For those looking to pursue education abroad, an education loan is often necessary.

Indians are mostly risk-averse. That is why the stock market has few participants. A loan, even a student loan for study abroad, is viewed with caution.

Vague information, a disorganized market, and colossal price tags—these barriers continue to keep students (and their parents) at a distance from a bright future.

FundRight is the bridge between the present and the future for students. This guide is our attempt to offer definitive answers to the most common questions asked by students. The answers are from experts in student education finance.

10 questions about student loans for study abroad

1. Do I need to be a topper to get a student loan for studying abroad?

From a banking perspective, an education loan,—like any other—is an investment.

The bank wants the confidence that it’ll get its money back, with a decent return, that’s it.

More than your academic performance, a lender wants confidence that the loan you take (and the education you buy using the money) will get you into a prosperous career down the line.

Now you know why an overwhelming number of study loans for abroad finance the study of STEM subjects. High-paying jobs are plentiful for students having these degrees.

The loan disbursement officer balances the two variables: your past academic performance, your creditworthiness, and your future career prospects.

A decent GATE or GRE score should convince them about your future prospects, right?

Your local bank branch’s loan disbursement officer might be biased towards STEM education, Ivy League universities, and that too only in the USA and UK. What about studying humanities in Canada? What about studying a language in Australia?

That’s where students need an equalizer. FundRight is just that. An equalizer. Because on FundRight, your application is open for bids by 14 lenders. Where there’s competition, there’s little oxygen for the whims and biases of a lender.

2. How does a lender scrutinize a student loan application?

Most banks have a standard procedure for granting student loans for study abroad.

Usually, the disbursement officer evaluates the merits of the application based on these factors.

Your past academic ability. Someone who has breezed through Grade 10, 12, and graduated in the top five percentile is likely to receive a loan without a problem.

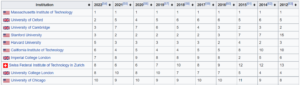

The institute where you wish to pursue further education. The higher it ranks on QS World University Rankings or a similar list, the better the chances of getting a loan.

BTW, these are the top 10.

Goes without saying: a lender is more eager to fund education in data science than in art history.

The credit history of the guarantor affects the loan process. If they have defaulted or been late, you might not get that loan.

Collateral plays a large role. An FD—as collateral for a loan—is better than a flat. The bank can access an FD with it in an instant, whereas auctioning a house is a lengthy process.

3. Can I receive a student loan for study abroad without a guarantor/co-borrower?

Usually, banks require a family member to sign on as a co-borrower. Of course, the rule is not set in stone and much depends on

- amount and type of collateral,

- degree,

- past record, and

- the creditworthiness of the applicant.

The guarantor must be an Indian citizen who earns enough to repay the loan. Rules of banking do not allow anyone outside the family to become a co-borrower or guarantor.

So, is it impossible for you to secure an education loan without a guarantee? No.

On FundRight, you can.

That’s because we also allow international lenders to bid on your loan application. And these lenders don’t insist on a guarantor. That’s because the rules and standards of banking for these lenders aren’t the same as Indian banks.

So, give yourself the best chance. Find your best education loan—for the lowest rate of interest, and most flexible terms—at FundRight.

4. When is the right time to apply for a student loan for study abroad?

Most educational institutions like to see proof of funds before granting an admission letter. Most banks like to see an admission letter before they grant the funds. It is a Catch-22 that causes a lot of stress among students and family members.

We suggest you scout for a loan early in the process and have lenders lined up.

Most banks can release loans in 72 hours if they have scrutinized the application before. The scrutiny can take at least a week. Therefore, have that cleared up beforehand.

You could request the bank to place the funds in a type of escrow whereby they release the funds but do not allow drawing rights till they see an admission letter. In this way, the university would have no problem finding proof of funds and the bank also does not worry about misuse.

This is generic advice, of course. Each bank differs, and so does each university. Experience comes into play here. You could eliminate this chick-or-egg situation with an expert advisor by your side. On FundRight, you are always covered by an unbiased advisor with decades of experience in helping students find and secure their best education loans. You don’t pay a penny for this service; it’s 100% free.

5. How long is the repayment period for a student loan for study abroad?

Almost every lender offers a repayment period of up to 15 years. But most banks would advise the client to settle the loan in a decade. You could as well extend it later on citing economic reasons.

If a student is 23 at the time of completing post-graduation, a 15 years loan means he/she will repay till 38.

That is not ideal since a large outstanding would affect his ability to take a home loan or car loan. Also, banks like the outstanding to be repaid as soon as possible.

As a customer, insist on a long moratorium, rather than a long tenure. The job market is uncertain and it might take you a while to find a suitable job in the city of your choice.

Banks can have a moratorium on principal and interest or a moratorium on interest alone. Understand the terms and conditions carefully before you sign.

Perhaps you don’t have the acumen or the time to read through the dozen-or-so pages of fine print. Again, trust your FundRight advisor to do the heavy lifting. You ask questions, and you get answers. And that’s 100% free.

6. Do I get any tax benefits against my education loan repayments?

Sec 80E of the Income Tax Act provides tremendous relief to those who take student loans for study abroad. When you repay, you can subtract the interest portion of the EMIs paid during a financial year.

The principal repayment has no tax benefits.

There is no upper limit on deductions. Since interest at around 10% of the EMI is a large sum, the benefits are immense.

To claim you need to get a certificate at the end of each financial year from the bank. It is like the certificate of TDS issued to those having bank deposits.

Note that the person who actually repays the foreign education loan must claim it and not necessarily the student. Thus, if you are earning, you can claim. If your parents are repaying, they can claim relief.

7. What is accepted as collateral for an international education loan?

The collateral can be movable property (e.g., fixed deposit and jewelry) or immovable (house, land, shop, etc).

On large loans, collateral is almost always needed, even if the co-borrower has a good credit score. Education loan for studies abroad without collateral is usually limited to amounts less than ₹10 lakhs.

This isn’t enough, given the cost of international education.

Also, different banks have differing thresholds for collateral needs. Usually, banks do not accept gemstones (diamond necklaces) or shares of a company as collateral. These cannot be valued easily and might not remain valuable for a long time.

8. How is the interest rate on an international education loan decided?

Interest rates are tied to a benchmark. They are over the benchmark by an amount known as the spread.

The benchmark used most often is the RBI repo rate. It is the rate at which a bank can borrow funds from RBI. The other benchmark used is interest on short-term treasury bills.

A bank has administration costs and profit that make up the spread. The greater the security of the loan (large collateral, for example, or a good degree) the lower is the spread (because the risk is less).

Currently, education loan interest rates vary between 6.5% and 14% whereas the repo rate hovers at 4%.

9. What are the documents I need for an international education loan?

- Completed Application Form

- Proof of Admission

- Photo

- Photo ID

- Address Proof

- Marksheets of Board/Public Exams

- School Report Cards

- Bank Statement of Borrower and Co-borrower

- Income Tax Return of Borrower and Co-borrower

- PAN card of Borrower and Co-borrower

- Income Proof of Co-borrower

- Documents establishing ownership of the collateral

10. Do banks allow prepayment of international education loans?

All education loans come with a prepayment feature.

Usually, banks charge a small fee (2% of the amount returned) as pre-payment charges. This is because if the bank had lent to another client, the amount could have earned interest without a pause.

Barring this minor penalty, there is no reason for a bank to suspend prepayment.

How can you find your best education loan on FundRight?

We believe that the modern student must be able to secure their education loans,

- without having to answer the same questions to half a dozen bank officials,

- without having to be satisfied with the branch closest to their home,

- without having to rely on biased advice from bank agents and education counselors.

On FundRight, there’s competition. And where there’s competition, there’s fairness. Create your profile on FundRight, let lenders compete for your loan, select a loan with the most favorable terms, upload your documents, and let the lender disburse the money.