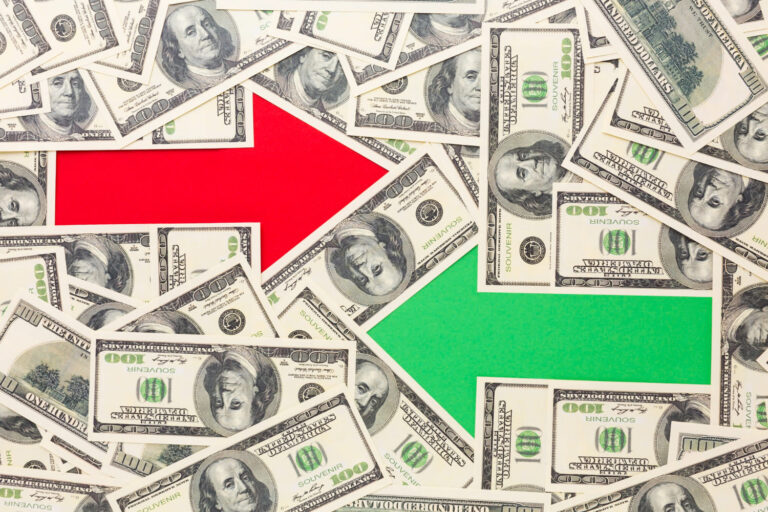

Since the 1980s the cost of education has increased by about 169%.

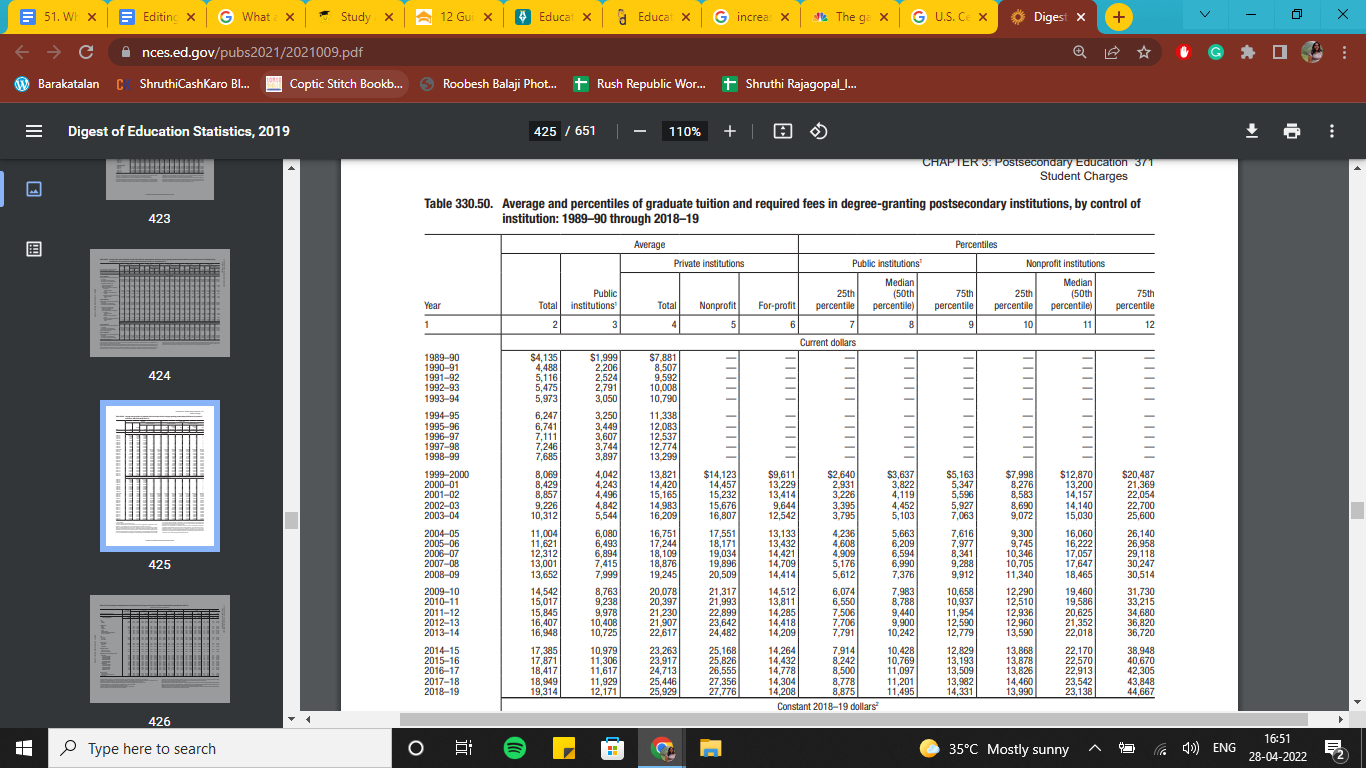

Here’s a chart you’re probably not going to waste time on. Thats okay.

What matters is – making sense of this.

The difference is even more jarring if you’re an international student. You’ll have to pay for additional costs like visa and passport application, rent, and food.

So most students opt to take an education loan for studying abroad.

Now, there are various ways to go about securing an education loan for abroad studies.

- Going directly to the banks and negotiating with them. Aka, the hard way

- Securing an education loan through FundRight. Aka, the easy way

Let us explain how we make your life easier. You can:

- Share your profile details and get various offers from one place

- Compare various lenders’ rates from your home

- Get fast-tracked loan approval within 2 days

Stages Of Education Loan For Study Abroad

Though we’re there to help you, it’s still wise to know the various stages of a study abroad loan process. Read on to learn all about it.

7 Steps To Secure A Study Abroad Loan

1. Check Your Study Abroad Loan Eligibility

- a. Select and Apply For your University

Most lenders do not ask for an acceptance letter for an education loan for study abroad. But that doesn’t mean you shouldn’t start the process.

It’s always a good idea to apply early. Start your college application process before you start your loan process. This will give you a better idea of how much money you’ll need to borrow.

If you’re confused about college applications, then SelectRight is the resource you need. Speak to college alumni to get a first-hand account of the experience at your dream colleges.

Without an acceptance letter, most lenders will only sanction a conditional loan.

- b. Course-related Eligibility

Your loan being sanctioned is based on one basic criterion alone. Your ability to repay it.

That’s why students pursuing some courses like STEM, MBA, or Law have a higher chance of approval. But that doesn’t mean it’s a no-go for Arts majors.

You still have a good chance of getting an education loan to study abroad, but your interest rates may change.

- c. Financial Eligibility

As we said before if the bank feels you can’t pay back a loan, they won’t lend to you. That’s why one of the education loans for abroad studies eligibility factors is your financial situation.

Well, not yours, but that of your guarantor. They should retain a good credit score, have paid their taxes on time, and have a good bank balance.

2. Choose Your Bank

This is perhaps the most strenuous part of the whole process – the research. Many banks and lenders advertise one interest rate. But it’s only after your application is complete that you’ll be hit with curveballs like hidden fees.

So people then spend the time going from branch to branch to do their comparison study. But that’s not necessary if you’ve signed up with FundRight.

Our platform is a one-stop place to compare the interest rates and fees across 30+ lenders. Plus, you won’t have to negotiate with the banks. Our platform is the one place where lenders will fight over themselves to give you lower interest rates.

Here’s a quick comparison of bank rates per their website.

| Lender Name | Interest Rate | Moratorium Period | Processing Fee |

| Axis Bank | 13.70%-15.20% | Course Length + 12 Months (Only Principal Moratorium) | Upto 20 lacs: 15000 +GST (Refundable fee) Above 20 lacs: 0.75% of differential loan amount above 20 lacs + GST ( Non–Refundable fee ) |

| HDFC Bank | 12.5% | Course Length + 12 Months (or 6 months after getting a job) | Upto 1% of the loan amount |

| City Union Bank | 14.25%-15.65% | Course Length + 12 Months (or 6 months after getting a job) | 0.20% of loan amount |

| Auxilo | 11%-14% | Course Length + 6 – 12 Months | 1%-1.5% of loan amount |

| InCred | 11.75%-16% | Partial repayment mandatory (Can be as low as ₹2000 per month) | 1% to 1.25% + GST |

| Avanse | Starts at 12.65% | Course Length + 6 or 3 Months (Only Principal Moratorium) | 1%-2% of loan amount |

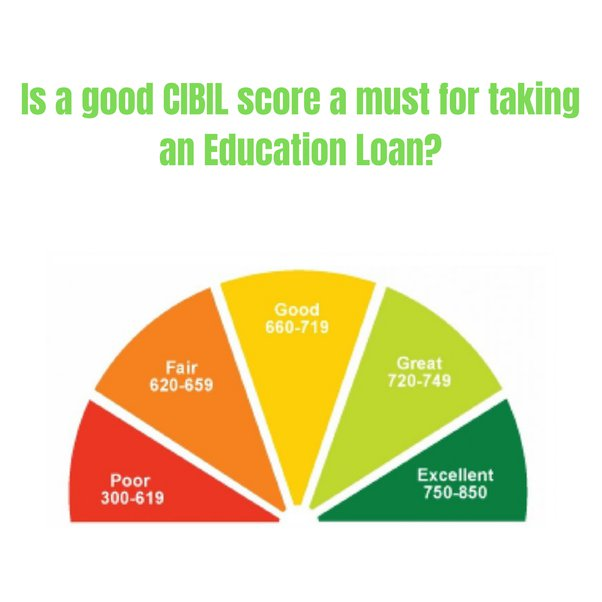

One reason why the preliminary research is crucial is that you should ideally only apply for a loan once. With each application you make, the banks will check your CIBIL score. Each time your CIBIL score is checked, the score will decrease.

IAT: Education Loan For Study Abroad

3. Prepare Your Documents

Any loan process requires oodles of documents. And it’s hard to keep track of it all when the loan officer is yelling for one document or another.

Here is a checklist of the documents you’ll need.

Documents Needed For Both Applicant & Co-Signer

- Passport Sized Photo

- Photo ID: PAN card, Drivers License, Aadhar Card, Voter ID card, or Passport

- Proof of Residence: Share Certificate or Title Deed (with Flat No), Electricity Bill, Municipal Tax Receipt, Registered Rent agreement (with utility bill), Landline phone bill, Voter ID, Aadhaar card or Passport

- PAN Card

- Aadhar Card

- Birth Certificate

Documents Needed For Applicant

- Academic Documents: 10th, 12th, UG Graduation Certificates, Provisional Certificate, Entrance test scores, TC (if applicable)

- Admission Proof: Not all lenders mandate this, but if you have it, attach the document

- Fee Structure of applied University

- Documents to prove work experience (where necessary)

Documents Needed For Co-Signer

- Registration certificate (in the case of Doctor or CA professional)

- If Salaried: 3 months salary slip, 3 months bank statement, Form 16

- If Self-Employed: 2 years ITR with the statement of income

Documents Needed If Submitting Collateral

If Immovable Collateral:

- Property title deed

- Building approved plan

- NOC for a mortgage from a builder or society

If Liquid Assets

- Proof of FD, Government Bonds or Life Insurance Policy

4. Home & Telephonic Verification

Within one week of applying for a loan, officers from the bank will conduct a home verification. This is only to check whether you do live at the address you’ve provided.

Agents may also ask to verify your ID documents at your home. Expect some questions about your cosigner’s income status.

The same details will be verified again on the number you’ve provided to the bank. All this is done to assure that the information you’ve provided to the bank is correct.

At this point in a study abroad loan process, there is a very low chance for your loan application to get rejected.

5. Study Abroad Loan Subsidy

This stage is applicable if you’re below a particular income slab or if you belong to a minority community.

Some subsidies lower the interest rate component. Some schemes pay a portion of the interest for you. Do not that education loans from NBFCs do not qualify for government subsidies.

Here are some education loan subsidies for abroad studies by the Indian government.

Padho Pardesh Scheme

This is targeted toward meritorious students belonging to minority communities. Your total family income from all sources should not exceed ₹6 lakhs/annum.

This scheme awards a 100% interest subsidy on study abroad loans for the duration of the moratorium period.

Central Scheme of Interest Subsidy for Education Loans (CSIS)

This is an interest subsidy scheme for those belonging to economically weaker sections. This subsidy is granted to students whose family’s annual income is less than ₹4.5 lakhs/annum.

You can avail a full interest subsidy during the moratorium period.

Dr. Ambedkar Central Sector Scheme

This is a subsidy granted to OBC and EBC candidates. If you belong to the OBC group, your total family income should not be higher than ₹3 lakhs/annum. For EBC candidates, the total family income shouldn’t exceed ₹1 lakh/annum.

You can avail 100% interest subsidy during the moratorium period.

6. Loan Approval Stage

This is when you can start breathing a sigh of relief.

Once all the verification is completed, the bank will have you sign a loan agreement. Read the terms carefully.

Along with the bank, you’ll come up with a repayment plan. The EMI you’ll need to pay will be informed. You will also get a loan disbursement calendar. Most lenders send the money directly to the institution, but some will transfer it to your bank account.

After you’ve signed, you’ll get the loan sanction letter.

7. Post-Approval Responsibilities

It’s not all over once your loan is sanctioned. Unless you have a complete loan holiday, you should diligently keep up with the EMI payment.

An interest backlog may result in fines and extra charges.

Some banks also request you to update them about your scores. This is just to ensure that you’re keeping up your end of the deal by scoring well.

Getting Education Loans Through FundRight

This whole process, when you do it through a bank, might take more than a month. Some students don’t have that time. That’s why FundRight is a better channel for loan approval.

You don’t even need an admit letter before applying for a loan through us. You can get your loans disbursed even before Visa-approval.

We send you a custom funding recommendation report within 10 days based on your profile. This makes your decision process a breeze.