India’s most exciting study abroad fest

Delhi, Feb 21st

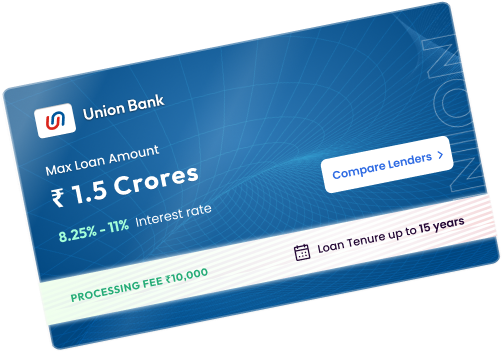

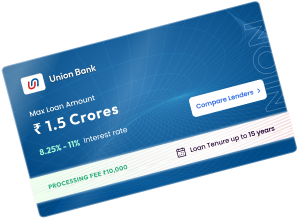

The “union bank education loan” is a student financing scheme by Union Bank of India to help Indian students fund studies in India or abroad, covering tuition, living, travel, and more.

Covers tuition, living accommodation, travel, books and other study-related costs.

Yes. Interest paid on a union bank education loan may qualify for deduction under Section 80E of Income Tax Act.

Backed by

Copyright © 2026 GradRight. All rights reserved.