIRST Bank customer support for assistance

- Unlock and apply for an IDFC FIRST loan through FundRight

Irrespective of the channel you use, you will be asked to fill out a loan application form.

In the form, you have to:

- Provide all necessary personal, academic, and financial details.

- Ensure accuracy and completeness to avoid any processing delays.

- Attach all the required student and co-applicant documents.

Important: In case you are applying for the loan online, you will have to scan and upload the documents. You can also submit physical copies of your documents at the branch.

Note: We recommend that students maximize their options by comparing offers from top lenders. With FundRight, you can create a profile and receive loan offers from over 15 lenders, both Indian and international, within just 30 minutes. These offers may include both collateral and non-collateral loans.

Step 2: Get your documents verified

Once you have submitted the required documents, IDFC FIRST Bank will review and verify them. This process can take a couple of days to complete.

Note: You can securely upload all your documents on FundRight and avoid submitting them repeatedly to multiple lenders. Plus, you can track your application progress every minute on the platform itself.

Step 3: Get your loan approved

Once all documents are verified and admission confirmation information is provided, IDFC FIRST Bank will process your loan application.

You will receive an approval notification if your loan application meets all criteria.

IDFC education loan is also available if your admission is not yet confirmed. This is called a conditional sanction, which is based on your academic profile and the type of course, country, or institute you have applied for.

Note: You can get your loan approved via FundRight in as little as 10 days. We recommend you compare loan offers from top lenders onFundRight before you go ahead with a lender.

Step 4: Get your loan disbursed

The entire loan amount does not get disbursed in one shot. You can coordinate with the bank to schedule the release of funds as and when the educational institution expects the semester fees to be paid.

Important: The loan amount is directly disbursed to the educational institution as per the fee structure. Additional funds (for other expenses like travel, laptop, or living expenses) are disbursed to your or the co-applicant’s account.

IDFC First Bank education loan eligibility

The eligibility criteria for an IDFC education loan includes:

| Category | Criteria |

| Nationality | The applicant must have Indian citizenship. This includes residents and Non-Resident Indians (NRIs) |

| Age | At the time of loan commencement, the applicant must be >=18 years of age. |

| Admission | The applicant should have secured admission to a recognized institution or course.

This can include courses such as:

If the admission is not confirmed, the applicant can still apply for a conditional sanction. |

| Additional |

|

Other than these, a co-applicant is also mandatory for availing an IDFC bank education loan.

Let’s understand who is eligible to be a co-applicant.

Your parents, siblings, spouse, parents-in-law, or maternal/paternal uncle/aunt can apply to be the co-applicant.

An NRI parent or relative can also be included as a co-applicant, provided they meet the specified criteria under IDFC FIRST Bank’s policy.

Meeting these eligibility criteria ensures that both the applicant and co-applicant are prepared and qualified for the financial commitment.

Collateral rules for IDFC education loan

IDFC FIRST Bank offers collateral-free education loans of up to ₹ 85 lakhs. However, for loans above ₹ 85 lakhs, collateral is required.

What counts as acceptable collateral?

- Real estate properties, such as houses, flats, and commercial properties (office buildings, shops).

- Fixed Deposits (FDs)

- Residential lands

Also Read: Collateral Vs Non-Collateral Education Loans For Abroad Studies

Why choose an IDFC bank education loan for studying abroad?

There are several reasons to choose an IDFC FIRST Bank education loan for studying abroad. Some of these reasons include:

- Loans up to ₹ 1.5 crore

IDFC FIRST Bank offers education loans up to ₹ 1 crore. Such a big loan amount can cover all your expenses, including tuition fees, living costs, travel, and more. This means you can focus on your studies without worrying about finances.

- Collateral-free loans

You can get a loan of up to ₹ 75 lakhs without any collateral. This makes it easier for students who may not have valuable assets to pledge but still need financial assistance.

- Flexible repayment options

IDFC FIRST Bank provides multiple repayment options, such as:

- Immediate EMI

- Simple interest

- Partial simple interest

This flexibility allows choosing a repayment plan that suits your financial situation not just during, but even after your studies.

- Quick and easy process

The IDFC education loan application process is simple and mostly online. This reduces approval times. The bank also offers loan sanction even before admission confirmation, which helps in securing your seat in the desired institution.

Note: You can experience even faster approval times by applying for your loan via FundRight. Students have got their loan approvals in as little as 2 days using FundRight.

- Additional Benefits

IDFC FIRST Bank offers up to 100% financing. This means the loan will cover all course-related and additional expenses. Plus, you get income tax benefits under Section 80E. These benefits together make IDFC education loans a preferred choice for managing your study abroad expenses.

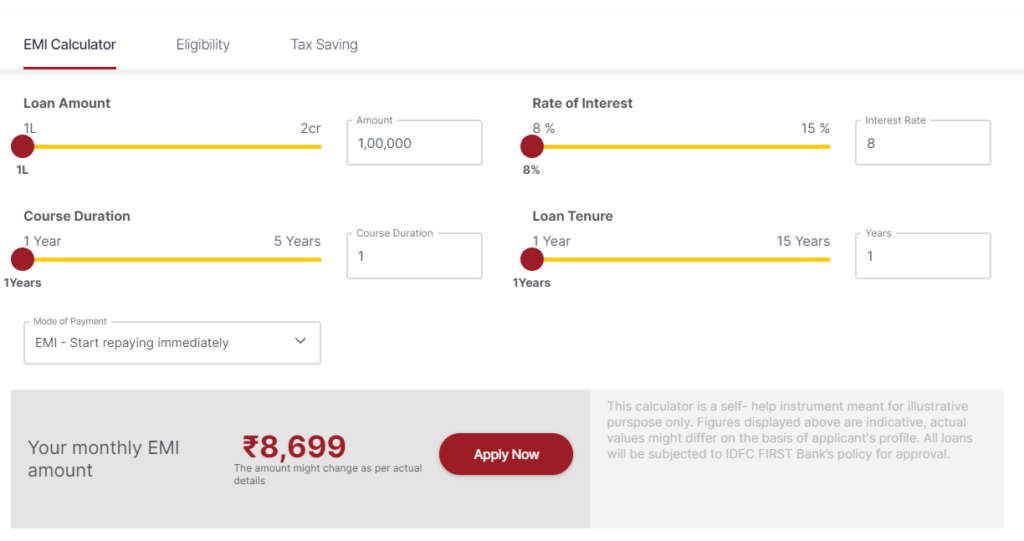

IDFC bank education loan abroad EMI calculator

IDFC FIRST Bank offers an education loan EMI calculator to help you plan your loan repayment efficiently.

It helps you estimate your monthly installment (EMI) for your education loan. Here’s how it works and what it shows:

Inputs

Loan Amount: You can adjust the loan amount using a slider or by entering the exact amount. The range typically goes from ₹1 lakh to ₹2 crores.

Course Duration: Enter the duration of your course in years, ranging from 1 to 5 years.

Rate of Interest: Adjust the interest rate using the slider or input the specific rate. The interest rate typically ranges from 8% to 15%.

Loan Tenure: Set the loan tenure (repayment period) using the slider or by entering the specific number of years, ranging from 1 to 12 years.

Mode of Payment: Choose your preferred mode of payment from the dropdown menu. The options are:

- EMI – Start repaying immediately

- SI – Pay only simple interest while you study

- Moratorium – Do not pay anything while you study

Based on the inputs, the calculator shows your estimated monthly EMI. This is the amount you will need to pay each month to repay your loan within the selected tenure.

You can check out the IDFC education loan EMI calculator here.

Note: The figures displayed by the calculator are indicative. Actual values might differ based on the applicant’s profile and IDFC FIRST Bank’s approval policies.

Things to remember when applying for an IDFC bank education loan

Before you get an IDFC education loan, here are some things to keep in mind:

- Application timeline

It’s recommended to apply for an education loan well before the start of your academic session. This gives you enough time to furnish all documents and secure an education loan on time.

- Countries and courses covered

IDFC FIRST Bank’s education loan can be used to study a variety of courses across many countries. This includes professional or technical courses offered by prestigious universities. It also funds executive, part-time, vocational, and diploma courses.

The eligible countries include:

- USA

- UK

- Canada

- Australia

- Germany

- New Zealand

- Singapore

- And more

For a complete list of eligible countries and courses, get in touch with GradRight’s study abroad loan experts..

- Charges

When you get an IDFC education loan, there are certain additional charges you need to bear. These include:

- Up to 1.5% processing fee

- Stamping charges

- Cancellation charge of 1% of the loan amount plus interest accrued from the date of loan disbursal till the bank receives your cancellation request. This is in case you cancel the loan within 30 days or before the first EMI due date.

- Margin money

IDFC bank education loans come with up to 100% financing options. This means you may not need to provide any margin money. However, the exact amount of margin money, if any, is subject to the bank’s policy.

- Repayment Options

IDFC education loans come with flexible repayment options. These options include:

- Immediate EMI: You start repaying the loan as soon as it is disbursed.

- Simple Interest (SI): You pay the accrued simple interest immediately while you study.

- Partial Simple Interest (PSI): You pay a portion of the accrued simple interest while you study.

- Moratorium Period: You do not pay anything during the course duration plus a grace period of 12 months. The unpaid interest accrued during this period will be added to the principal amount, and the EMI will be calculated based on the total amount.

By understanding these key points, you can better prepare for your loan application process with IDFC FIRST Bank.

Also Read: Education Loan in India: Interest Rates, Process, Best Banks & More

Making the right choice with FundRight

IDFC FIRST Bank education loan is one of the many excellent options among study abroad loans. But it’s important to know that you need to compare IDFC bank education loan interest rates and loan terms with alternatives in the market.

Now, choosing the right one can be challenging. This is where FundRight comes in as a valuable resource.

FundRight is a platform designed to help students in India find the best education loans for studying abroad. It operates through a unique loan-bidding system, which ensures students get competitive loan offers from multiple lenders.

Here’s how FundRight works:

- Students create a profile on FundRight and provide necessary academic and financial details.

- FundRight anonymously shares the profile with various banks and financial institutions.

- These lenders then compete with each other by offering competitive loan options to the student.

- Students receive multiple loan offers and can compare them based on interest rates, repayment terms, and other benefits.

- Students get the help of an expert financial advisor and negotiate for even better terms from the lenders.

- Students upload their documents on FundRight and get their loans approved in around 2-10 business days.

With FundRight, you don’t just get lower interest rates and better conditions, you also get:

- Non-collateral loans for amounts up to ₹ 1.5 crore

- Loan offers from 15+ lenders in 2 days

- Loan approvals in 10 days

- Access to various scholarships

- Access to unbiased and expert financial advice at every stage

Join 60,000 Indian students who found their best education loan with FundRight. Check your offers.

FAQs

1. What is the maximum education loan I can get from IDFC Bank?

IDFC FIRST Bank offers education loans up to ₹ 1.5 crore for FundRight applicants. Talk to an IDFC Bank representative to understand what is the maximum loan amount that you can get.

2. What is the maximum repayment tenure for IDFC Bank education loans?

The maximum repayment tenure for IDFC Bank education loans is up to 15 years.

3. How long does it take to get an IDFC Bank education loan?

The loan sanctioning process is expedited through end-to-end digitization. This reduces the approval and disbursal time. However, the exact duration can vary based on individual cases.