Germany is a lucrative option for higher studies. When it comes to Indian students, Germany was the 8th most popular destination in 2022 according to a report by the Indian Ministry of External Affairs.

| Country | Number of students |

| United States (U.S.) | 465791 |

| Canada | 183310 |

| United Arab Emirates (UAE) | 164000 |

| Australia | 100009 |

| Saudi Arabia | 65800 |

| Qatar | 46000 |

| Oman | 39550 |

| Germany | 34864 |

| Russia Federation | 18039 |

| Philippines | 15000 |

Overall, it is a clear indicator that a huge number of students opt for higher studies abroad. However choosing the right program and education loan can be a hassle.

So, we have put together this simple guide to collate all the information needed to secure education loans for Germany in a single place. This guide will help you familiarise yourself with the loan criteria, eligibility, and the process of application. We will explain how to choose banks, factors to consider, things to remember, and collateral rules for education loans for Germany.

About Studying in Germany

Germany is a great choice for Indian students looking to pursue higher studies abroad. German universities are renowned for their excellence. Many of the programs offer free tuition for international students. Plus, a lot of them are taught in English. So, you can get a top degree at an affordable cost and enjoy a culturally rich and historic country.

Application Process for Education Loan in Germany for Indian Students

We will now walk you through the general process that one needs to follow in India to apply for an education loan for Germany.

- Research and shortlist vendors. Explore banks in India that offer education loans specifically for studying in Germany. Consider key factors like interest rates, loan amounts, repayment terms, and processing fees.

- Compile all the required documents. This includes your acceptance letter, program cost details, proof of identity and residence, PAN card, bank statements, and proof of income. In some cases, you will need proof of funds for a blocked account in Germany.

- Apply for loans to your shortlisted lenders. You will need to answer a few questions. Your academic background, chosen program, and financial situation will be up for scrutiny.

- Once you receive loan offers, the important part begins. You should compare interest rates, repayment terms, and any hidden fees. Feel free to negotiate with the lenders for a better deal.

- The lender will conduct due diligence and credit checks once the loan is finalised. They will disburse the loan when it is approved. It can be either directly to you or the university, depending on the lender’s policy.

Eligibility for Education Loan for Germany

Financing your Master’s in Germany with an education loan for Germany can be a strategic way to pursue your academic goals. Now, we will discuss the eligibility criteria that lenders in India consider when evaluating applications for an education loan for Germany.

Here are the common eligibility requirements:

- You must be an Indian citizen.

- An acceptance letter from a recognized German university for your chosen program (be it a Master’s or Bachelor’s degree).

- The minimum age requirement can vary but is usually 18 years or above.

- Most lenders prefer programs with clear career prospects, as this helps ensure your ability to repay the loan after graduation. So, focus on job-oriented courses for your education loan for MS in Germany or any other program.

Other things to keep in mind:

- Some lenders might offer education loans for Germany without collateral, it’s more common for them to require a co-signer or security deposit to mitigate risk. This could be fixed deposits or property.

- A good financial track record for you and your co-signer (if applicable) can improve your chances of securing an education loan for study in Germany considerably.

These are some general guidelines. Any specific eligibility criteria will depend on the lender you choose.

Also Read: Education Loan Eligibility Criteria Guide For Indian Students

How To Choose a Bank for Study Loan in Germany?

Finding the right bank for your education loan for Germany is crucial for a smooth study experience. There are a number of key factors to consider when making your choice. We will have a look at them individually.

This is the crucial factor on which the overall cost of your education loan for MS in Germany will depend. Compare interest rates offered by different banks to broker the most competitive deal.

Loan Amount

Ensure that the bank you choose offers a loan amount sufficient to cover your tuition fees and living expenses in Germany. The maximum loan amount can vary with different lenders, so factor this in while comparing options.

Repayment Terms

Evaluate the repayment period and flexibility offered by the bank carefully. Look for repayment schemes that align with your projected future income.

Collateral Requirements

While education loans for Germany without collateral might exist in some cases, it’s more common for banks to require a guarantor or security deposit. Understand the bank’s specific requirements regarding collateral.

Processing Time

The loan application process can take time. Choose a bank known for efficient processing. This is especially important if you have a specific deadline for securing funds for your education loan for study in Germany.

Additional Benefits

Some banks might offer add-on benefits like interest rate waivers or loyalty programs. Consider these perks while comparing options for your education loan for Germany.

Don’t limit yourself to just one bank or organisation. Research and compare offerings from multiple lenders in India specialising in education loans for international students. This will help you find the bank that suits your financial needs best.

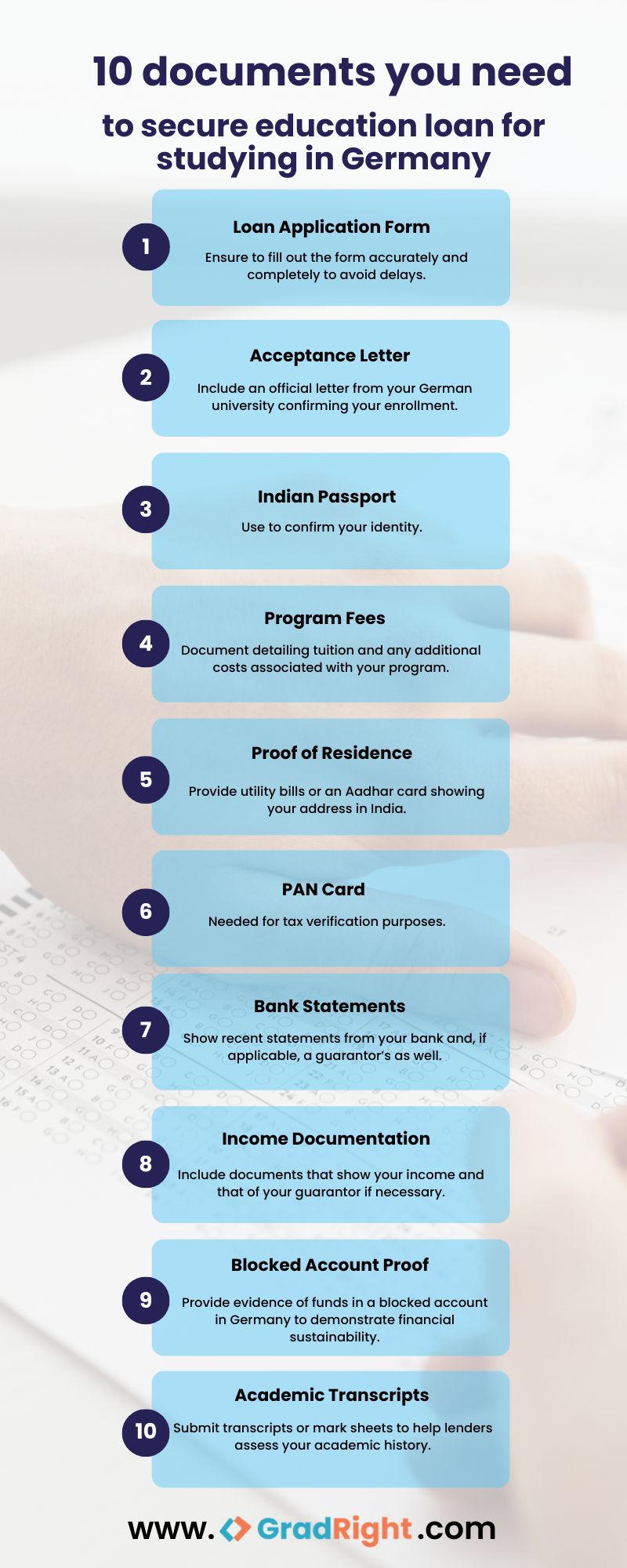

Documents Required for Securing a Student Loan in Germany

Applying for an education loan for Germany requires a number of documents. So, you need to be prepared beforehand. Here’s a breakdown of the typical documents you will need as an Indian student.

Essentials

- Fill out the Loan Application form accurately and comprehensively.

- An official acceptance letter from your chosen German university for your desired program.

- Documents outlining your program fees, including tuition and any additional costs.

Proof of Identity and Residence

- Indian Passport to establish your identity.

- Documents like utility bills or an Aadhar card with your Indian address for proof of residence.

Financial Documents

- Your Permanent Account Number or PAN is needed for tax verification purposes.

- Submit bank statements (yours and potentially a guarantor’s) for the past few months to demonstrate your financial standing.

- Similar to bank statements, the lender might require documents showcasing your income (and potentially your guarantor’s income).

Additional Documents

- Proof of funds deposited in a blocked account in Germany. While applying for an education loan for Germany blocked account is a way for lenders to check your financial sustainability.

- Some lenders might request your academic transcripts or mark sheets. This will help them assess your academic background.

To secure your education loan for Germany efficiently, gather all of these documents beforehand. This will streamline your application process.

Things To Remember When Applying for Germany Education Loans

There are some things that you should keep in mind while getting an education loan for Germany. We have prepared a checklist to help you out.

- Education loans for Germany typically cover more than just tuition fees. Accommodation, exam fees, books, equipment, travel expenses, and in some cases, a return ticket to India from Germany can be part of the loan. Make sure you know everything that will be covered with the loan you are getting.

- A lot of lenders in the market offer education loans. Take the time to compare them to find the best fit for your financial needs.

- Understand the loan process and terms thoroughly. If in any doubt, contact the relevant authorities at the organisation you are lending from and clarify your doubts before signing a chunk of your future earnings away.

- With many options available, it’s essential to choose wisely. Get started early and take your time to find the education loan that fits your career goals and financial situation.

Keep these things in mind if you apply for an education loan for Germany without collateral, with collateral, or even if you want an education loan for Germany with a blocked account.

Collateral Rules for Germany Education Loans

A collateral is a safety net for the lender. It is a valuable asset you or your guarantor puts up as security for the loan. The lender can seize the collateral to recover their money in case you can’t repay the loan. So, choose your collateral carefully.

Types of collateral

- Property can be put up as collateral. Land, a house, or an apartment you or your guarantor owns are good fits. The property value should be enough to cover the loan amount.

- Fixed deposits, government bonds, or even life insurance policies with a surrender value can sometimes be used as collateral.

Benefits of using collateral

- With collateral backing you up, lenders will be more open to offering a larger loan to cover all your education expenses.

- Because the loan is less risky for the lender, you can qualify for a more favourable interest rate.

Things to consider before using collateral

- If you default on the loan, the lender can take possession of your collateral or your guarantor’s collateral. This can be a major financial setback.

- In case you have a guarantor, make sure they understand the risks involved. They are legally obligated to repay the loan if you can’t.

Alternatives to collateral

- Unsecured education loans are a good way to avoid putting up collateral. These loans don’t require collateral, but they often come with higher interest rates and stricter eligibility criteria.

- Explore scholarships and grants from the German government, universities, or private organisations to help finance your studies.

Also Read: Your hunt for a non-collateral ed-loan is over!

Role of a Guarantor in Germany Education Loan

A guarantor is someone who will be responsible, legally, for the repayment of the loan in case the student defaults on it. Here is how a guarantor helps you secure the loan you need.

Offers financial strength<

German lenders heavily weigh the guarantor’s financial health. They assess income, credit score, and existing debt to ensure the guarantor can handle repayments if the borrower defaults.

Improves eligibility

A strong guarantor can significantly improve a student’s loan eligibility. Students with a limited credit history or lower income may require a guarantor to secure the loan or qualify for a larger loan amount to cover all their educational expenses.

Communication for repayment

In case a loanee defaults on their payment, the guarantor is legally obligated to fulfil the repayment. The lender can impose wage garnishes and asset seizures among other debt collection measures.

Impact on credit score

Defaults and late repayments by the borrower will negatively impact the guarantor’s credit score in Germany. This can affect their ability to secure loans or mortgages in the future.

Guarantor release

In some cases, after a certain period of on-time repayments by the borrower, the guarantor might be partially or fully released from their obligation. This needs to be specified in the initial loan agreement.

Indian Banks and NBFCs Offering Loans To Study in Germany

List of Indian banks that offer education loans for Germany.

FundRight: Your Go-to Tool for Education Loans

The process for education loans for Germany is complex and requires expert assistance. FundRight, our loan comparison and selection tool, will help you secure the best loan that fits your financial needs and career goals.

While compared to traditional loans, FundRight can help you save up to 23 lakhs from the loan amount.

Note: Use our EMI calculator to see how much you will need to repay once you get placement. This will help you to promptly stay on top of your loan payments.

FAQs

1. I need a loan for a blocked account in Germany. Can you help?

Yes, some lenders in India offer education loans that cover blocked account deposits for Germany.

2. I’m aiming for an MS in Germany. Do loans cover tuition fees?

Yes, most education loans for Germany cover tuition fees for various courses, including MS programs.

3. Can I get a education loan for studying in Germany, but without collateral?

It’s possible, but unsecured loans often have stricter requirements and higher interest rates.

4. I’m an Indian student. Can I get a loan to study in Germany from an Indian bank?

Yes, several Indian banks offer education loans specifically for studying in Germany.

5. What are the typical interest rates for Germany education loans?

Rates vary depending on the lender and your profile but typically range from 10% to 14%.

6. Can international students get education loans to study in Germany?

Yes, but typically through lenders in their home country. Some German banks might offer options in specific cases.

7. What documents are required for a Germany education loan application?

Documents usually include admit letters, academic transcripts, proof of finances, and co-signer details (if required).

8. How long does it take to process a Germany education loan application?

Processing times can vary, but generally take 4-6 weeks for approval and disbursal.

9. What are some alternatives to education loans for studying in Germany?

Scholarships, grants, and working part-time while studying are some options to explore.

10. Where can I find more information about education loans for Germany?

Research Indian banks, NBFCs, and German scholarship programs for the latest information.